Investors, regulators, governments, suppliers, and others are playing a critical role in shaping environmental, social, and governance (ESG) practices as stakeholders look towards sustainability. To discover how these considerations are changing the landscape of credit risk management, S&P Global Market Intelligence (“Market Intelligence”) hosted a webinar on July 26, 2023. The session examined the growing focus on ESG issues, its impact on credit risk, and how ESG factors are integrated into Market Intelligence’s Credit Assessment Scorecards. This article summarized the highlights of the discussion.

Key Takeaways:

Credit Risk Meets ESG

We are starting to see the conversation around sustainability getting a lot more attention when we speak about financial wellness. In the case of banks and other financial institutions, ESG factors obviously impact the creditworthiness of loans and investments. But, in prior schools of thought, ESG was a separate conversation. Now the market is shifting to how E, S, and G can also impact probabilities of default (PDs) and creditworthiness.

European regulators have been at the forefront of different ESG initiatives. The European Banking Authority (EBA) has created roadmaps to allow institutions to bring in objectives and timelines to assess the materiality of ESG and is trying to understand the most appropriate approach for the banking frameworks themselves.

“EBA recommends that institutions set out appropriate criteria for the assessment of the creditworthiness of counterparties, taking ESG factors and ESG risks into account”.[1]

We're now at a stage of incorporating ESG factors within associated risk policies. For example, authors of the banking regulations (i.e., the Basel committees) are starting to introduce climate-related and ESG-related risks into the Pillar 1 and 2 frameworks on stress testing. We're seeing a lot more push and reasoning behind inclusion of ESG within the credit risk environment.

In Asia Pacific as a whole, top regulators, such as Bangko Sentral ng Pilipinas (BSP), are speaking to environmental and social risks both from credit operations, due diligence, and the relationship and assessment of ESG risk profiles and creditworthiness. So, it’s no longer just a credit conversation, but ESG and credit. Of course, everyone is trying to understand the best approaches to drive these assessments.

Some institutions have always considered aspects of climate and broader ESG issues within their day-to-day work. For example, insurance underwriters have long used sophisticated weather forecasting and detection technologies to determine premiums required for insurance policies. ESG considerations have also been a subject of credit analysis within the S&P Global Ratings framework for many years, although these factors weren’t highlighted.

“They (ESG credit factors) have always played a prominent role in creditworthiness and, thus, in our credit ratings – even before the term ESG was coined more than a decade ago”.[2]

Moving Forward on the Integration

Market participants need a view of traditional creditworthiness alongside ESG credit risk factors, as well as transparency around how ESG is impacting credit risk, credit scores, and PD analysis. That said, not all standalone ESG factors will have a material impact on creditworthiness, as ESG risks and opportunities tend to come to fruition down the road, while credit considerations have a shorter time horizon, typically three or so years. So, it’s important to determine which ESG factors will have an impact where there is sufficient visibility and certainty.

For example, cement production is highly polluting but, from a credit standpoint, there's no viable substitute in the short term, or perhaps even in the long term. Given that, credit analysts wouldn't necessarily put a negative position on cement producers from an ESG standpoint. If you take another example, however; electric vehicles (EVs) and batteries as an alternative for oil as a fuel, this is a different story. While EVs are still lagging combustion engine cars, they are gaining more traction in some geographies and shifting market sentiment & consumer preferences to a ‘greener’ substitute.

