Learn how you can stay ahead of US power sector’s energy transition

Big Tech dominates the corporate renewable energy space as contracted capacity approaches 60 GW. The evolution of the top 10 U.S. corporations by cumulative capacity, which account for nearly 60%, or 34.9 GW, of the total tracked by S&P Global Commodity Insights, shows Google long occupying the top spot, before relinquishing the corporate-tied renewable energy crown to Amazon after 2021.

Visualizing solar capacity, performance across the US

Solar capacity factors rose across all independent system operators in 2020, pushing the weighted U.S. average up 1.8 percentage points year over year as more than three-quarters of the states housing utility-scale solar projects experienced increases. View article >

U.S. wind capacity factors jumped a weighted average 3.1 percentage points between 2019 and 2020, with the windy longitudinal corridor running from Texas through North Dakota logging some of the largest increases, helping Southwest Power Pool post the highest ISO capacity factor average at 42%, according to S&P Global Commodity Insights data. View article >

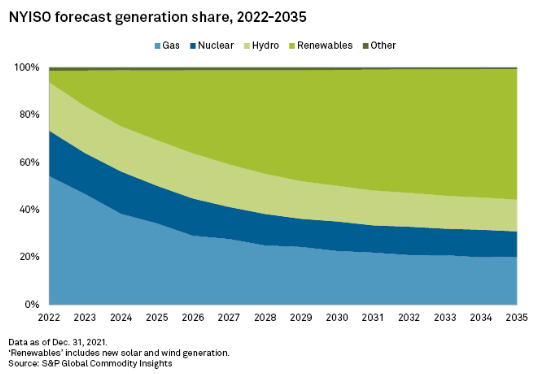

In New York, economics and policy may align for a surge in new solar

Although solar contributions to New York's wholesale electricity mix is small today, recent growth in natural gas and CO2 emissions prices appears poised to stoke the state's solar market. Combined with aggressive commitments to increase carbon-free generation by the end of the decade, Market Intelligence forecasts substantial new growth in solar energy in NYISO.

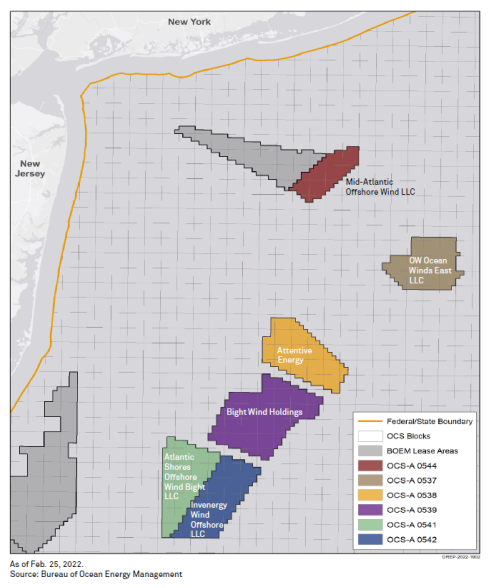

Industry growth could ease concerns over high bids of offshore wind auction

The recent New York Bight offshore wind auction held by BOEM awarded six offshore lease areas with bids totaling $4.37 billion.

US governors place spotlight on EVs, clean energy in state addresses

Out of the 34 2022 State of the State addresses where energy and environmental topics were mentioned, however briefly, most of them did so in the context of the transition to cleaner fuel sources, electric vehicles and an effort to embrace new energy technologies. Several governors expressed concerns about the ongoing climate crisis and the reliability of the electric grid. View article >

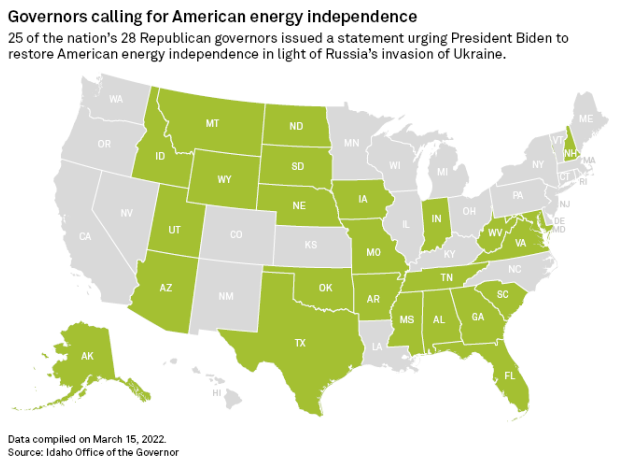

US governors call for energy independence as Russian invasion continues

As the Russian invasion of Ukraine begins to change the direction of U.S. energy policy, governors across the country have started to weigh in on how the conflict could impact their states' energy situations. View article >

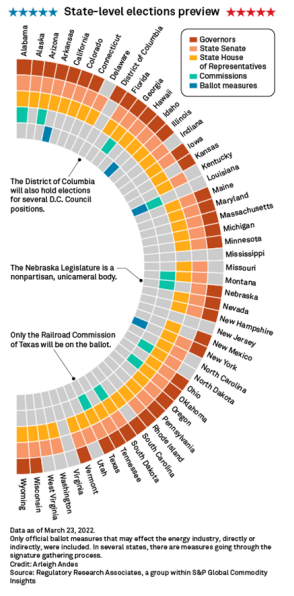

Road map: The energy sector braces for 2022 midterm elections

The 2022 election season kicked off at the beginning of March when Texas held its primary election and will conclude in December with a potential general run-off election in Louisiana. This year's general election is set to take place on Nov. 8, where 36 governors, the mayor of the District of Columbia, 88 legislative chambers, 17 utility commissioners and a handful of ballot measures will be on the tickets. View article >

