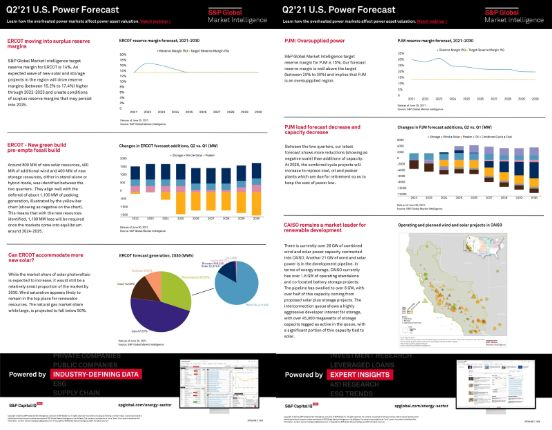

Based on S&P Global Market Intelligence Q2 Power Forecast, CAISO, ERCOT and PJM are projected to have surplus reserve margins in varying degrees between 2021 to 2030. PJM has the highest forecast surplus reserve margin of 20%-30% against the target of 15% throughout the decade, implying a significant oversupply of power projects. In CAISO, the current pipeline of solar projects has capacity nearly doubling over the next 5 to 6 years, with 13,500 MW in various stages of development compared to roughly 2,400 MW of wind.

Gain vital insights on how the warmer spring weather shaped our Q2 forecast on CAISO, ERCOT and PJM:

- Reserve margin forecast 2021-2030

- Quarterly changes in forecast additions

- ERCOT forecast generation, 2030

- CAISO wind and solar operating and planned capacity

Source:S&P Global Market Intelligence. Images for display purposes only.