This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

As credit markets evolve, the dynamic between bank and nonbank lending institutions continues to change too. The disintermediation of banks and concurrent growth of private credit funds has been well documented, as have the burgeoning partnerships between large financial institutions and asset managers seeking to partner on direct lending initiatives.[1] Additionally, Significant Risk Transfer (SRT)[2] has emerged as a further mainstream means through which banks and investment firms can operate in a symbiotic manner. SRT allows banks to retain more operational normality in the face of increasingly stringent regulatory controls, while investment firms can benefit from a product that offers attractive and differentiated risk-adjusted returns.[3]

Per S&P Global Ratings’ recent commentary:

- SRT activity is increasing as banks seek to obtain regulatory capital relief and manage their risk exposures.

- SRTs enable banks to offload credit risk in reference loan portfolios to third-party investors.

- European banks are the most active issuers and U.S. peers have begun to follow suit after the Federal Reserve clarified its approach.[4]

So, whilst SRT trades date back two-decades to the introduction of Basel II in 2004,[5] renewed impetus has been given to the market and is expected to continue, due to higher capital charges mandated by the looming reforms of Basel III Endgame.[6] While this is not to say there have been no other contributory factors to the growth in SRT transactions taking place in Europe and the US, regulatory reforms have served to crystalise the long-term market opportunity that investors are seeking to take advantage of. These investors include specialist SRT credit funds, multi-strategy asset managers, insurance companies, pension funds and supranationals.

To date, credit funds and asset managers have accounted for 75% of total SRT market credit protection sold in Europe. [5] These firms are able to fully fund a banks’ potential losses on day one and subsequently realise mid teens net returns at an attractive, well-covered attachment point.[7] Simultaneously, the investor is able to benefit from the fact that the bank continues to hold and manage the loan assets, meaning no misalignment of incentives and a full repertoire of bank work-out resources to utilise if required. It is easy to see why there has been a flurry of credit funds seeking to obtain a seat at the SRT table.

Underwriting an SRT trade is not without risk, however, as highlighted by S&P Global Ratings: “credit is credit and SRT investors are on the hook for losses in the reference pool in excess of the relevant attachment points.”[4] To this end, it is imperative for the purpose of pricing (and thus returns), that SRT investors understand to the greatest extent possible the likely Probability of Default (PD), Loss-Given Default (LGD) and Expected Loss (EL) for the reference portfolio. Investors may find it difficult to evaluate non-disclosed pools because they do not have access to detailed information about the underlying assets. As a result, they must rely on statistical analysis, through-the-cycle data, and the ability to apply macro stresses to understand how different scenarios may impact the portfolio holistically.[8] Even for disclosed pools, where an SRT issuer may be able to share names and public ratings of Broadly Syndicated Loan (BSL) issuers included within a portfolio, investors also need to supplement the information from bank data tapes, and Collateralized Loan Obligation (CLO) markets, with statistical top-down analysis to support the underwriting process.[9] This may be done to plug data gaps where there is no external rating, or to serve as an overlay to make the pricing process for a trade as efficient and as accurate as possible. Further, the challenge around data scarcity in SRT trades is only heightened when we consider that credit fund General Partners (GPs) are often contending with ever more data hungry Limited Partners (LPs) that increasingly demand robust reporting or even full look-through transparency into their underlying risk exposures,[10] and only more so when large amounts of capital will be put to work/ locked-up for a significant amount of time as in a typical SRT transaction.

So how might some of the above-mentioned market frictions/ SRT workflow requirements be solved for? At S&P Global Market Intelligence (Market Intelligence) our suite of quantitative Credit Analytics models, built upon a wealth of credit expertise, and leveraging a robust database of default, transition and recovery data alongside public and private company fundamentals and advanced imputation capabilities, can help investors to:

- Efficiently understand the underwriting approach of new partner banks active on the issuer side.

