This blog is written and published by S&P Global Market Intelligence, a division independent of S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Most businesses have critical dependencies on their supply chain. Being able to rapidly and accurately assess and manage the financial stability of your counterparties has never been more urgent. Here, Rogier Binsbergen - Director and Commercial Lead EMEA, KY3P®, and Ernest Breitschwerdt, CFA - Head of Credit Product Specialists, Europe, Credit & Risk Solutions, discuss how better to manage potential financial risk in your supply chain.

From common lessons learned and best practices to what the future holds for continuously monitoring a supplier's financial health, here are the most common questions and the answers you need to know.

#1: How do customers typically manage suppliers and their financial risk?

First of all, what we see is that there are still different approaches, with some companies being more mature than others. We see that companies with a lot of focus in managing their supply chains, for example, with a dedicated supply chain management or supplier risk function, do generally have a broader, holistic perspective of their supplier base. They have details on who their suppliers are and manage that centrally, not in silos. That enables them to look at financial, cyber, E. S. and G, and other risks in one place using the same evaluation process. With less mature companies, it is more fragmented, and they tend to manage risks in silos and rely on basic tools like Excel, which is not sustainable.

Companies that use a central platform typically have a well-structured process to manage the “third-party risk lifecycle”. As shown in Figure 1 below, before onboarding, this involves several stages, starting with an assessment to determine the risks associated with the services or products that a supplier provides and how critical these services or products are for the entire supply chain.

Figure 1: How to optimize your approach for a third-party financial health assessment.

Source: S&P Global Market Intelligence. For illustrative purposes only.

While a financial health assessment should be one of the key considerations, this risk is often not accounted for, as many supply chain managers are more concerned about on-time delivery and cost management. A large European manufacturer admitted that the procurement department was treated as only a cost center with little strategic input, and members of the team had limited access to data and analytical tools. Instead, they used very simple financial risk models that lacked sophistication and were not able to capture the interactions between different risk drivers and the strategic importance of the different partners to the business. Specifically, credit risk is multidimensional in nature and needs to account for factors such as industry and business risk, the credit environment, and sentiment. Plus, any analysis should be globally applicable because supply chains are global in nature.

Many risk departments utilize sophisticated credit risk monitoring tools but, in the past, often did not interact with the supply chain managers. The onslaught of COVID-19 and subsequent supply chain disruptions, coupled with today’s rising interest rate environment that is bringing a lot of stress to highly levered entities, is changing that and putting financial health assessments on the radar screens of procurement professionals.

#2: Why can assessing the financial risk of suppliers be challenging?

Here is an example that underscores why this can be a challenge. A large manufacturing company had a very extensive supplier base consisting of bigger public companies and many smaller privately held local firms. Information on these suppliers was scattered, and members of the procurement team wanted a central platform to house everything. They were also interested in evaluating the financial health of the providers to avoid any negative impact on the business. This was a challenge since private firms do not have the same financial reporting obligations as publicly held firms.

This created an opportunity to combine the power of S&P Global Market Intelligence’s Credit Analytics with the KY3P® platform that came with the IHS Markit merger. Credit Analytics blends cutting-edge credit risk models with robust data to help users reliably assess the credit risk of rated and unrated, public and private companies across the globe. KY3P is an integrated suite of solutions to manage end-to-end vendor risk.

Where financial data is readily available for firms via S&P Global Market Intelligence, credit scores[1] are produced to assess creditworthiness. A company can then go through the approval process and be onboarded and monitored. Where financial statement information is not publicly available, KY3P can be used to interact with suppliers to gather all information required to generate credit scores. These scores are subsequently fed back into the KY3P platform, which manages all the data in one location for profile generation, reporting, and more.

Step 6 in Figure 1 shows the important aspect of remediation in red. This “managed service” incorporates active interaction with suppliers to a) help understand the credit risk outcome and b) to advise them on how to improve the financial health going forward to finally being listed as an “approved vendor”. Scores can be created again to be confident about the financial stability of a supplier before proceeding further. Thie data collection and automated and outsourced processes enable companies to work with a wider array of suppliers more efficiently.

