Given the current challenges faced by investors in traditional assets classes, interest in private asset investments, such as infrastructure debt, is rising.1

Infrastructure projects, whether a bridge or clean energy plant, contractually locks in revenue over multi-year periods, with services provided by many projects having no alternatives (e.g. water).. Infrastructure projects are often aligned with investors’ environmental, social and governance (ESG) goals, helping fuel the growth in fundraising. According to Preqin,2 renewable energy will become the focus of many infrastructure funds because of the Russia-Ukraine war, for example.

This European-based asset manager was launching its first private infrastructure debt fund, and members of the debt investments team needed a reliable credit assessment model to evaluate the credit strength of corporate counterparties. In addition, they needed to integrate ESG factors into the credit analysis to be compliant with the requirements of the Sustainable Finance Disclosure Regulation (SFDR) that became applicable in March of 2021. This would require enhancing their current credit assessment process.

Pain Points

Members of the debt investments team required an easy-to-use, well-grounded methodology to score business risk factors that could also account for a wide range of potential ESG concerns to meet the SFDR requirements. In particular, they wanted:

- A granular credit assessment framework that could generate reliable results, be quickly deployed and give the team control over the process.

- A clear methodology to assess probabilities of default (PDs).

- A capability that could incorporate ESG factors and show their impact on the creditworthiness of counterparties.

- Expert support to assist team members as they became familiar with the approach.

The team was familiar with S&P Global Market Intelligence ("Market Intelligence") and reached out to see what capabilities were available.

The Solution

The Market Intelligence Corporate Assessment Scorecard with ESG Credit metrics (“Scorecard”) provides an effective framework to navigate the ever-changing climate. This is especially useful for low-default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated.

The Scorecard is an easy-to-use tool that draws on a mixture of quantitative and qualitative questions in a check-box style to identify key risks. It considers explicitly ESG credit risk factors as part of a holistic approach to credit risk analysis. It is fully transparent and provides the underlying logic, including weights, and generates numerical scores that are broadly aligned with S&P Global Ratings’ criteria,3 supported by historical default data back to 1981. This solution would enable the debt investments team to:

|

|

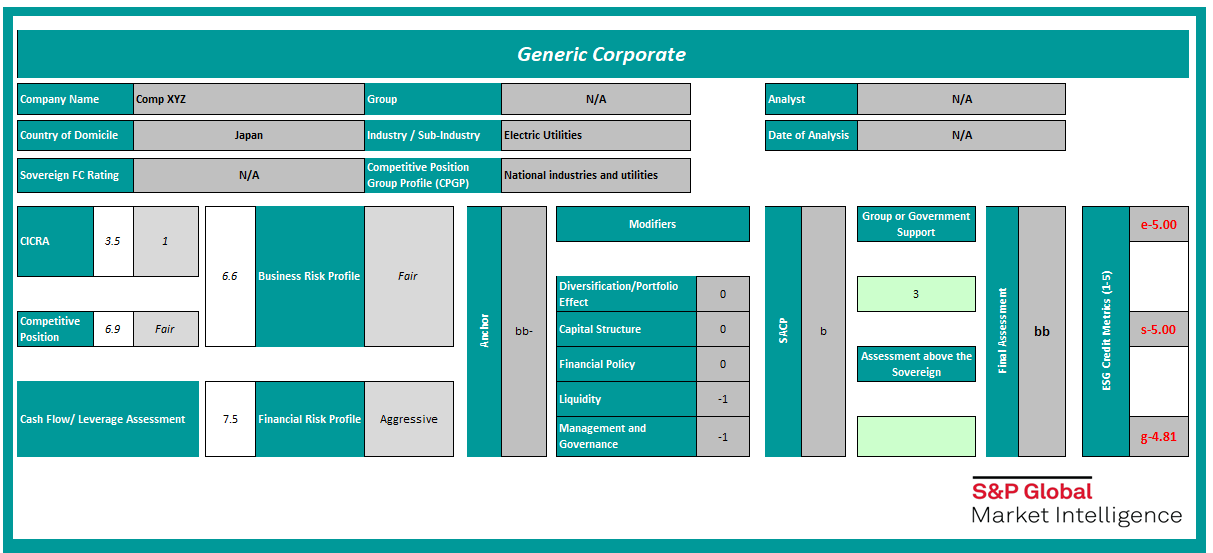

Evaluate potential credit risks with corporate counterparties | The Scorecard provides a consistent framework for calculating credit risk, as shown in Figure 1 below. Point-in-time factors combine with forward-looking qualitative factors, converging trends and relationships between key drivers to provide a full picture of credit risk. |

Figure 1: Sample Corporate Scorecard1

Source: S&P Global Market Intelligence. For illustrative purposes only purposes only.

