Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

In this edition, we take a close look at some of the key obstacles facing the U.S. labor market's recovery, including the impact of COVID-19. An estimated 7.9 million Americans were out of work because of the virus in early September, up from about 4.9 million three months earlier, based on U.S. Census Bureau household surveys. COVID-19 has worsened a shortage of childcare in the U.S., locking an increasing number of parents out of the job market. Meanwhile, data from some states suggests that scrapping pandemic unemployment may not spur a jobs bonanza in the country.

A new coalition of electricity suppliers in the Western U.S. with about 11 million combined customers is exploring further power market integration, as the drought-ravaged region seeks to slash greenhouse gas emissions while boosting grid reliability.

Credit unions are increasingly looking to buy nonbanks such as insurance brokers and wealth management firms to raise and diversify their revenue streams. Many credit unions see insurance as a "natural fit" with their consumer-heavy loan portfolios since they present cross-selling opportunities, according to Lucas Parris, a senior vice president at Mercer Capital.

Labor Market Recovery Hurdles in Focus

Pandemic fears squeeze labor market as millions of Americans stay home

Nearly 8 million people without jobs in early September did not look for work because they or a family member had caught the coronavirus, or they were afraid of doing so.

— Read the full article from S&P Global Market Intelligence

US jobs may fail to get boost from end of extra COVID-19 unemployment support

Twenty-six U.S. states chose to end a $300 weekly unemployment benefit early to spark a return to the workforce, but there was little noticeable impact.

— Read the full article from S&P Global Market Intelligence

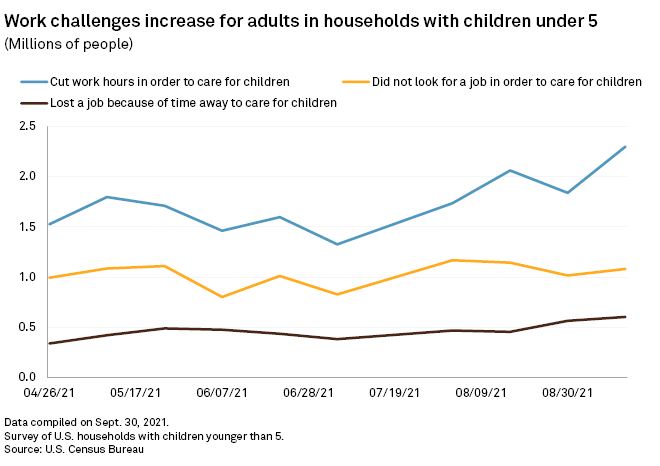

Child care shortage shuts millions of Americans out of workforce

Nearly 1.7 million women remain out of the labor force as millions of Americans stay out of work to care for young children.

— Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

US banks boost CLO holdings to gain yield amid excess liquidity

More than 75% of collateralized loan obligations in the U.S. banking industry remained in the hands of Wells Fargo, JPMorgan and Citigroup, and several smaller banks have added CLO holdings over the last year after reporting zero a year ago.

— Read the full article from S&P Global Market Intelligence

Credit unions hunting for nonbank M&A to diversify revenue

After nearly a decade of little fee income growth for the industry, an increasing number of credit unions are looking to boost their fee income by acquiring fee-generating businesses such as insurance brokers or wealth management.

— Read the full article from S&P Global Market Intelligence

Bank M&A is bigger in Texas, but number of deals smaller than usual

The number of bank M&A deal announcements is trending down in the Lone Star State compared to years past, but the targets are larger.

— Read the full article from S&P Global Market Intelligence

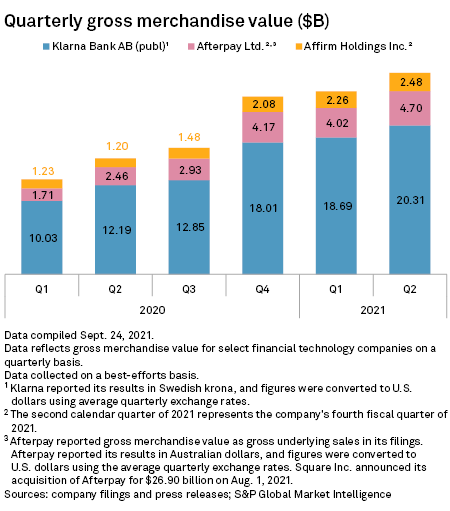

Banks outsource buy-now, pay-later to new class of fintech firms

Banks are turning to a cottage industry of companies that build buy now, pay later platforms in an effort to gain market share from fintech giants spending billions to acquire lenders in the space.

