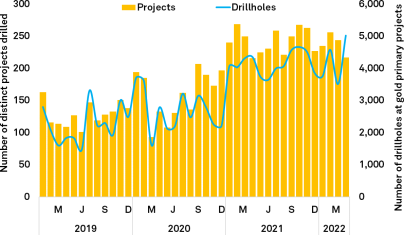

Gold project drilling activity lower in April, but drillholes up MOM

S&P Global Market Intelligence data indicates that reported drilling at gold projects decreased in April, with the total number of drilled gold projects down 11.1%; however, the number of drillholes increased 42.8% — mainly driven by the Latin America and Asia-Pacific regions.Africa and North America also showed strong drill results, while the number of drillholes at European projects was down marginally. The number of fundraisings for gold rose 7% to 130, but no transactions were valued above US$50 million, compared with seven in March. Gold's year-to-date total of US$2.17 billion is 28% less than the US$3 billion recorded in the comparable 2021 period. See related article >

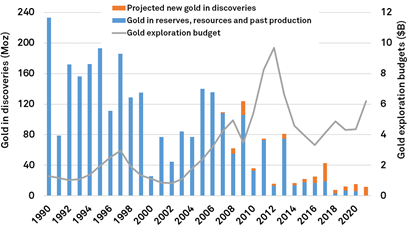

Several new discoveries over recent years

Our data includes all gold deposits containing over 2 million ounces in reserves and resources. Well-established operating assets remain the exploration focus despite increased exploration spending and a modest rise in the number of new discoveries. Our research indicates that only 28 out of 341 deposits were discovered in the past decade, containing just 171.8 Moz, or 6% of all gold discovered since 1990. The sharper decline over the past five years points to a lack of significant deposits discovered combined with the pending exploration efforts required to expand resources beyond our 2-million ounce threshold. Should exploration efforts continue along historical trends, we anticipate that discoveries over the past decade will increase modestly, to just 251.6Moz. See related article >

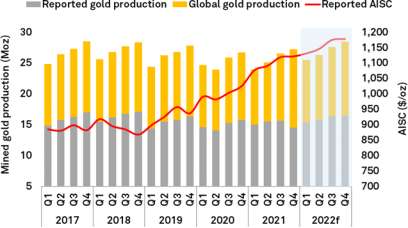

Supply outlook remains robust as producers capitalize

Multidecade-high inflation rates have had an impact on gold producers' all-in sustaining costs, particularly in 2022, exacerbated by Russia's invasion of Ukraine. Global gold supply rose 2.2% quarter over quarter in the December 2021 quarter — driven mainly by Canadian production — maintaining production above pre-COVID-19 levels. Profit margins increased slightly, to $675/oz from $670/oz in the previous quarter. For full- year 2021, supply rose approximately 2.7% year over year as production rebounded from the pandemic-induced lows of 2020. We expect production to increase almost 5% in 2022, with producers' profit margins under pressure from rising costs. See related article >

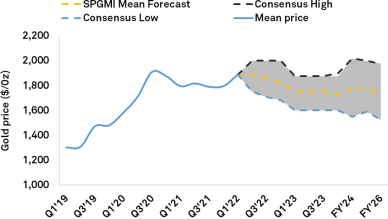

Gold declines to around $1,800/oz as interest rates increase to rein in inflation

The London Bullion Market Association gold price retreated to around $1,810/oz May 16, but was still up 1.85% year-to-date on the back of interest rate hikes and continued geopolitical tensions related to Russia's invasion of Ukraine. First signs of lower inflation appeared in May as 25- and 50- basis point hikes came into effect in successive Fed meetings, dampening the gold price performance. U.S. real yields moved into positive territory in May for the first time since 2020, putting additional downward pressure on gold prices. Additional and more aggressive rate hikes are expected in the U.S., as the Fed reiterated a more hawkish stance to rein in inflation. The U.S. 10-year T-Note rose 89.4%% year-to-date, and in the same period the S&P 500 declined 18.0% as investors sought refuge in safer havens, while Brent Crude continued to hover above the $100/bbl mark in May, gaining 33.1%. See related article >

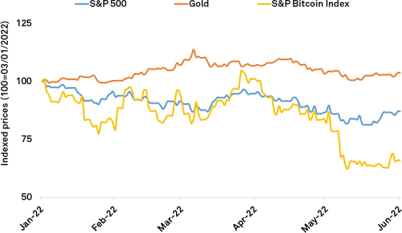

Gold returns marginally positive as cryptocurrencies exhibit volatility

Alongside gold, cryptocurrencies have generally been viewed as a natural hedge against inflation. The total market capitalization of cryptocurrencies is currently estimated at $1.7 trillion, according to the World Economic Forum. Year-to-date, the S&P Bitcoin Index has experienced significant volatility, shedding 34.5%, and the S&P 500 declined 15.6%, while gold returns remained positive. Cryptocurrencies face additional scrutiny, with U.S. President Joe Biden signing an executive order in March to put in place a regulatory framework for digital assets, which may prompt other governments to follow suit.

Gold outlook positive in medium term as inflation reined in

After reaching a 19-month high March 8, gold prices now face downward pressure as real yields have moved into positive territory and the Fed raises interest rates. S&P Global Economics anticipates the global economy to slow further in 2022 than previously expected, with U.S. and China economic growth downgraded, stoking fear of a recession. The gold price outlook currently appears steady despite these downside risks, as we expect the price to remain around $1,800/oz through the December 2022 quarter before ending our five-year forecast horizon closer to $1,700/oz. See related article >