Introduction

From the early days of 2022, one word that has been in everyone’s focus is “inflation”; we encounter it daily in all media as it affects sectors which reverberate to our daily life.

Global central banks are forced to raise interest rates (except Bank of Japan) to fight inflationary forces in their respective countries. The Russian war is also putting a lot of upward pressure on energy prices, creating inflationary pressure in the European continent.

One question our customers have been asking is if there is a new dataset which can be used to gauge how inflation affects their companies of interest in general.

It is not an easy task as everyone will have different views to approach the problem.

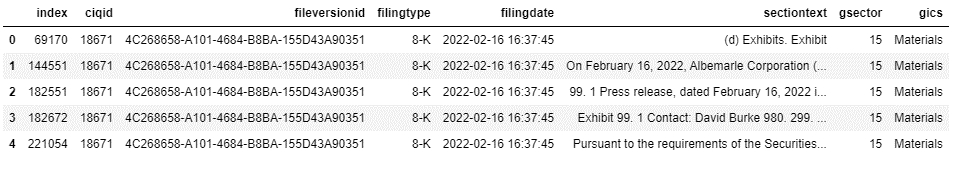

In this short article, we’d like to explore the concept of identifying the sectors which are potentially concerned about inflation the most by using Market Intelligence’s Machine Readable Filings (LINK to Marketplace) dataset. We’ll use a very simple Natural Language Processing of doing word count (after properly parsing the words and applying stop words relevant to financial analysis).

The Machine Readable Filings data contains public companies’ official regulatory filing documents (10-K, 10-Q, 13-F, etc.) making it an official document on which the companies have to choose their words carefully.

The Ingredients

- S&P 500 universe, current constituents

- All 2022 filings (excluding environmental-related ones) up to September 1st 2022 for the above companies

- GICS Level 1 Sector classification

Methodology

- All analysis was done in Market Intelligence’s Workbench, a cloud-based analytical platform, using SQL and Python

- Pull the constituents data along with the GICS info and all related filings

- Group the textual data into a big text blob by GICS Sector

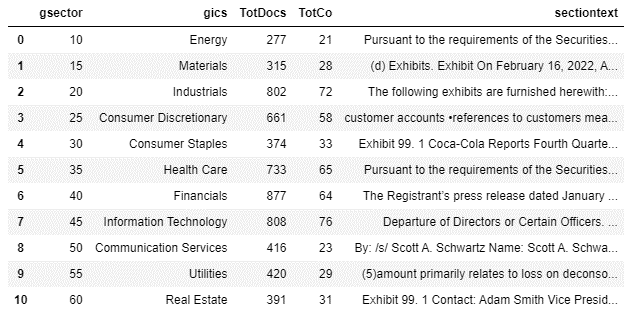

- Count the number of companies and filings documents in each GICS Sector

- Count the number of times the word “inflation” shows up in the documents

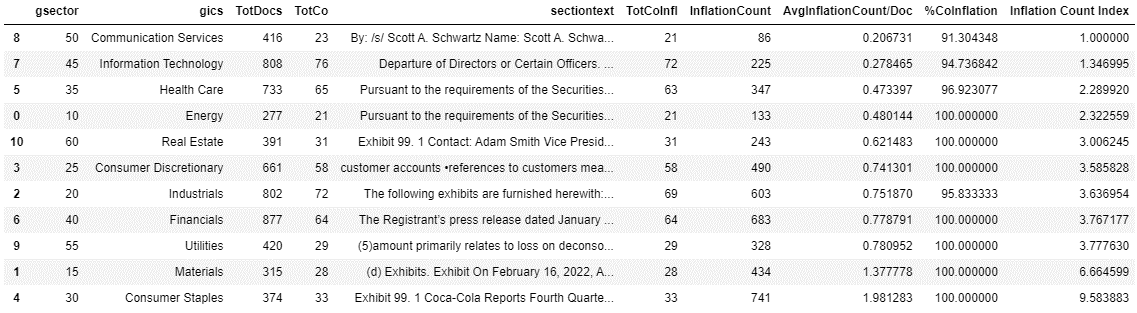

- Normalize the “inflation” word count by the total number of documents in Each GICS Sector

- Create a simple “Inflation Count Index” by dividing the metric from #6 above by the lowest number from all Sectors

Once we have the above, we can just use a simple visualization to make it easier for our brains to capture any new insights.

