This is the second blog in a series on ESG and Credit Risk Analysis

In the first blog of this series, we discussed the increasing importance of sustainability factors in credit risk. We now take a deeper dive into the governance factor by discussing the:

- Definitions and importance of governance

- Assessment of governance and integration with credit analysis

- Latest trends in governance

- Definition and importance of governance

While no universal definition of governance exists, elements included in all definitions are heavily influenced by one defining thing: at its core, governance relates to the process of undertaking smart short- and long-term decisions for an organization.

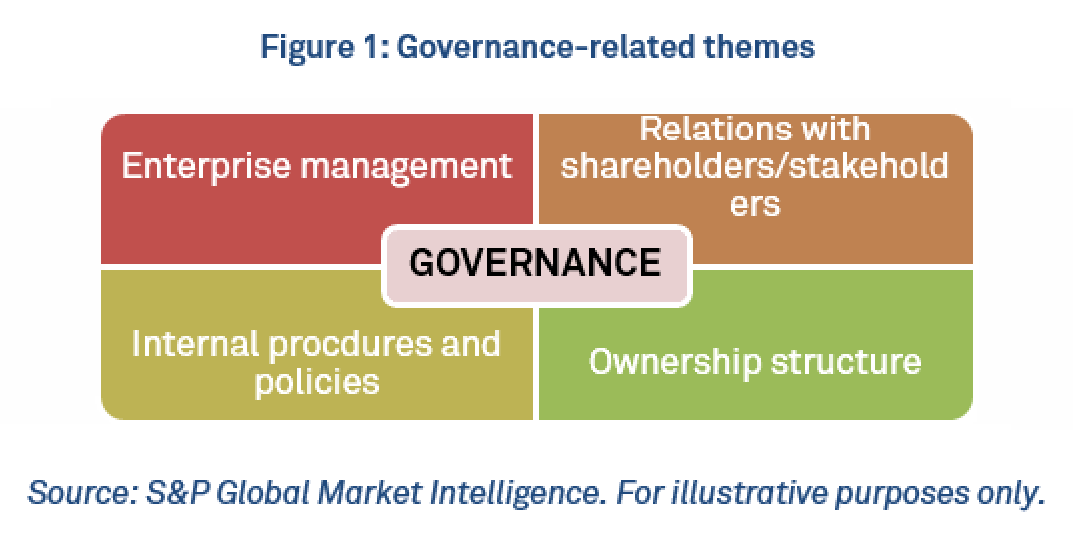

Focusing on governance through the lens of credit risk, a narrower definition can be derived. Governance should include issues related to: a) how an enterprise is managed, b) its relationships with shareholders and stakeholders, creditors, and others, c) its ownership structure, and d) how internal procedures and policies create or mitigate risks.

Weak governance can have a significant impact on a corporation’s prospects, as governance serves as the foundation upon which sound business decisions are made. Consequently, governance failures have been the root cause of many corporate failures, such as FTX in 2022 with the then-CEO admitting that the company did not have sufficient assets in reserve to meet customer demands.

Quite often the quality of governance will have an asymmetric impact on the future of a corporation, with the negative impact of poor governance being stronger than the positive impact of good governance. It is this asymmetry that makes the assessment of governance so vital.

Assessment of governance and integration with credit analysis

Governance is a key dimension within the S&P Global Market Intelligence Credit Assessment Scorecards with ESG Credit Metrics (“Scorecards”), directly impacting the final credit score and defining the ‘G’ Credit Metric. See here for further details on the S&P Global Market Intelligence ESG Credit Metrics.

Given governance covers many aspects, its assessment is best undertaken via multiple subfactors, as shown in Figure 1 below. This “bite-sizing” enables analysts to score factors more consistently and reliably, focusing on those subfactors that are most relevant.

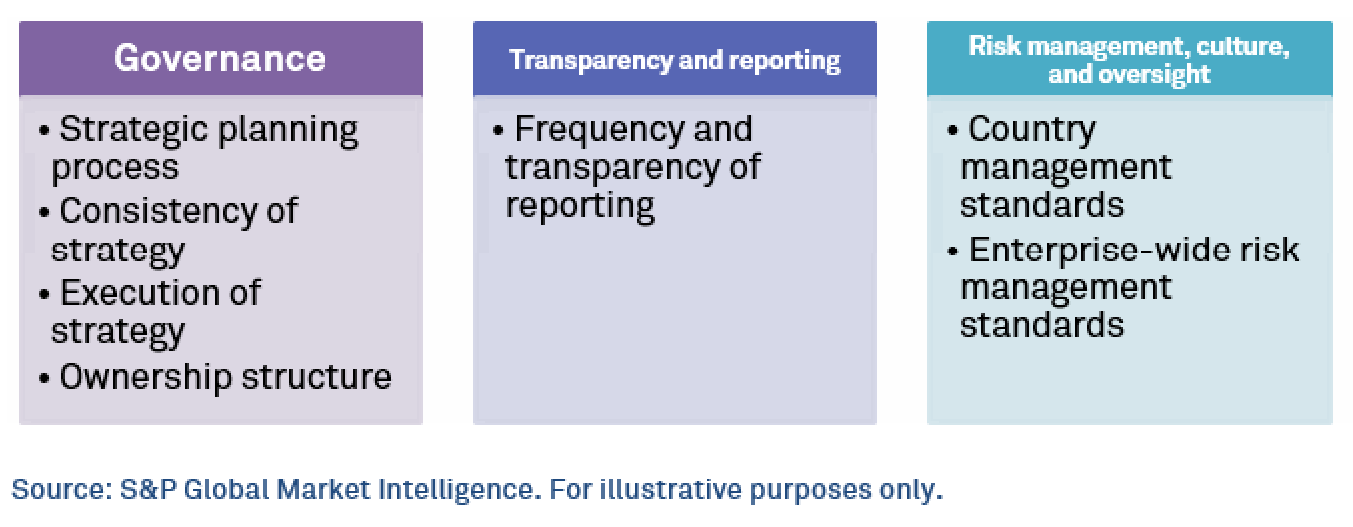

Figure 2: Subfactors used to assess governance in the Scorecards.

Each subfactor is assessed using detailed scoring guidelines, which link specific characteristics to appropriate scores. The scores assigned to each subfactor are combined to form a complete assessment of both governance and management. The combination is based on a quasi-weakest link approach, whereby a certain number of weak scores for the governance subfactors trigger a downgrade to the final score. The potential impact varies from 0 to -2 notches. Furthermore, since the quality and frequency of information forms the bedrock on which an assessment of credit is based, a weak score for the “frequency and transparency of reporting” risk factor leads to a maximum negative adjustment (irrespective of the scores assigned to other governance factors).

The combination and incorporation of governance factors within the Scorecards can only have a negative impact on the credit assessment. Put another way, strong governance in isolation cannot improve the credit assessment. This asymmetry is based on our understanding that good governance typically manifests itself in a stronger competitive position and/or balanced financial profile. Conversely, a weakness in any one governance subfactor can act as a signal of a potential future weakening of business and financial risk profiles.