Business Description:

iMedia Brands, Inc was a US-based interactive media company, founded in 1990 and headquartered in Eden Prairie, Minnesota. The company operated in three segments: Entertainment, Consumer Brands, and Media Commerce Services. The company provided and led its subsidiaries including ShopHQShop, Bulldog TV, ShopHQHealth, Shop Jewelry and the Christopher & Banks brand. Before defaulting, the company was a part of the Nasdaq.

Note: Christopher & Banks Corporation filed for Chapter 11 bankruptcy in January 2021, read the case study here >

Bankruptcy Summary:

After the Covid-19 pandemic, the entertainment industry was impacted significantly by losing many of the additional subscribers it had gained during the lockdown periods. Demand for home entertainment was predictably boosted during the pandemic lockdowns. However, as the Covid-19 vaccine was rolled-out, and restrictions were lifted, people began to spend more time outside, and did not rely on media as their only source of entertainment. As a result, companies such as iMedia Brands started to experience a drop in revenues (For instance, Netflix also announced that after the Covid-19 pandemic, they lost nearly 1 million subscribers),[1] with flagging demand further exacerbated by a rise in the cost of living as inflation rose. In addition, the supply chain disruptions and monetary easing (both on the back of the pandemic) started to bite. Buffeted on both ends (higher costs and lower revenues), iMedia Brands began to struggle, resulting in failure to make payments on obligations to Synacor which included a $10m secured promissory note. After two years of solid performance, driven by the influx of new customers during the lockdowns, the subsequent unwinding and fallout of the pandemic response led to the firm eventually filing for bankruptcy.[2] This resulted in the company going into administration on June 28th 2023, under Chapter 11 of the United States Bankruptcy Court for the District of Delaware.

Fundamental Probability of Analysis:

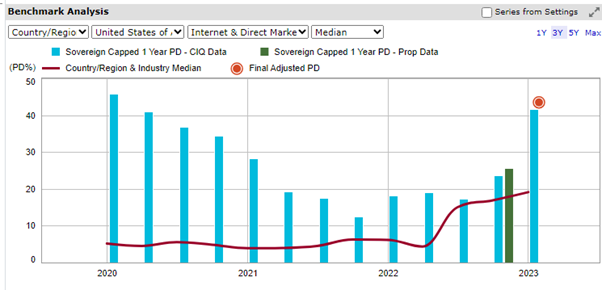

The Fundamental Probability of Default (PDFN) was higher than the prior probability of default (PD) of 25.57% as of the 28th of January 2023. As a result of iMedia Brands’ deficient performance, its PD was in the bottom (worse) 25% when benchmarked against the other US companies in the Internet and Direct Marketing Retail Industry. In Figure 1, the PD of iMedia Brands, on the 1st of February 2020 reached a high of 45.83% relative to the country and industry median of 5.21%; S&P Global Market Intelligence’s Credit Analytics captured the volatility and risk associated with the company from the start. Indeed, the PD did decrease between the period of Q4 2020 to Q4 2022, however, it remained much higher than the country and industry median. Thus, when iMedia Brands defaulted and went into bankruptcy, the final adjusted PD on the 28th of January 2023 was 41.87%.

Figure 1: Analysis of Fundamental Probability

Source: S&P Global Market Intelligence as of August 9, 2023. For illustrative purposes only.

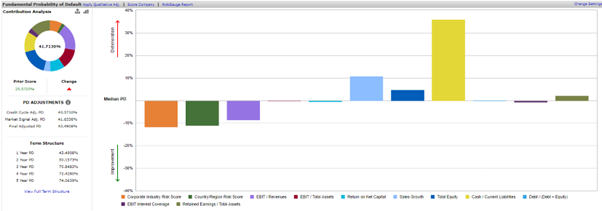

Looking at our model risk drivers, the most significant factor that impacted the credit score of iMedia Brands was the Cash/Current Liabilities ratio, as seen in Figure 2. It can also be referred to as the quick ratio which along with the current ratio (current assets/current liabilities) provides a snapshot of the company’s position in terms of liquidity. However, the quick ratio is more conservative as it only focuses on cash and cash equivalents and does not include total assets, many of which will be difficult to liquidate in a hurry to cover short-term liabilities. The score was at 0.03 versus 0.26 for the country and industry median, resulting in a relative contribution of 35.97%; that is to say, it increases the PD by 35.97% relative to the country/ industry median. In summary, the market environment and company-specific factors pushed the company into its final state of decline.

Figure 2: Fundamental Probability of Default

Source: S&P Global Market Intelligence as of August 9, 2023. For illustrative purposes only.

Figure 3 – iMedia Brand: Key Developments:

|

Date |

Event Type |

Headline |

|

7th July 2023 |

Index Constituent Drops |

iMedia Brands, Inc (OTCPK: IMBI. Q) dropped from NASDAQ Composite Index |

|

5th July 2023 |

Index Constituent Drops |

iMedia Brands, Inc. (NASDAQCM: IMBI) dropped from S&P TMI Index |

|

3rd July 2023 |

M&A Transaction Announcements |

WRNN-TV Associate Limited Partnership entered into an asset purchase agreement to acquire Substantially All of the Assets of iMedia Brands, Inc. for approximately 50 million |

|

29th June 2023 |

Delistings |

iMedia Brands Receives Written Notice from the Listing Qualifications Department of the NASDAQ Stock Market |

|

29th June 2023 |

Bankruptcy - Other |

Motion for Joint Administration Filed by iMedia Brands, Inc. |

Source: S&P Global Market Intelligence as of August 9, 2023. For illustrative purposes only.

Contact us to find out how you can efficiently score and monitor your potential credit risk exposure to over 50 million public and private companies worldwide – including small- and medium-sized enterprises (SMEs).

This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings