While the January 1, 2022 IFRS 9 deadline for insurers may seem a long way off, there is still a lot of work that has to be done. Whether you go for an internal or an external solution, it is essential to have an understanding of all the core components and considerations involved in either approach.

First, there is the technology required for IFRS 9 data management, calculations, and reporting. In comparison to the banking sector, where many of the banks had advanced risk management systems in place for their normal course of business prior to IFRS 9 implementation, insurers may need to upgrade existing, or invest in new, risk management systems. These systems should also be ready to support a parallel run ahead of the “go-live” date. Ideally this would be for two years (and no less than one year), given the complexity and implications of IFRS 9 on Profit and Loss (P&L) accounts.

From an operational standpoint, there may also be a need to recruit new employees, or train existing employees, in order to update and implement the operational processes, accounting processes, and reports needed for IFRS 9.

There are a number of additional IFRS requirements that will need attention, in particular the reconciliation between IFRS 17 (accounting for insurance contracts) and IFRS 9, given that they both share the January 1, 2022 deadline.

Some of the key considerations for insurers in implementing an IFRS 9 calculation framework include:

- Classification of relevant financial instruments (assets and liabilities). Typically, but not exclusively: corporate bonds, government bonds, irrevocable loan commitments and financial guarantee contracts (not accounted for at fair value through P&L (FVTPL)), structured debt (senior tranches), and mortgage loans.

- Incorporation of past, present, and forward-looking information in order to perform the expected credit loss (ECL) calculation.

- Definition, implementation, and monitoring of the correct staging process – 12 month versus lifetime horizon, and looking out for a significant increase or reduction in credit risk since initial recognition

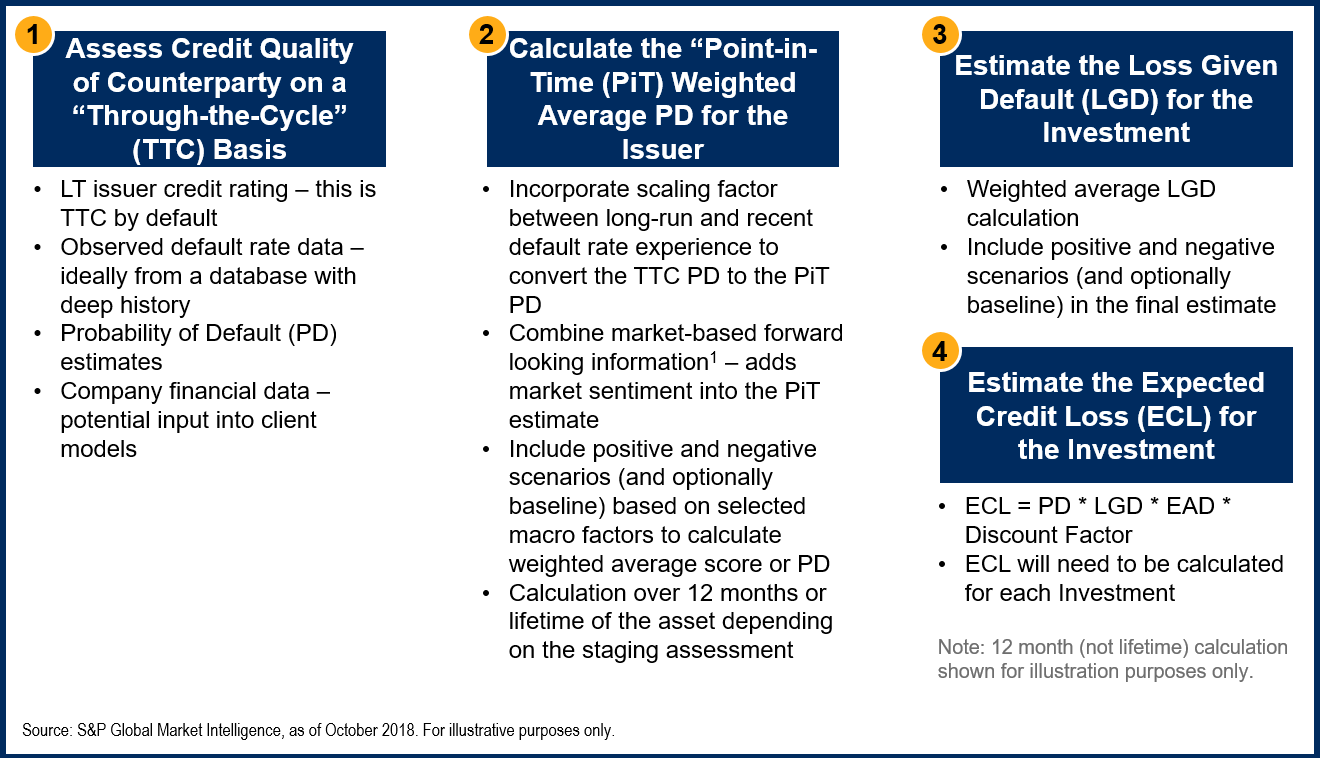

Therefore, it is evident that there are many important considerations for IFRS 9 adoption. One of the most critical is the ECL calculation itself and its composite parts. Looking at this in more detail, the four potential steps to arrive at the ECL are shown below (Figure1).

Figure 1: Steps to Arrive at ECL

1This is optional as detailed in section 5.5.4 of the IFRS 9 standard that suggests the use of: "all reasonable and supportable information that is available without undue cost or effort at the reporting date about past events, current conditions, and forecasts of future economic conditions."

Although the above steps may make the ECL calculation seem straightforward, in practice the lifetime calculation is more complex than the 12-month figure shown in the inset, and there are many complexities surrounding the calculation of the PiT values, as it needs to integrate past, present, and future information across multiple investments. This is particularly difficult for low-default asset classes, which will normally make up the majority of an insurer’s investment portfolio. This is because representative default data is hard to find and analytical capabilities and workflow tools are needed to undertake these estimates across multiple exposures. In addition, for the portion of an insurer’s portfolio that is unrated, a framework is needed that can reliably identify that risk.

Internal model approach

While it is recommended to leverage the approach described above, some companies may instead attempt to solely use internal models and data to calculate the PD, LGD, and ECL by using their company’s historical default data and applying this to the corresponding asset types.

This internal model approach can suffer from the following problems:

- Insufficient data for reliable modelling: This will particularly be a problem for small- and medium-sized insurers. Some of the larger insurers may have adequate volumes of historical data and sufficient sample sizes for internal model creation.

- Poor prediction of default: If only internal data is used, the broader default experience provided from complementary models built on deep and rich data sets will not be reflected in the IFRS 9 estimates. The predictive power of these internal models could then be compromised.

Moreover, a possible lack of precision, which can be inherent in this type of internal modelling approach, may prove more costly as more loss provisions may need to be allocated, and the potential benefits of lower ECL costs would then be lost.

Other Possible Benefits

There are two other possible benefits that can be gained from full IFRS 9 implementation:

- The hedge accounting component may provide a benefit to insurers in helping firms better reflect their risk management practices on their financial statements, which can potentially provide a competitive advantage since most investors typically like to see a company smooth out P&L volatility on their financial statements.

- It will also add transparency to financial reporting, which can be attractive to investors.

To find out more about the suite of S&P Global Market Intelligence solutions for IFRS 9 contact us here.

1 Permission to reprint or distribute any content from this presentation requires the prior written approval of S&P Global Market Intelligence. Not for distribution to the public