— Read the full article from S&P Global Market Intelligence

Insurance

Buyers of cars to airline tickets getting optional extra at checkout – insurance

Embedded insurance will "certainly play a key role" in growing premiums because it is best fit for simple and transparent offerings catering to small and medium-ticket sizes, according to Seth Rachlin, executive vice president at Capgemini.

— Read the full article from S&P Global Market Intelligence

US insurance companies with highest price-to-estimated EPS ratios in Q3

Kemper was the most richly valued P&C carrier in this analysis, while Primerica remained in its position as the most-expensive publicly traded life insurer.

Read the full article from S&P Global Market Intelligence

Credit and Markets

China targets debt sustainability over economic growth as Evergrande reels

Evergrande is the highest profile victim of China taking a tougher line on corporate debt as the country's leadership prioritizes a sustainable economy over the fast-paced growth of previous decades.

— Read the full article from S&P Global Market Intelligence

Energy and Utilities

PacifiCorp resource plan charts path away from coal plants

Under PacifiCorp's 2021 integrated resource plan, more than three-fourths of the company's coal-fired generating capacity is to be shut by 2040.

— Read the full article from S&P Global Market Intelligence

Utilities with 11 million customers eye power market integration in US West

A group of electric utilities in the Western U.S. is exploring further power market integration as the region faces growing threats to grid reliability caused by climate change-driven extreme weather.

— Read the full article from S&P Global Market Intelligence

Texas scrambles to weatherize power plants as winter approaches

More than half a year after a deadly winter storm caused blackouts across the state and left millions of Texans without power, regulators are still trying to decide how plants should be weatherized to prevent another such disaster.

— Read the full article from S&P Global Market Intelligence

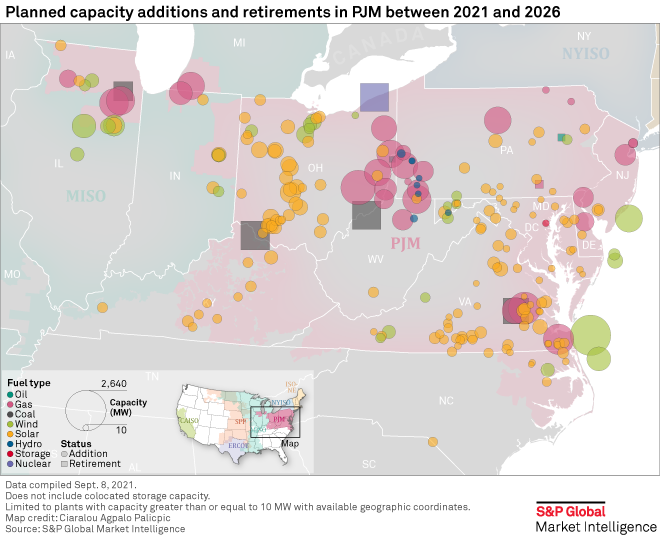

PJM market incentives, reliability needs drive robust gas plant additions

The development of nearly 22,000 MW of natural gas capacity in the region is viewed as a critical backstop for cleaner energy resources.

— Read the full article from S&P Global Market Intelligence

Healthcare

AstraZeneca's bet on rare disease with Alexion acquisition yields early win

AstraZeneca's $39 billion venture into rare disease has yielded a positive result in a late-stage study, a key step forward for the U.K. largest drugmaker best known for its portfolio of cancer therapies.

— Read the full article from S&P Global Market Intelligence

At-home health devices transform patient care, telehealth possibilities

Consumers and providers are embracing remote monitoring devices as insurers expand coverage for the equipment.

— Read the full article from S&P Global Market Intelligence

Metals and Mining

Stimulus windfall for miners left in limbo as Democrats split on budget bill

Billions for mining companies in the bipartisan infrastructure bill is being held up by a cohort of House Democrats concerned about the measure's climate impacts.

— Read the full article from S&P Global Market Intelligence

The Week in M&A

Sizing up a potential Invesco, State Street deal

Read full article

Seacoast Banking bagged Sabal Palm deal after increasing offer

Read full article

DentaQuest deal to scale Sun Life US business, spur price competitiveness – exec

Read full article

Merck & Co.'s largest buy since 2009 set to diversify past blockbuster Keytruda

Read full article

Dominion to sell Questar Pipelines to Southwest Gas; Carl Icahn opposes deal

Read full article

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @Allison_Good1 on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.