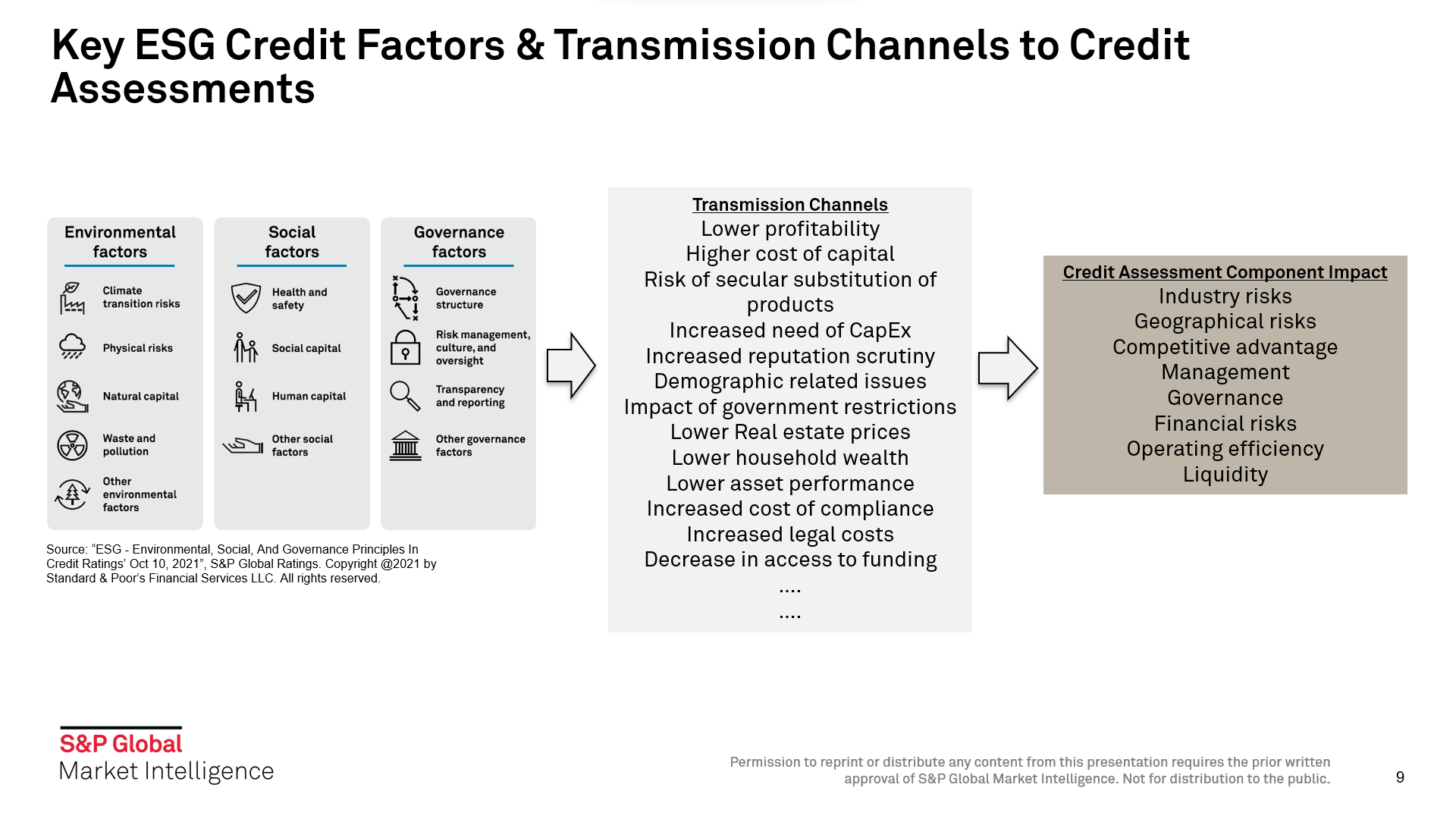

We need to look at the intersection of ESG and credit to be able to drive materiality and assess the impact on creditworthiness. This is shown in Figure 1, from those ESG credit factors, what they signal within the credit space, and where this would impact the credit assessment, from systemic risks to those entity-specific such as competitiveness, operating efficiency, profitability, and cash flow.

Figure 1: Key ESG Credit Factors and Transmission Channels to Credit Assessments

Now we understand that ESG credit factors can be material to creditworthiness, the conversation now moves to the extent of exposure across industries, which we can break down across E, S, and G, independently. Here are a few examples with the E, S, and G categories.

Sample Environmental Factors

There are two types of climate risks: (1) physical risks from climate hazards, such as hurricanes and wildfires, plus longer-term stresses, such as sea-level rise, and (2) transition risks from the costs associated with adapting to climate change and transitioning to a low-carbon economy.

For solar energy system providers, consumers interested in a greener economy could increase demand for solar, plus there are quite favorable government policies in place for clean and renewable energy. In this case, transition may have a positive impact on the business. Companies operating in a territory vulnerable to physical climate-related risks, like floods and hurricanes, would have a different story in the E category.

Natural capital (e.g., water, minerals, animals, and plants) may also affect companies in different ways. For example, utility companies with dated water infrastructure could have high leakage rates and need to consume a lot of water to operate. The capital expenditure requirements to upgrade facilities would be looked upon negatively and could increase credit risk.

Sample Social Factors

Health and safety falls in this area, with tobacco producers being a good example given the social risks from smoking. Another is data privacy & security that could be linked to socioeconomic and demographic issues in a given country or region. In Eastern Europe for example, providers of military personnel housing stand out. With the uptick in military spending, companies providing housing would benefiting from a social capital perspective, due to budget set out from supportive government defensive strategies and policies – something other real estate and housing providers may not be able to take advantage of.

The treatment of employees and working conditions also falls within this area. Apparel manufacturers face social risks in their labor supply chain. We've seen reports of child or forced labor that can damage a brand’s reputation and bring regulatory scrutiny that eventually can lead to further financial consequences. Unfair labor practices and poor working conditions can also impair brand value.

