Subscribe to our Essential Metals & Mining newsletter

Corporate Exploration Strategies 2021 – Key themes, analysis and commentary

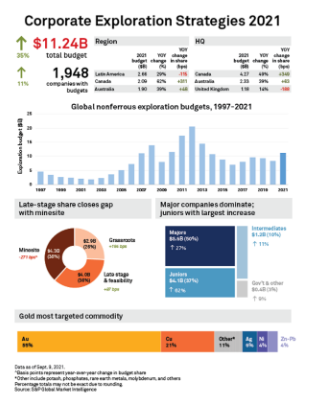

Strong metals prices and robust financing pushed the global nonferrous exploration budget total to a 35% increase year over year in 2021, as the mining industry continued to recover from a COVID-19-induced slowdown in 2020. View related webinar >

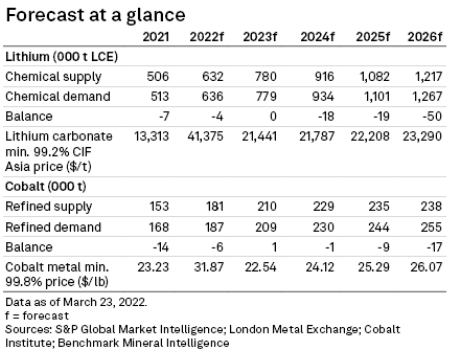

Lithium supply race heats up

Commissioning of new and restarting projects, as well as the expansion of existing operations, will be much needed to keep pace with unprecedented demand growth. We expect new and restarting lithium assets to add 355,000 tonnes of lithium carbonate equivalent capacity by 2023. Early production will benefit from persisting market tightness.

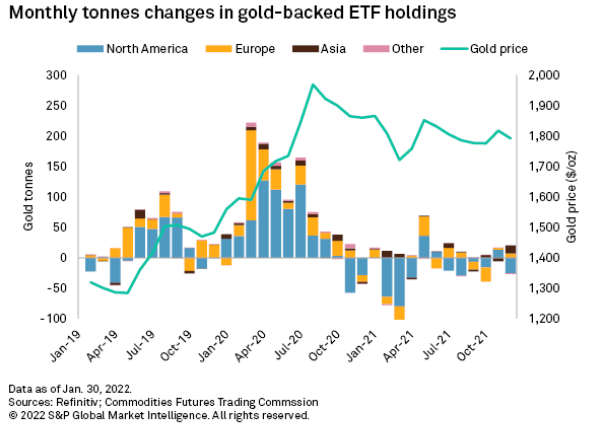

Gold ETFs — 2021 demand above pre-pandemic levels as inflation surges

In 2021, physical gold-backed exchange-traded funds posted a year-over-year decrease of 4.8%, or 181.3 tonnes, as collective gold holdings totaled 3,570 tonnes. The popularity of gold exchange-traded funds continues to hold the interest of investors, who are more willing to leverage gold as a hedge against inflation, heightened geopolitical risks and negative real yields.

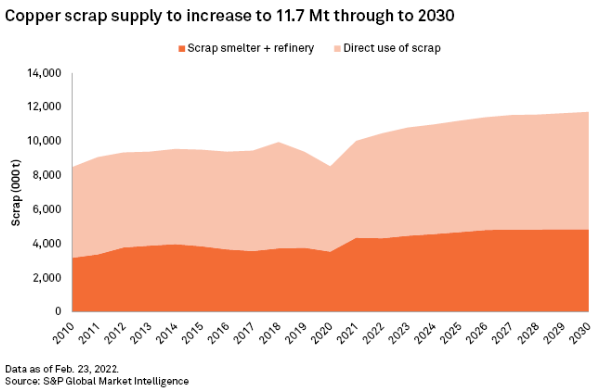

Copper scrap boasts decarbonization benefits amid challenging market dynamics

Currently on the rise as many copper-bearing products reach the end of their life, copper scrap supply boasts the potential to be a major disruptor to primary copper supply, and a force to satisfy the expected growth in copper demand from the renewable energy transition and electric vehicle revolution.

