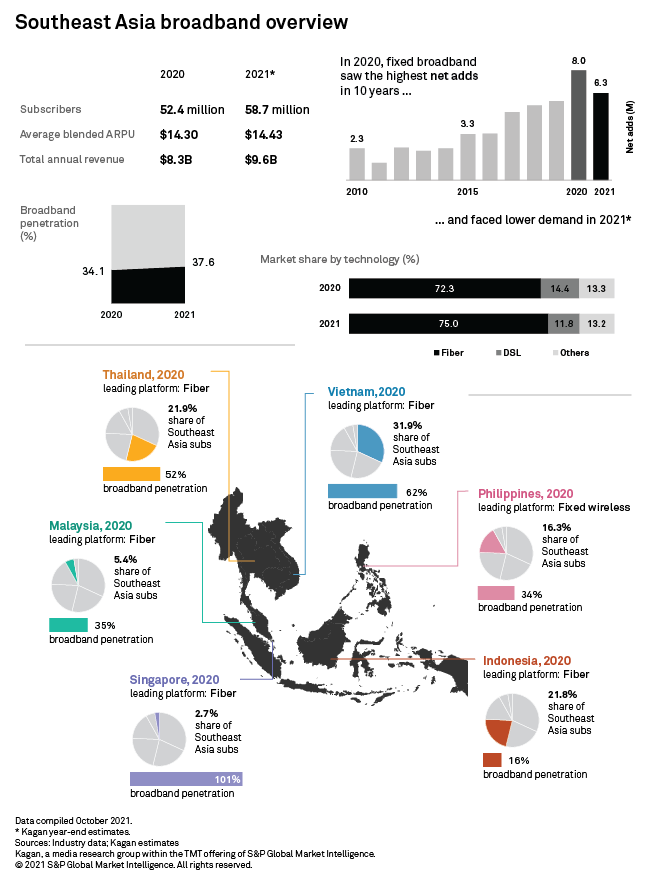

The COVID-19 pandemic boosted Southeast Asia's fixed broadband market to reach 52.4 million subscribers in 2020 with about 8 million new subscribers, yielding the highest net additions in the region within the past 10 years. However, broadband penetration remains low as fixed broadband connects only 34.1% of households in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. Kagan estimates broadband penetration will reach 37.6% by year-end 2021 amid slower subscriber growth due to lower demand, as social distancing restrictions ease up and countries gradually adapt to living in a pandemic-riddled environment.

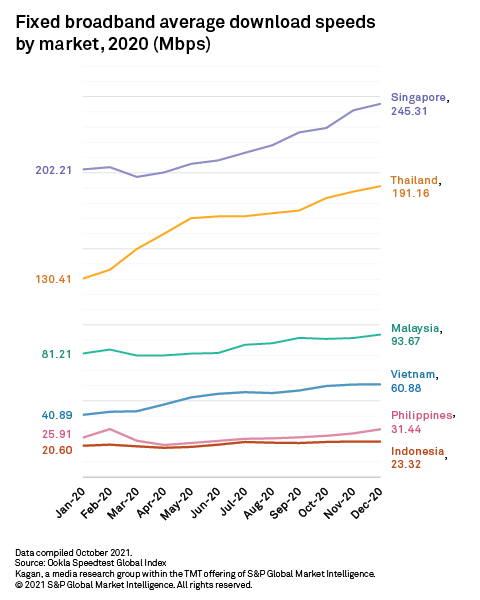

Thanks to its tech-savvy customer base and robust fiber network, Singapore also topped Ookla's Global Speedtest Index with its 245.31 Mbps average broadband speeds in year-end 2020. Meanwhile, Thailand achieved the fastest improvement in the region year over year, with its average broadband speeds growing by 52.8% from 125.12 Mbps in December 2019 to 191.16 Mbps in December 2020. Faster broadband speeds became more accessible as the dynamic market movement brought about by intense competition pushed multiple operators to leverage diverse sets of plans and bundles.

Despite being one of the very few industries that thrived during the pandemic, fixed broadband remains inaccessible to some rural areas and prices are still expensive relative to the region's purchasing power, restraining broadband's full potential to connect households online. Nevertheless, service providers can still address Southeast Asia's digital divide through continuous fixed infrastructure build-out along with proper pricing calibration.

Global Multichannel is a service of Kagan, a group within S&P Global Market Intelligence's TMT offering. Clients may access the full article along with Southeast Asia’s broadband and pay TV data by clicking here.