Major streamer launches and pandemic behaviors continued to influence digital video adoption and boost consumer spending on online video in 2020. Cheaper price points and an expanded breadth of content have translated to strong growth for some of the major subscription video-on-demand services. The streamers have also benefited from a shrinking multichannel video market as some consumers cut or shaved the cord.

While major streaming launches indicate a robust industry, some weaknesses in the market have become evident. The profitability point eludes many players, leading in some cases to closures and mergers, including Quibi shuttering and WWE Network folding into Comcast Corp.'s Peacock. As most of the major studios and content players in the U.S. have launched subscription services, we expect the coming years could include additional consolidation.

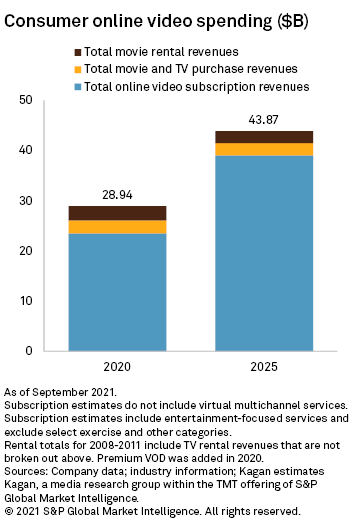

Subscription remains the leading category for paid online video, delivering an estimated $23.52 billion in 2020, up 34.7% from the previous year. The impact of the pandemic seems to be persistent, with many consumers opting for on-demand while discontinuing traditional pay TV. The launch of new streamers, such as Discovery+, Peacock and a rebranded Paramount+, further bolstered the category, helping to increase both subscription online video homes and services per home.

In the transactional VOD space, 2020 was a good year for the rental and electronic sell through, or EST, categories. Rental generated about $2.85 billion in revenues during the year. Premium video on demand, or PVOD, played a significant role in the market as studios released many films via that channel in lieu of theaters during COVID-19. We estimate PVOD contributed to a significant bump in rental, while library product also had a strong impact on rentals and EST.

Similar trends impacted EST, leading to an 11.5% growth rate during 2020 for $2.57 billion in revenues. Growth in the category was also greatly impacted by library titles and a lack of theatrical releases.

Looking ahead, we project that growth in subscription will begin slow and reach $39.02 billion by 2025. We also estimate that the transactional market will mature and that there will only be a limited number of films released on PVOD. Online purchase revenues are projected to drop to $2.47 billion in 2025 and online rental revenues to drop to $2.38 billion. Overall, we estimate consumers will spend $43.87 billion on online video in 2025.

More information and our exclusive forecasts for the online video sector can be found in the links below.