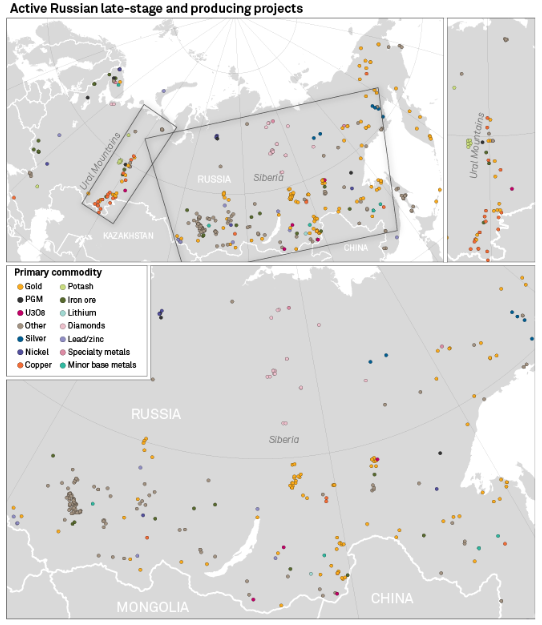

Russia and Ukraine – Mining by the numbers, 2021

Russia’s invasion of Ukraine is adding strain to already stretched global supply chains, and the metals markets are no exception. Russia is a major producer of precious, base and industrial metals, and has significant metals trade with Europe and Asia. In a period of low inventories of many metals globally, the invasion's impacts on the sector could be material.

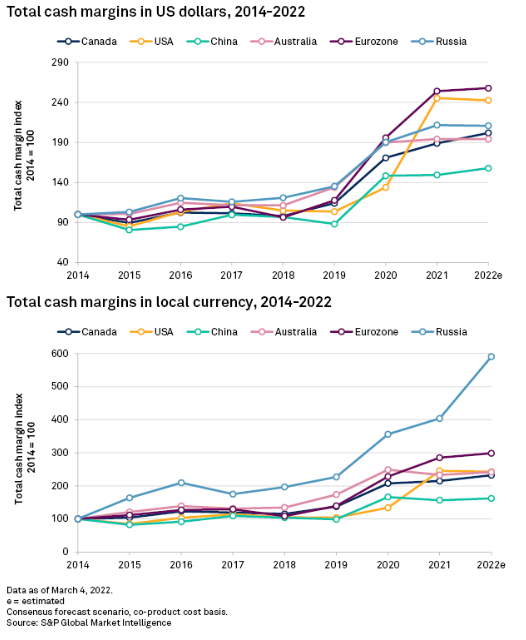

Russian gold miners expected to benefit from current market despite sanctions

Much higher inflation due to the ruble devaluation could raise costs for Russian miners, but margins are forecast to increase in local currency terms. Total cash margins of primary Russian gold operations in local currency are estimated to increase 46.3% year over year in 2022.

Russia-Ukraine conflict – Iron ore supply, trade risks escalate

Following the outbreak of hostilities, at least one key Ukrainian iron ore exporter has halted shipments, while Russian exports have been curbed as steel producers in Europe and Asia seek alternative sources for iron ore supplies. The threat also exists for Russian halts to commodity exports in retaliation.

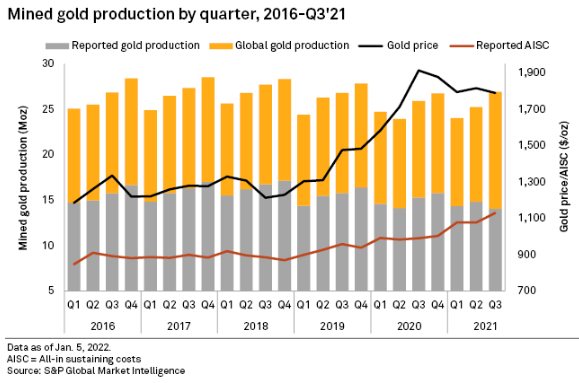

Gold Mined Supply — Supply up in Q3'21 despite lower prices, higher costs

Global gold supply levels increased 6.6% quarter over quarter in the September 2021 quarter, mainly driven by increased Latin American production, to attain levels last seen before the start of the COVID-19 pandemic. Despite rising costs, the relatively strong gold price has helped maintain healthy margins for producers.

