Netflix's move to slash subscription fees in some regions including Southeast Asia underscores the interesting pricing dynamics in emerging markets, where low willingness to pay remains a critical factor in growing uptake for subscription video-on-demand services. Affordability holds a lot of weight in the region, so raising subscription fees does not happen frequently, relative to other more affluent over-the-top markets.

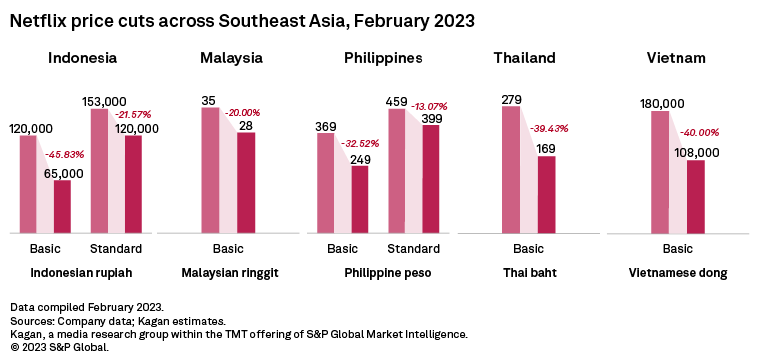

Netflix recently rolled out varying levels of price discounts in Southeast Asia for its Basic and Standard plans while retaining the fees for its Mobile-only and Premium plans. Kagan estimates that subscription fees for the Basic plan dropped by as much as 46% in some markets across the region. Netflix also reduced fees for the Standard plan in Indonesia and the Philippines by approximately 22% and 13%, respectively. Netflix's recent price reduction in Southeast Asia, where its household penetration remains considerably low, contrasts with the aggressive price hikes deployed by the company in most of its top markets by subscribers to boost profits. The global streamer had raised subscription fees in Indonesia and Malaysia in 2020, but those increases primarily coincided with the rollout of local regulations that imposed digital taxes on foreign service providers.

Given the current state of the global streaming sector, where sustaining healthy profit margins has taken priority as subscription growth fizzles, reducing prices may seem like a counterintuitive approach. But in Southeast Asia, where a significant portion of the customer base pays for the two cheaper entry-level plans, we believe the recent moves to lower pricing for the Basic and Standard plans might help with churn and subscription growth and also have the potential to improve low average revenue per user in the region. Making the next subscription tiers more affordable presents an opening that could help Netflix encourage users who were initially priced out to upgrade for access to better features such as additional simultaneous streams and better content formats in more supported devices outside of mobile phones and tablets.

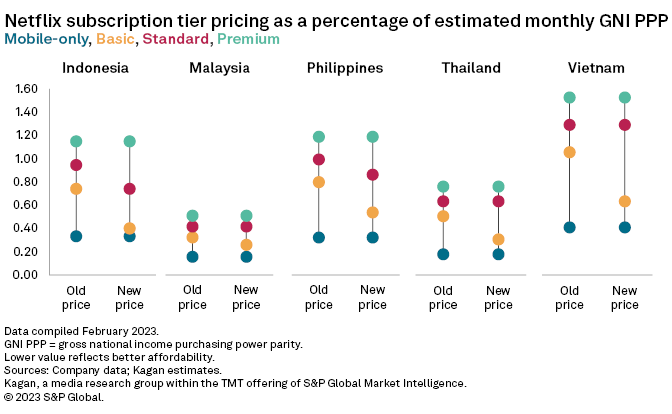

Our OTT affordability index, which measures subscription fees as a percentage of a market's estimated per capita gross national income at purchasing power parity, or GNI PPP, indicates that Netflix's recent price adjustment resulted in a substantial reduction in the affordability gaps between the Mobile-only tier and Basic tier in the five markets. Discounting the subscription fee for the Standard tier in Indonesia and the Philippines also provides an opportunity for members who used to pay the old price of the Basic tier in those markets to upgrade with little to no change in affordability to the next tier with better features. In addition, lowering entry-level fees could be an attempt to convince users to sign up for their own accounts instead, especially if Netflix decides to move forward with a password-sharing fee in these emerging markets.