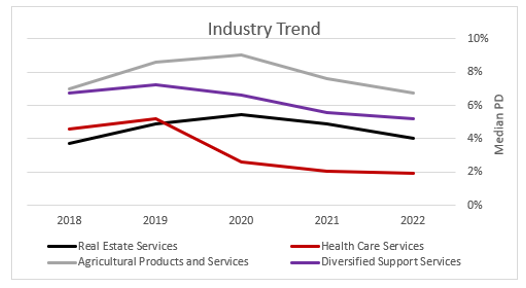

- Substantiate or challenge views on what industry exposures and industry concentrations may offer the best portfolio construct.

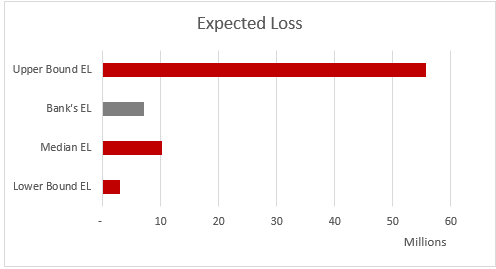

- Consistently and effectively quantify the risk of blind pools of corporate loans, including those secured by different collateral types.

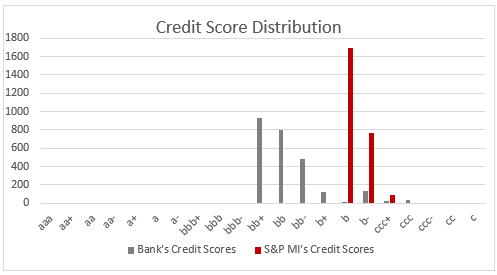

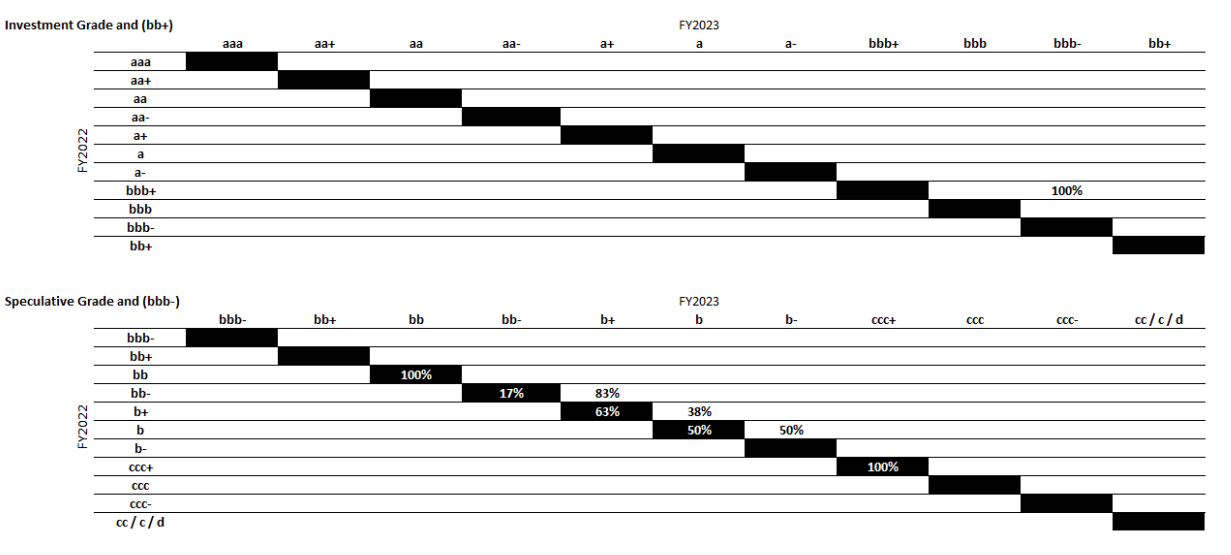

- Supplement the analysis completed on disclosed portfolios by plugging data gaps, or overlaying macro and Environmental, Social and Governance (ESG) scenario analyses plus alternative, and timelier, indicators of credit-risk.

- Optimise and expedite risk management and external stakeholder reporting through on-the-fly desktop and Excel based applications, plus automatable API/ data feed integration.