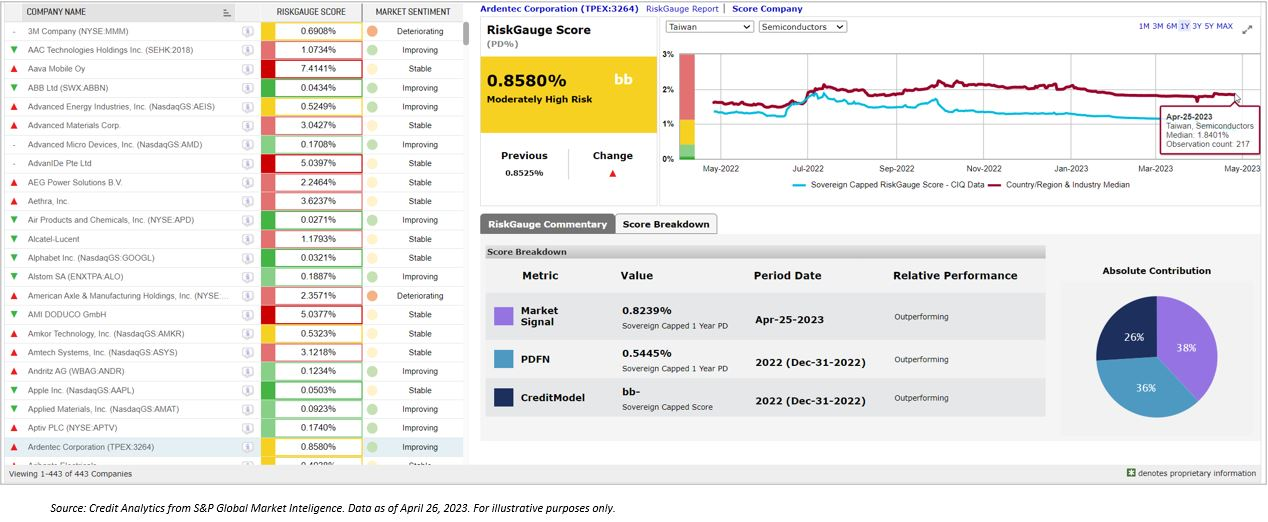

Figure 2 below shows a credit risk dashboard with RiskGauge Scores for a sample of real-life large to small companies. RiskGauge, part of the Credit Analytics suite of statistical credit risk models, generates credit risk assessments for public and private companies globally that can be mapped to a credit score on a 1-100 scale, where 100 equates to the lowest credit risk. The RiskGauge Scores represent probabilities of default (PDs) over a one-year forecasting horizon (i.e., how high is the likelihood that a specific entity will be in default over the next 12 months). This indicates which suppliers need close monitoring and, perhaps, the managed service.

Figure 2: Credit risk dashboard

The right-hand side of Figure 2 provides a “deep dive” into a specific entity with a comparison against a country and industry median. In this example, the supplier is a Taiwanese semiconductor manufacturer that, from a credit risk standpoint, is considered to be healthier than the median benchmark PD expressed at roughly 1.85%. The bottom of Figure 2 shows the underlying credit risk models that are the foundation of the RiskGauge Scores. They use financial statement information gathered from public sources or through the outreach described above. Additionally, a credit sentiment indicator works as a point-in-time overlay, being updated daily. These models are used by many credit risk professionals around the world and provide the ability to set different risk tolerances and treatment strategies for different suppliers.

#3: What were the impacts to companies with vendors facing financial distress?

There are many examples where companies have faced vendors going into financial distress, impacting production chains and service delivery and potentially leading to severe reputational damage and financial loss. Companies with sound operational resilience programs in place are better prepared to weather the storm. There are two fundamental aspects to this:

- Know which suppliers are critical to delivering on the business plan, products, and services. Then devise a multi-vendor strategy with a clear substitutability plan to limit exposure against disruption.

- When a back-up or substitutability option is not available, have a plan in place to resolve the situation. That could be with potential credit lines, credit insurance, or even equity/capital allocations to take over part of the supplier’s operation. This may sound drastic, but there may not be another option for a company to ensure that their own business keeps running.

These choices do not prevent a risk from materializing, but help with recovery. Staying close to critical suppliers is therefore essential to spot an event and take action before it happens.

#4: What additional measures can be taken to mitigate risk for halal supply chains

Halal logistics refers to managing the logistics operations according to the principles of Shariah law to ensure the integrity of halal products at the point of consumption. If having a halal supplier base is important, companies should construct relevant control questions and use them in the due diligence questionnaire to test suppliers. For example, to evaluate E. S. and G. risks many questions focus on issues such as human rights, diversity, and gender equity.

#5: What is the imminent role of AI in setting standards for supply chain data and analytics service providers?

AI is a big topic at S&P Global. At the moment, it is being leveraged in the back end of supply chain offerings to extract and spread financial data. For example, where data is delivered as a PDF file or image from a smaller firm that doesn’t report its financials, ProSpread™ can be used to automatically extract and standardize the data. In the end, however, there needs to be a “people component” to interpret the results and discuss issues with suppliers, especially where remediation is needed. A solution like KY3P can then host all data and results centrally and allowing for proper reporting and enable clients decision making.

#6: What do you see as the emerging risks of the future?

New or emerging dimensions of credit risk are primarily related to E. S. and G considerations, as well as climate risks. While E, S and G factors have always played a role in credit risk analysis, companies now want to quantify the influence of these well-known risk dimensions by using digestible scores where the factors actually have an impact on a credit risk assessment.

Climate-related risk considerations translate climate scenario projections into future credit risk by utilizing sophisticated stress testing methodologies. Thereby both physical risks (e.g., the impact of weather-related events) and transition risks (e.g., the costs associated with moving to a greener economy) can be assessed with a focus on the financial health of a company. In the context of supply chain management, there is a strong appetite for supply chain managers to utilize scenario stress testing tools to plan the supply chain of the future and to start discussions with current suppliers about potential risks they may not be considering.

#7: What do you expect from the recession and the financial impact on supply chains?>

It is hard to predict the future, but we have recently released the Economic & Country Risk projection overlay as part of a macroeconomic stress testing tool. Whereby users can rely on externally sourced macroeconomic projections to stress test their suppliers against various scenarios, including recessions.

Request more information on our Supplier Financial Risk Management Solutions here >

[1]S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.