Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

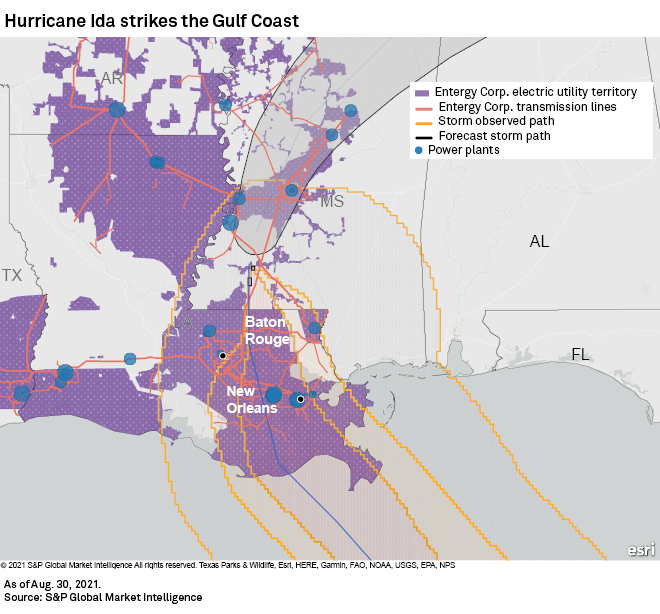

In this edition, we take a close look at the fallout of Hurricane Ida, which made landfall on the southeastern coast of Louisiana as a Category 4 storm on Aug. 29. The storm caused widespread damage, knocked out transmission lines and left more than a million Gulf Coast residents, primarily Entergy Corp. customers in Louisiana and Mississippi, without power. However, preliminary loss estimates from Ida could reach $25 billion, well below the devastation caused by Hurricane Katrina in August 2005, according to rating agencies and analysts.

The U.S. Small Business Administration, which administered the now closed Paycheck Protection Program, has turned its attention to simplifying the loan forgiveness process. Meanwhile, banks, eager to recognize fee revenue, have prodded their borrowers to submit applications. But with deadlines for repayments yet to come due, some borrowers may not see an immediate incentive for PPP loan forgiveness, analysts said.

A rush of labor strikes rattled mine operators this summer as negotiations and walkouts at operations across the Western Hemisphere threatened to exacerbate a supply crunch for key metals needed for infrastructure, renewable energy, and electric vehicle batteries.

Hurricane Ida in Focus

Hurricane Ida losses likely short of Katrina totals, could hit $25B

Despite the significant impact to the U.S. Gulf Coast, insurers and reinsurers should be able to absorb claims caused by the storm without injury to their capital positions, Wells Fargo analyst Elyse Greenspan said.

— Read the full article from S&P Global Market Intelligence

More than 1 million without power in Louisiana, Mississippi as Ida moves east

"It would be premature for me to speculate at this time when power will be restored," Entergy New Orleans President and CEO Deanna Rodriguez said during a midday news conference with New Orleans city officials Aug. 30.

— Read the full article from S&P Global Market Intelligence

'We've been here before': Entergy exec addresses Ida's destruction

Rod West, group president of utility operations for Entergy, said the storm trailed along the company's transmission system in Louisiana, leaving New Orleans in the dark.

— Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Top 50 US banks in Q2'21

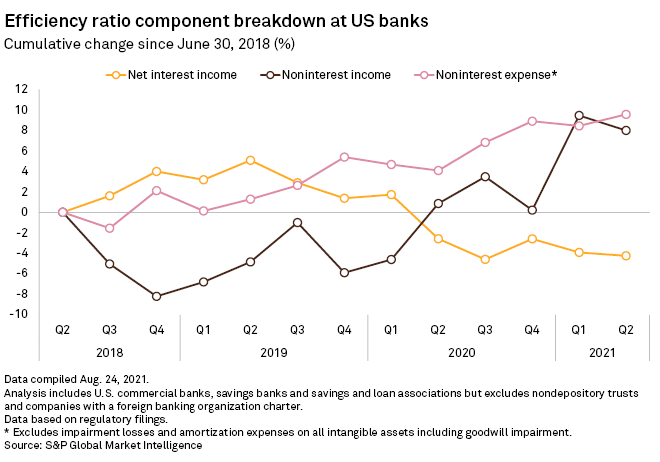

The aggregate efficiency ratio for U.S. banks crept up to 61.0% during the second quarter. The deterioration was a result of a modest increase in expenses and a continuation of the stressed revenue growth environment.

— Read the full article from S&P Global Market Intelligence

Criticized loans at US banks recede as pandemic deferrals dwindle

Loans that banks have tabbed as having higher chances of default declined at a majority of big U.S. banks for the third straight quarter, though such balances remain well above pre-pandemic levels.

— Read the full article from S&P Global Market Intelligence

Banks prod hesitant borrowers to apply for PPP forgiveness

Now that the Paycheck Protection Program is closed, the U.S. Small Business Administration has turned its attention to simplifying the forgiveness process, while banks have prodded their borrowers to submit applications.

— Read the full article from S&P Global Market Intelligence

US banks' efficiency ratios come under pressure again in Q2

The aggregate efficiency ratio for U.S. banks crept up to 61.0% during the second quarter. The deterioration was a result of a modest increase in expenses and a continuation of the stressed revenue growth environment.