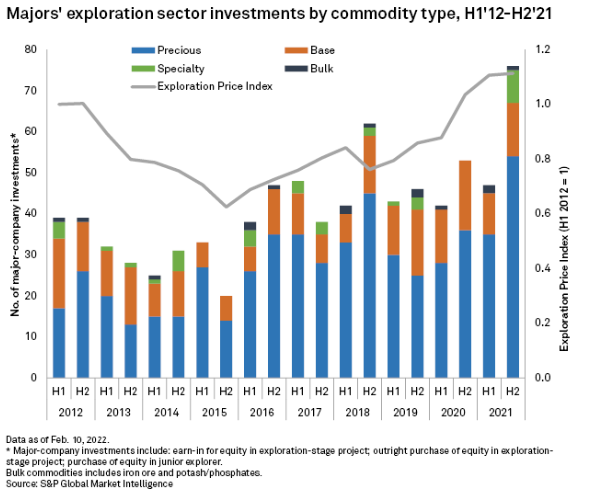

Major producer early-stage exploration M&A up for 2nd consecutive year

Major mining company deals involving the exploration sector reached a 10-year high in 2021 with a rise of 29% year over year, the largest in six years. Acquisition of all or part of junior exploration companies accounted for all the increase, with purchases of equity in early-stage projects declining slightly.

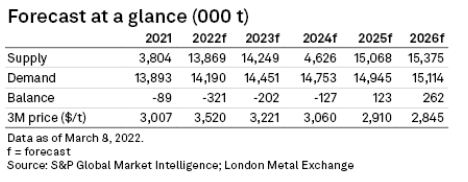

Commodity Briefing Service Zinc March 2022

We now see the zinc price averaging higher year over year in 2022 at $3,520/t, even with a slightly shallower deficit of 321,000 tonnes, as high energy prices dampen demand growth despite stretched zinc supply. We nevertheless still expect the nearest zinc surplus to be in 2025.

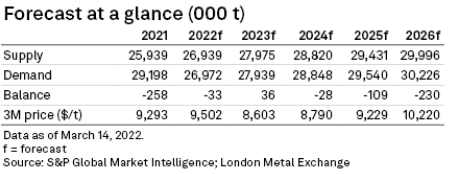

Commodity Briefing Service Copper March 2022

Across 2023-26, we kept our forecast London Metal Exchange three-month copper price at an average of $9,211/t, although we expect the copper market balance to move into a small surplus in 2023 after we slightly reduced our projection for global copper consumption.

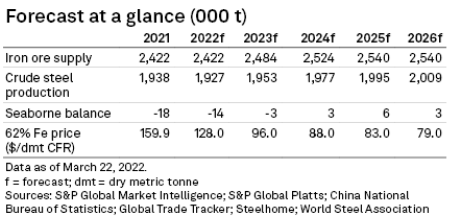

Commodity Briefing Service Nickel March 2022

The prevailing market tightness is set to ease as 2022 progresses, resulting in the London Metal Exchange three-month nickel price averaging below its recent high levels at $32,868/t for 2022 — a startling 78.0% increase year over year.

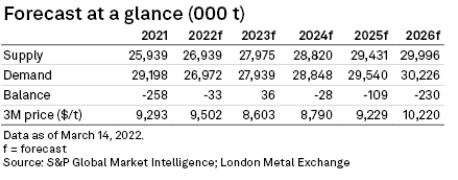

Commodity Briefing Service Iron Ore March 2022

We expect iron ore prices to remain strong in the second quarter with an average of $142.00/t, supported by tight supply and a rebound in Chinese demand. We have therefore upgraded the forecast 2022 average price to $128.01/t.

Commodity Briefing Service Lithium & Cobalt March 2022

We expect the pace of increase in the lithium carbonate CIF Asia price to slow, due to demand resistance in light of record-high lithium prices in the electronic and two-wheeler sectors, and unprofitable plug-in electric vehicle models.

Learn how S&P Capital IQ Pro platform can help you stay ahead of global mining activities and metals markets analysis and forecasts. Request a demo >