Key takeaways:

- The S&P Global Market Intelligence solution set of Credit Analytics and S&P Capital IQ Financials was predictive in identifying warning signs of credit deterioration.

- S&P Global’s Probability of Default Market Signal model (PDMS) highlighted a marked deterioration in Party City’s credit quality as early as FY2021.

- Party City’s decline in profitability, reinvestment, and liquidity were significant contributors to its worsening credit quality.

During the pandemic, many retailers experienced a significant slowdown in foot traffic at brick-and-mortar locations due to shelter-in-place restrictions. Many businesses can still feel the effect of this abrupt change of life today. One such example is Party City.

Over the years, Party City has experienced a decline in its operating performance and consequently, its ability and willingness to pay back its lenders. S&P Global Market Intelligence Credit Analytics, a quantitative suite of models, can help identify early warning signs of credit deterioration through its combination of fundamental and market signal approaches.

The Probability of Default Fundamentals and Probability of Default Market Signals highlighted a significant increase in Party City’s credit risk profile a year prior to its bankruptcy.

Probability of Default Fundamentals

PD Model Fundamentals identifies potential default by assessing financial risk, and business risk. Calibrated on +15 years of defaults, and available for more than 8 million* public and private companies.

FY2021:

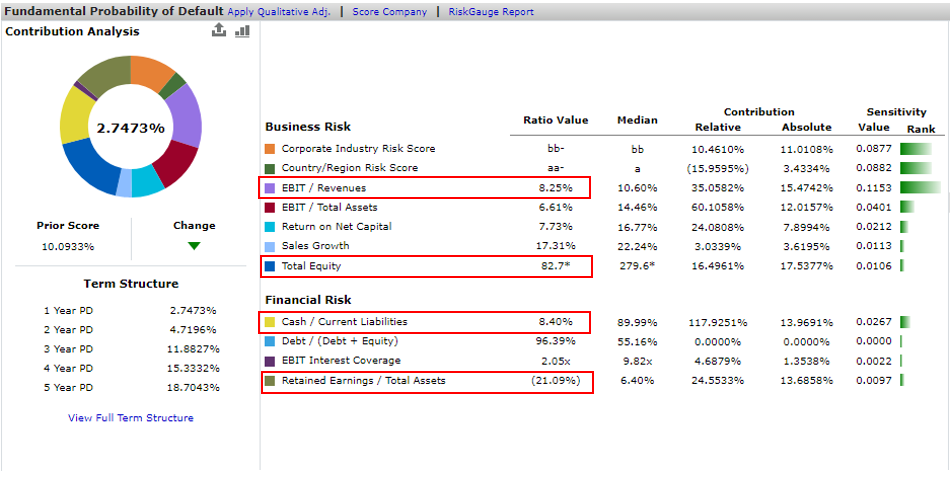

Figure 1: Party City Holdco Inc.'s Probability of Default Fundamentals (PD FN) output using December 31st, 2021 financials

FQ12022:

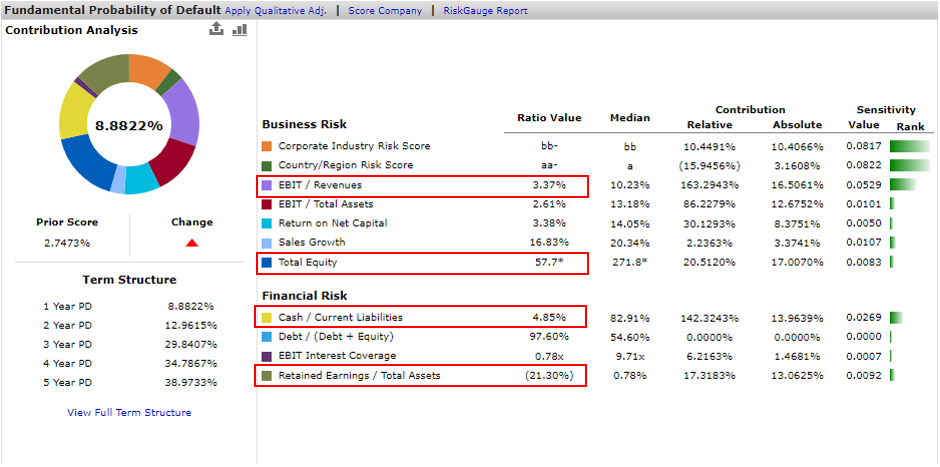

Figure 2: Party City Holdco Inc.'s PD FN output using March 31st 2022 financials

PD Fundamentals identified potential credit deterioration as early as FY2021 when Party City’s EBIT margins were well below the median of its peers. In fact, this trend was exacerbated when Party City’s EBIT margin fell to 3.37% in FQ12022 from 8.25% in FY2021.