Figure 1: Median PD trend analysis across sectors

Source: S&P Global Market Intelligence. For illustrative purposes only. As of March 31, 2024

Figure 2: Example EL analysis for a reference portfolio

Source: S&P Global Market Intelligence. For illustrative purposes only. As of March 31, 2024

Figure 3: Credit score distribution, portfolio vs ‘universe’

Source: S&P Global Market Intelligence. For illustrative purposes only. As of March 31, 2024

Figure 4: Portfolio specific, macro-scenario transition matrix

Source: S&P Global Market Intelligence. For illustrative purposes only. As of March 31, 2024

To summarise, the opportunity to underwrite a pool of loans that provides exposure to bank quality risk across sectors and geographies where a fund would struggle to achieve the same level of diversification if investing directly, while also receiving equity-like returns for the Credit Default Swap (CDS)-like cover provided, makes the allure of SRT as an asset class clear. Concurrently, this is proving to be a cost-effective way for banks to avoid penal capital charges/ expensive capital raising and to free up capacity to continue with lending activities that can often pave the way for cross selling of lucrative additional services. At Market Intelligence we are fortunate to already be working with prominent SRT investors to provide statistically robust benchmarks and analytics that temper data opacity, enhance decision making and support external stakeholder reporting. Please get in touch if you would like to discuss further.

[1] Platt, E. (2023) Wells Fargo and Centerbridge team up on $5bn private credit fund. Available at: https://www.ft.com/content/280f25aa-8f1b-4aac-a30c-0df81810028a (Accessed 26 March 2024).

[2] Significant Risk Transfer (SRT) may also be referred to as Synthetic Risk Transfer, Credit Risk Transfer, Capital Relief Trade, Credit Linked Note, Regulatory Capital Relief Trade. See: Keenan, J. et al (2024) Synthetic risk transfers (SRTs) A growing opportunity in private debt. Available at: https://www.blackrock.com/institutions/en-zz/literature/whitepaper/synthetic-risk-transfers-a-growing-opportunity-in-private-debt-stamped.pdf (Accessed 26 March 2024).

[3] Stupar, M. (2023) Significant Risk Transfer: poised for further growth. Available at: https://alts.axa-im.com/insights/private-debt-alternative-credit/alternative-credit/significant-risk-transfer/significant-risk-transfer-poised-further-growth (Accessed 26 March 2024).

[4] Barnes, R. et al (2024) Banks Ramp Up Credit Risk Transfers To Optimize Regulatory Capital. Available at: https://www.spglobal.com/ratings/en/research/articles/240222-banks-ramp-up-credit-risk-transfers-to-optimize-regulatory-capital-13009236 (Accessed 26 March 2024).

[5] González, F. et al (2023) European Systemic Risk Board Occasional Papers, No. 23, The European significant risk transfer securitization market. Available at: https://www.esrb.europa.eu/pub/pdf/occasional/esrb.op23~07d5c3eef2.en.pdf?cb310722a7f90a87e0b4639ee0c20485 (Accessed 26 March 2024).

[6] Also referred to as Basel IV. See: Basel Committee on Banking Supervision (2017), Basel III: Finalising post-crisis reforms. Available at: https://www.bis.org/bcbs/publ/d424.htm (Accessed 26 March 2024).

[7] Beaney, S. (2024) Banking on innovation in private debt fundraising. Available at: https://www.preqin.com/insights/research/blogs/banking-on-innovation-in-private-debt-fundraising (Accessed 26 March 2024).

[8] Pickett, A. (2024). ‘Growth Expectations’. Interviewed by Vincent Nadeau. Structured Credit Investor. 12th March 2024. Available at: https://www.chenavari.com/wp-content/uploads/2024/03/PF_SCI-Chenavari-SRT-Interview-1.pdf (Accessed 26 March 2024).

[9] Ehrmann, D. (2024) ‘Bank Capital Releases’. Interviewed by Claire Coe Smith. Private Debt Investor. 1st April 2024. Available at: https://www.privatedebtinvestor.com/download-the-april-2024-issue-of-private-debt-investor/ (Accessed 5 April 2024)

[10] Guy, K. (2024) Bridging the GP-LP Data Gap. Available at: https://www.spglobal.com/marketintelligence/en/mi/research-analysis/bridging-the-gplp-data-gap.html (Accessed 5 April 2024).