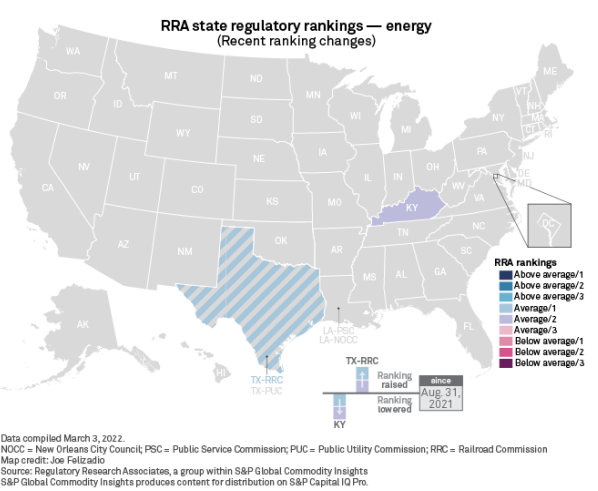

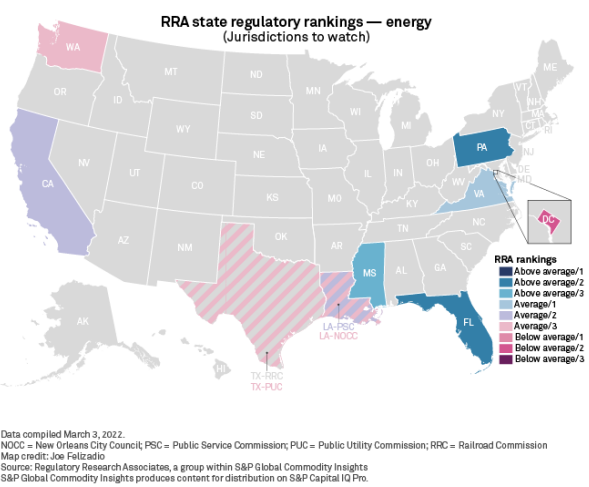

Regulatory ranking of 2 jurisdictions changes, 10 bear watching

Regulatory Research Associates has lowered its ranking of Kentucky regulation and raised the ranking of Texas regulation as it pertains to gas local distribution companies.

10 other jurisdictions could experience noteworthy changes in the level of regulatory risk for investors in light of ongoing issues and proceedings in those jurisdictions.

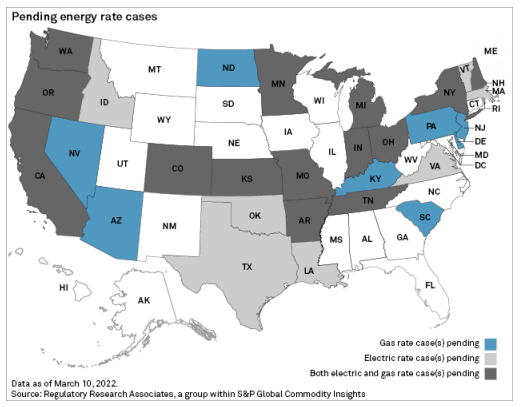

Electric, gas rate case activity remains steady amid inflationary pressures

The pace of state-level rate case activity has remained steady in 2022, with 85 electric and gas rate proceedings pending in 29 states as of March 10. In these cases, the utilities are seeking rate changes aggregating to a $14.8 billion net rate increase.

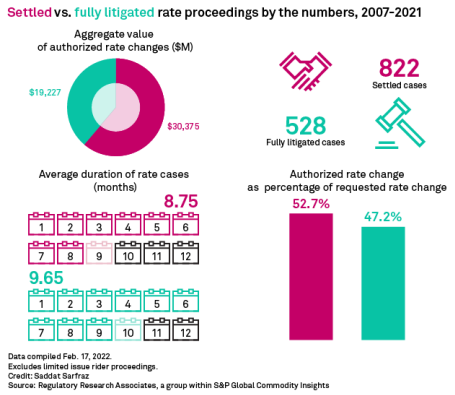

Review of utility regulatory settlements shows it pays to set aside differences

Settlements are used extensively in electric and natural gas utility base rate proceedings and can be an appealing way for the utilities and the major participants in these cases to bridge the differences between their respective positions. In the years 2007 through 2021, Regulatory Research Associates followed 1,350 electric and gas utility base rate cases. Of these proceedings, the 822 deemed to be "settled" gave rise to more than $30 billion in rate increases. An additional 528 cases were considered "fully litigated" and resulted in about $19 billion in approved rate hikes.

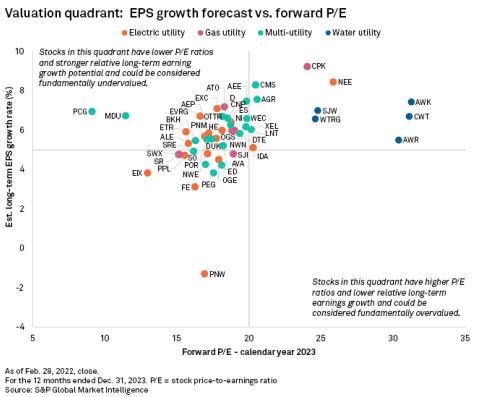

Utility valuations hold steady with S&P 500 as broad markets sag in February

Forward valuations on a next-12-month basis between the S&P 500 Utilities and the S&P 500 continue to trade essentially in lockstep. Utility stocks traded at a valuation discount to the S&P 500 throughout 2021 before a convergence of factors weighed heavily on broad markets at the outset of 2022.

Subscribe to receive our energy content directly to your inbox.