Takeaways:

- Standardization of metrics. The proposed requirements pose potentially significant challenges in collecting relevant data and preparing the required disclosures.

- Data collection for all? The proposed rules don’t mandate a specific methodology for data collection nor GHG calculations.

- Overhaul of corporate policies and procedures. The governance and production of GHG emissions disclosure data could be required for most companies eager for certification.

In March 2022, the U.S. Securities and Exchange Commission (SEC) proposed climate requirements for the collection, measurement, and disclosure of emissions data. If adopted, they would require reporting companies to provide certain climate-related information in their registration statements and annual reports filed with the SEC. The SEC decided to do this, in part, because while voluntary disclosure of emissions and climate-related risks and opportunities has been on the upswing in recent years, it remains uncommon in all but a handful of sectors, according to S&P Global Sustainable1 data.[1] On top of that, the numbers are not consistent enough to allow an apples-to-apples comparison.

Most companies will likely face significant challenges in collecting the relevant data and preparing the required disclosure, given the breadth of the proposed rules and the disclosure controls required to include such disclosure in SEC filings. The nature of the data required for the proposed greenhouse gas (GHG) emissions disclosure means many registrants will not have a dedicated unit or department – let alone the personnel – that can obtain, validate, and prepare the required information for disclosure. For that reason, companies should assess their internal capabilities and expertise, and fix any gaps or deficiencies, well in advance of any compliance date.

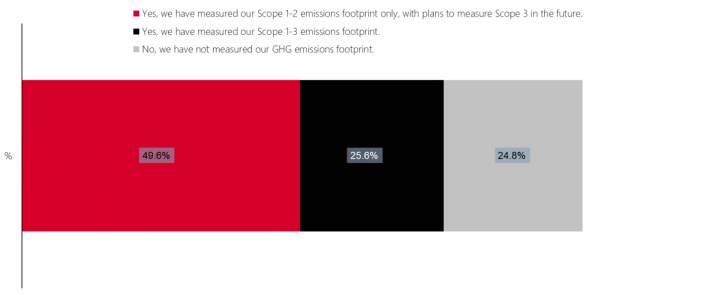

On June 1, 2022, S&P Global Market Intelligence hosted a webinar with Esther Whieldon, Senior Writer, ESG Thought Leadership for S&P Global Sustainable1, and Grace Kao, Head of Analytics (Corporates) also for S&P Global Sustainable1. They discussed the key three stages of action companies should consider when factoring the proposed requirements into business strategies and polled the audience to find out whether they have incorporated scope greenhouse gas (GHG) emissions into their current ESG reporting framework. whether they have incorporated scope greenhouse gas (GHG) emissions into their current ESG reporting framework.

Regardless of what stage you’re at, discover how ESG and Sustainability professionals are setting the pace when it comes to Net Zero targets.