— Read the full article from S&P Global Market Intelligence

Insurance

Largest US-listed commercial insurers all logged earnings beats in Q2

The earnings beats provide evidence for investors that the positive rate momentum seen in U.S. commercial lines in the last two to three years is flowing through to the bottom line, UBS analyst Colm Kelly said.

— Read the full article from S&P Global Market Intelligence

Credit and Markets

Short bets rise against consumer discretionary stocks as stimulus fades

The sector is now the most shorted on major U.S. exchanges for the first time since January.

— Read the full article from S&P Global Market Intelligence

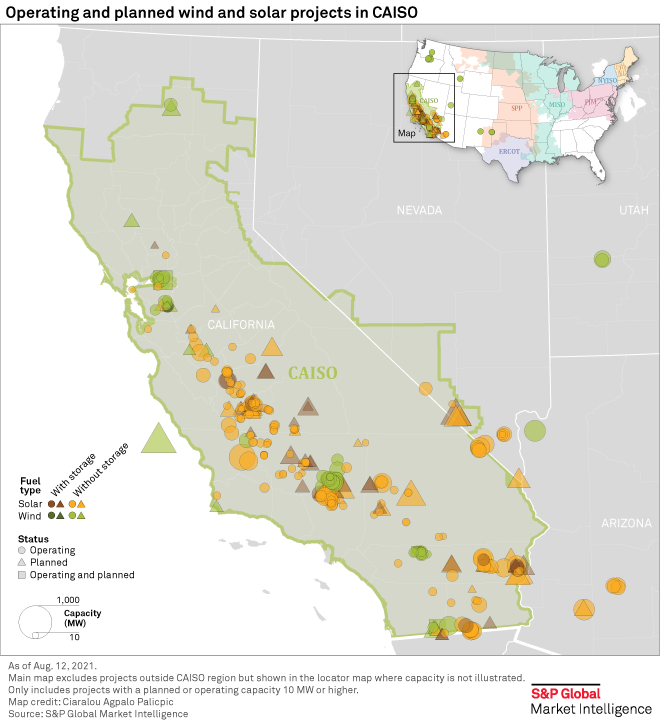

Energy and Utilities

FERC's Chatterjee prepares to leave agency as 'the Green New Neil'

"I think, hopefully, that history will judge that I at least tried to do what I thought was best in the public interest," Federal Energy Regulatory Commission member Neil Chatterjee told S&P Global Market Intelligence ahead of his Aug. 30 departure.

— Read the full article from S&P Global Market Intelligence

Rich in renewable energy, Chile seeks to become global hydrogen powerhouse

Chile's early bet on clean energy paid off. Now the government has offered up the country as a hydrogen laboratory to the world, with a goal of becoming one of the top three exporters by 2040.

— Read the full article from S&P Global Market Intelligence

Healthcare

Telehealth, virtual care CEOs see 2020 pay climb while hospitals suffer drop

Virtual primary care provider One Medical's Amir Rubin topped S&P Global Market Intelligence's list of the highest-paid healthcare provider CEOs.

— Read the full article from S&P Global Market Intelligence

Private Equity

More than $19B in PE insurance sector M&A already at record high

This year's disclosed deal value already exceeds the full year 2020 total of $12.88 billion and is the highest value on record for at least 10 years, according to S&P Global Market Intelligence data.

— Read the full article from S&P Global Market Intelligence

Blackstone's 2021 stock performance outpaces peers, S&P 500

The private equity giant, which entered the second year of its C-corp conversion, credited its share price appreciation to its financial performance and access of its stock to a wider investor pool.

— Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

AMC Networks at crossroads amid CEO change, streaming competition

Longtime CEO Josh Sapan's move to executive vice chairman raises questions about who will steer the content company through the rapidly evolving streaming ecosystem — and whether a sale could be on the horizon.

— Read the full article from S&P Global Market Intelligence

Biden faces looming deadline for FCC pick as acting chair's term winds down

Since January, the FCC has been deadlocked in a 2-2 partisan split, and the White House has yet to nominate a new commissioner. At the same time, FCC Acting Chairwoman Jessica Rosenworcel's term is already running on overtime.

— Read the full article from S&P Global Market Intelligence

Metals and Mining

Labor unrest threatens to disrupt commodities boom

From Canada to Chile, labor unrest has been slowing production as demand and prices climb for minerals critical to the renewable energy transition.

— Read the full article from S&P Global Market Intelligence

Top miners' copper output climbs 2.2% in Q2'21

Codelco and Freeport-McMoRan led the pack of top copper producers in terms of year-over-year output gains in the second quarter of 2021.

— Read the full article from S&P Global Market Intelligence

The Week in M&A

BHP-Wyloo bidding war for Noront reflects top miners' exploration M&A focus

Read full article

Ginger, Headspace merger opens door to further mental health app consolidation

Read full article

Santander Consumer's perseverance rewarded with minority stake buy-in

Read full article

I-bank advisory revenue sees strong growth in Q2 on increased M&A activity

Read full article

The Big Number

Trending

— Read more on S&P Global Market Intelligence and follow @AbbieRBennett on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.