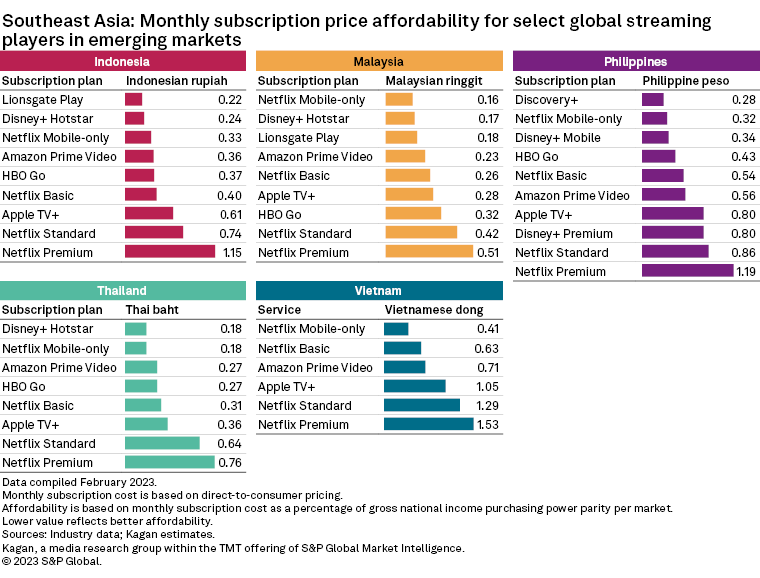

Netflix was not the first global OTT service in Southeast Asia to implement a subscription price cut. Amazon Prime Video, which also entered the region with a high subscription cost in 2016, relaunched localized platforms with cheaper monthly fees in Indonesia, the Philippines and Thailand in 2022 to attract more users.

Disney+/Disney+ Hotstar and Lionsgate Play were among the most affordable global streaming services in the region. Disney's competitive pricing strategy was a huge factor in driving high uptake for its streaming services in Southeast Asia. Warner Bros. Discovery Inc.'s HBO Go is slightly more expensive than the entry-level plans of most global streamers, although we believe a considerable chunk of its customer base in the region continues to access the platform as part of the HBO add-on bundle from their pay TV subscriptions with fixed-term contracts, so willingness to pay for video content may be less of an issue for the service. HBO Go also offers a three-month subscription plan while Disney+ in the Philippines and Singapore provide an annual subscription option to help minimize churn.

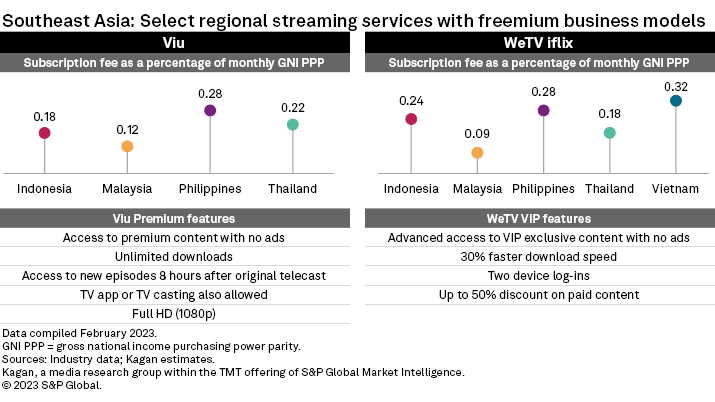

For top regional services like Viu and WeTV iflix, adopting a freemium model has mass appeal and relevance in a crowded field. Balancing their free, ad-supported tiers with more affordable subscription fees for their paid tiers than global counterparts has helped these regional services maintain competitiveness, especially as Netflix, Prime Video and Disney have also started investing in premium Asian content like Korean dramas and local originals.

Economics of Internet is a regular feature from Kagan, a media research solution within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.