|

|

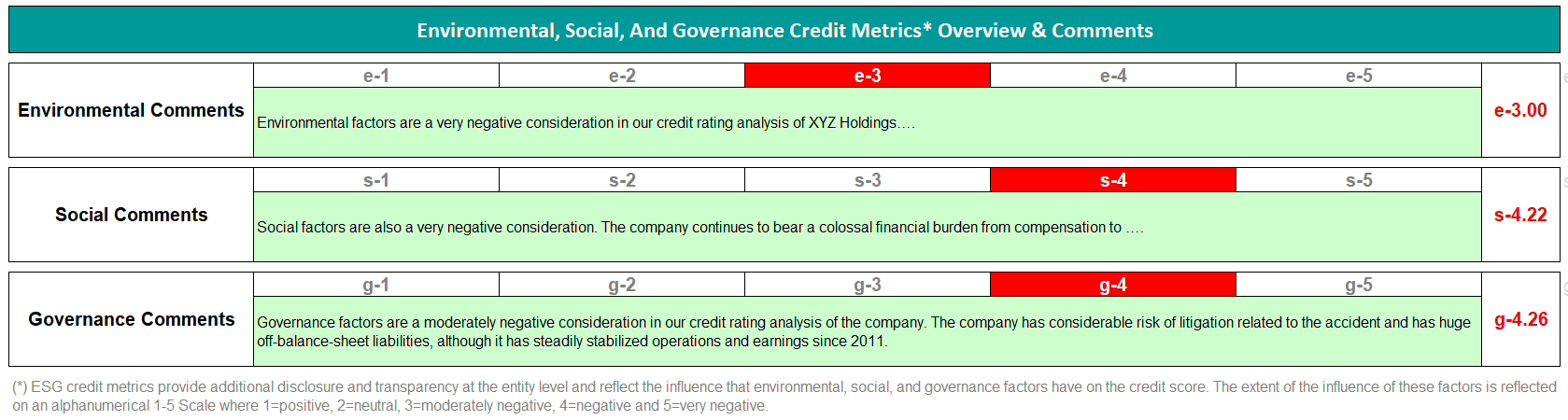

Determine the impact of ESG factors on creditworthiness | The Corporate Credit Assessment Scorecard with ESG Credit Metrics gives users the ability to produce a 'traditional' credit score by explicitly considering relevant ESG credit factors. The Scorecard also outputs a Credit Metric for each E, S and G factor. These credit metrics provide an alpha-numeric representation of the impact of ESG factors on the final credit score. See figure. |

|

|

||

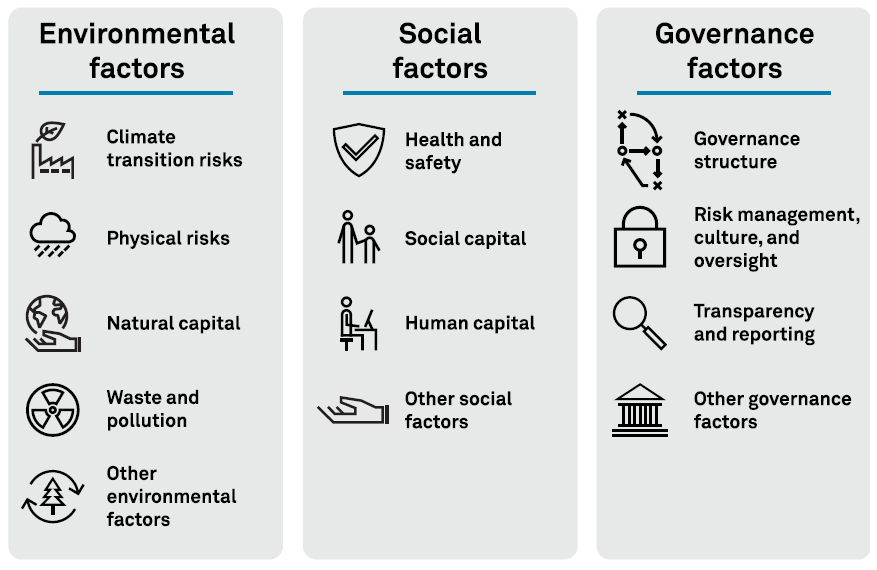

| The Scorecard can also inform stakeholders of the numeric (i.e., credit notch) impact of ESG factors on the final credit score. This is crucial as many stakeholders including regulators require this. As ESG factors can be event (e.g. flooding), trend (e.g. technology innovation) and policy driven (e.g. new regulations), our framework considers a comprehensive list of ESG factors. (see figure). | ||

|

|

||

| The Scorecard framework facilitates scenario analyses, which helps evaluate the impact of ESG factors under different assumptions. This cutting-edge ability allows for all stakeholders to make informed credit decisions. |

Key Benefits

Members of the debt investments team foresaw great value in the Scorecard with its methodological transparency that reveals all risk factors, weights, benchmarks and scoring algorithms. They expect to have full control over the risk assessment process and be able to clearly communicate underlying risks to investors. The ESG Credit Metrics was a critical add-on that helps them understand the impact of individual ESG factors on each credit exposure. They subscribed to the capability and now have access to:

- A sound framework to meet the SFDR requirements, with 75% of Scorecard outputs being within one notch of public credit ratings.

- Identification of default risk through a granular rating scale, along with the ability to perform sensitivity analyses, scenario analyses and stress tests.

- Technical documentation describing the analytical/statistical processes used to develop the Scorecard, identifying the data used in its construction and providing testing performance results.

- Scoring criteria and a User Guide kept up to date with a rigorous annual methodology review, which also helps users meet regulatory requirements.

- Scorecard implementation and application training workshops.

- Ongoing analytical support enabling the team to benefit from the latest analytical trends.

Click here to learn more about S&P Global Market Intelligence's Corporate Scorecard with ESG Credit Metrics