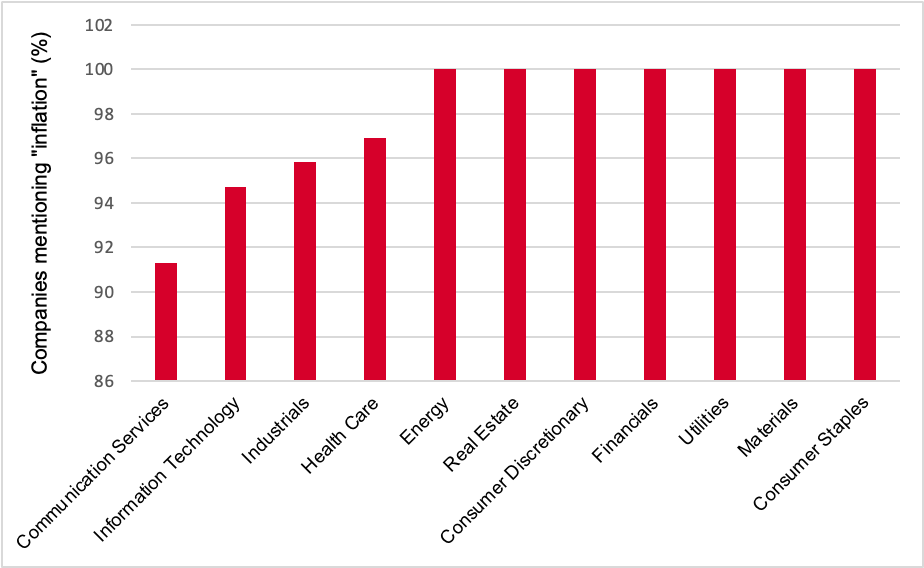

How many companies mentioned “inflation” in all their 2022 regulatory filings?

According to Figure 1 below, almost all companies (> 91%) in their respective GICS Sector mentioned “inflation” in their 2022 regulatory filings captured within our Machine Readable Filings dataset. This potentially indicates that inflation is an important factor for most companies, such that they’d need to put it in official writing.

Figure 1: Percentage of Companies Mentioning “Inflation” in 2022 Regulatory Filings (as of 9/1/2022, Source: S&P Global Market Intelligence)

Which GICS Sector has the most mention of “inflation”?

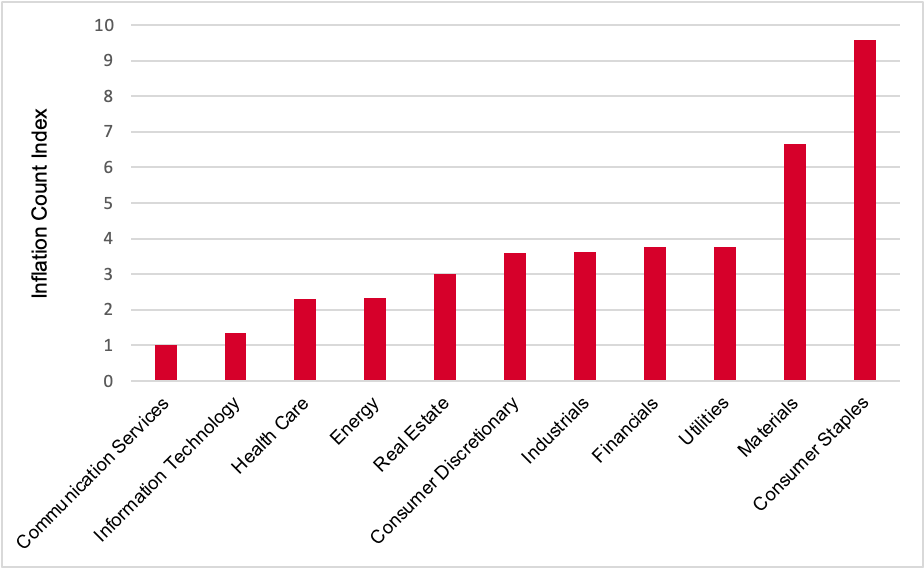

To answer this question, we will use Figure 2 to visualize the “Inflation Count Index” calculated before:

Figure 2: Inflation Count Index (as of 9/1/2022, Source: S&P Global Market Intelligence)

The chart above potentially confirms most of the reader’s understanding that Consumer Staples will be the Sector most affected by inflation and hence the companies potentially had to explain their stances. This sector’s mention of “inflation” is 9.5x of the least one, Communication Services.

Companies in Consumer Staples (supermarkets, food & beverages manufacturers, etc.) usually use inflationary periods to increase their prices to account for rising costs, as well as to protect their profitability. On the other hand, the consumers will be the ones having to bear these rising prices of groceries and other daily necessities.

The second highest mention of inflation came from the Materials sector. This sector deals with physical assets and commodities such that their product prices and asset values usually rise with inflation.

Despite having the lowest Inflation Count Index among all GICS Sectors, the readers need to stay vigilant on Communication Services, which definitely needs energy sources to power their daily operation. Perhaps since we’re using S&P 500 as the base universe, the US-listed companies in this sector haven’t really been affected significantly by inflation and hence, the inflation mentioned is lower compared to other sectors. US Government is also still releasing significant Strategic Petroleum Reserve at the moment to sustain its oil needs. The readers are surely aware that the prolonged Russian war is forcing energy prices to go up significantly in Europe and as such if we shift the analysis to European companies the result could have been very different.

We hope this article will inspire readers to take advantage of textual data and turn it into simple analysis to gain valuable insights on current world affairs to support their workflows. No need for complex analysis using AI or machine learning algorithm; sometimes a simple word counting could be just what we need.