It is critical to note a large portion of Party City’s issues with profitability also stems from large expenses incurred during the COVID pandemic, resulting in poor retained earnings. Retained Earnings/Total Assets across FY2021 was -21.09% compared to a median of 6.40% for other U.S-based specialty retailers. After supply chain crises and geopolitical tensions, Party City’s Retained Earnings/Total Assets fell further to -21.30% compared to a median of 0.78% in FQ12021. This decline in reinvestment resulted in Party City financing its inventory through short-term borrowing, as noted by both an increase in short-term borrowings as well as a continuous decline in Cash/Current Liabilities. Cash/Current Liabilities fell to 4.85% from 8.40% in FQ12022 over FY2021.

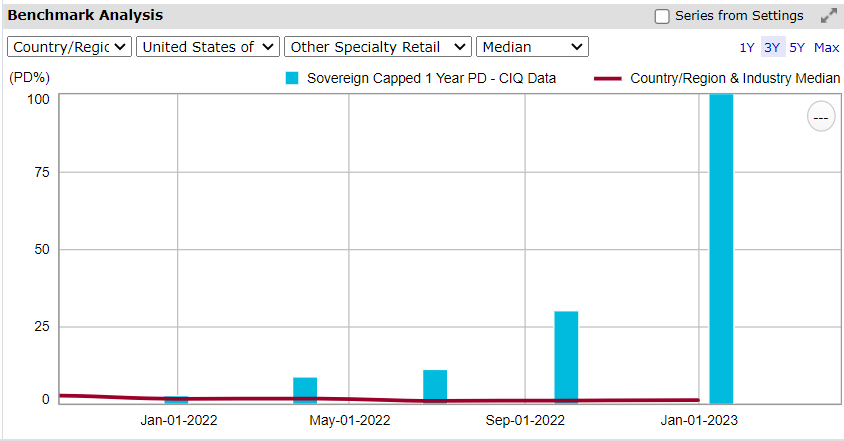

This trend in declining operating profit, reinvestment, and liquidity continued quarter over quarter with PDs spiking as far as 30.25% in FQ32022. Party City filed for bankruptcy shortly thereafter on January 18th2023.

Figure 3: PD FN benchmark analysis over 1 year time horizon

Probability of Default Market Signal (PDMS)

PD Market Signals provide a point-in-time view of credit risk, and early warning signals of potential default between reporting periods, for 82,000+* public companies.

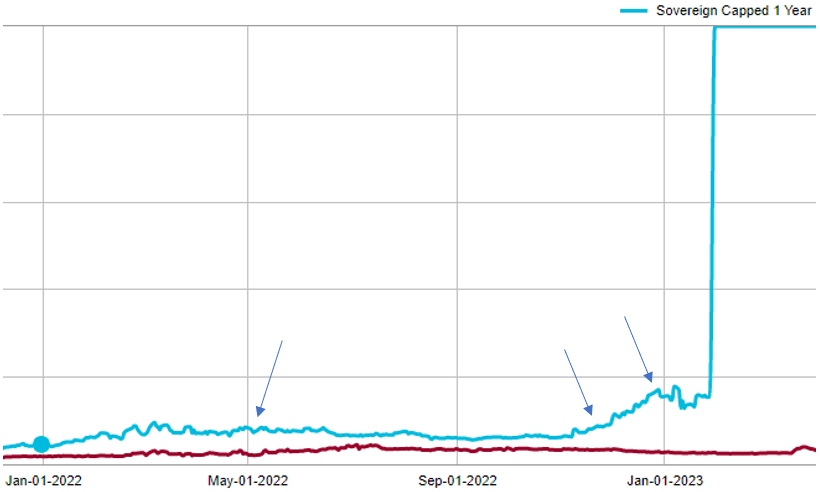

From a market sentiment perspective, investors had been increasingly wary of Party City’s problems from FQ12022 onwards. Party City reported asset write-downs and lowered its corporate guidance in May 2022. Some knock-on effects of this resulted in eventual ratings downgrades In November 2022 as well as a delisting notice from the NYSE in December 2022. As a result of declining retained earnings and a declining share price in Party City, S&P Global’s PD MS model highlighted upticks in declining market sentiment, highlighted by the graph below.

Figure 4: Party City Holdco Inc.'s Probability of Default Market Signals (PD MS) output over 1 year time horizon

This large uptick in PD could have been tracked not only through our quantitative models, but also through S&P Global portfolio monitoring tools that can create alerts if PDs and/or credit scores breach a desired threshold. Investors that use our models would know to keep a watchful eye on Party City, especially as the likelihood of bankruptcy approached.