Sample Governance Factors

This is not new for those working in the credit risk space. Essentially, this is how an entity is organized and run to make decisions in the best interest of stakeholders. It would include policies and procedures, Board oversight and how effective they are in identifying and mitigating potential risks, plus the strength and diversity of the management team. Another important factor is transparency and the quality, reliability, and frequency of information disclosure.

One area of focus is staff turnover, retention, and demand risk. So, those family-controlled companies with very little Board oversight, a lack of any independent oversight, or aggressive shareholder distributions are typically viewed negatively. A positive attribute would be a management team with good depth and breadth across business lines, reducing key personnel risk, and a team with considerable expertise and experience and a strong track record of success.

Data Availability

ESG analysis is still a relatively new area, so disclosures and availability of information differs between countries and companies. In some regions, we see information finding their way into annual reports and corporate sustainability reports, as well as company websites for listed companies.

However, the key thing to mention, especially in APAC, is that we have a long way to go to quantify all ESG credit factors, run correlation analysis, look at trends, and more. The good news is that there are many discussions underway, and we hope to see sustainability disclosures having a much greater focus from the market and being used in the credit space.

Specific ESG Factors That Stand Out

When we dive into each of the different E, S, and G credit factors mentioned earlier, three stand out: climate transition risks, health and safety, and governance structure. From our research, most of the negative impacts are from environmental-related ESG credit factors associated with high industry risks. Typically, the environmental ESG credit factors affect every participant in that industry, whereas governance is entity specific. That highlights the importance of having both industry-wide datasets on things like greenhouse gas emissions and entity-specific data.

Climate transition is mostly driven by increasingly tight regulations across the globe and across industries. On the health and safety side, the COVID-19 pandemic exacerbated the impact on credit quality. Some industries have bounced back quite strongly, but not all. For governance,

most of the negative considerations have been driven by private equity-owned entities, where corporate decision-making may promote the interest of one stakeholder over another.

The Credit Assessment Scorecard Approach

Scorecards provide a consistent framework for calculating credit risk, drawing on a mixture of quantitative and qualitative questions in a check-box style. They are fully transparent, providing underlying logic and weights, and generate numerical scores that are broadly aligned with S&P Global Ratings’ criteria.[3] Scorecards are especially useful for low-default portfolios that, by definition, lack the internal default data necessary for the construction of statistical models that can be robustly calibrated and validated.

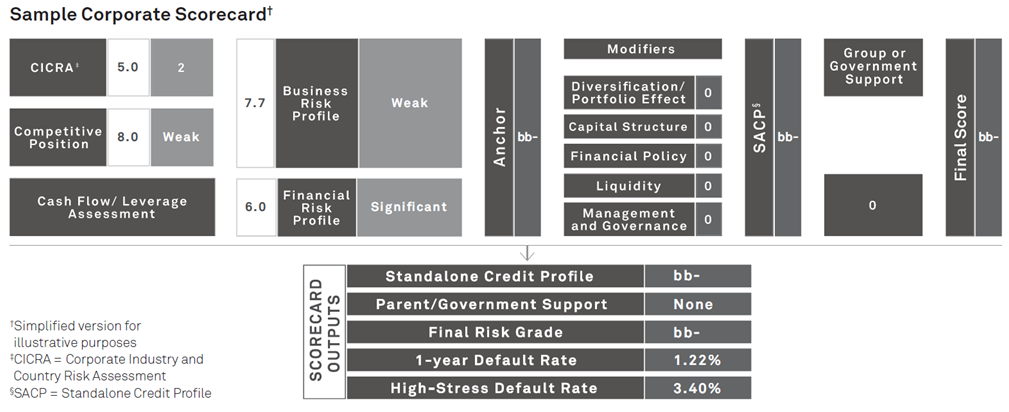

Figure 2 shows a generic Corporate Credit Assessment Scorecard used to assess the creditworthiness of any corporate entity regardless of sector, industry, or geography. The traditional credit assessment approach forms the corporate industry and country risk assessment (CICRA) shown on the left.

Figure 2: Corporate Credit Assessment Scorecard

You also see an assessment of the competitiveness of the entity, which helps form the business risk profile, followed by a review of the entity’s ability to generate cash flow and its leverage requirements that drive the financial risk profile. Together, they form an anchor assessment, which is a letter-grade scale that can be further modified when needed to obtain a stand-alone credit profile. Beyond the stand-alone credit profile, there are external overlays related to group support, government support or, in some situations, group and government intervention.

Looking at the E, S, and G factors, the G is clearly identified directly in the assessment within the management and governance modifier that can impact the anchor assessment. E and S can impact at the industry level and/or the entity level when doing peer analysis. They can affect competitive advantage, operating efficiency, and more. It's going to differentiate one entity from another based on the level of preparedness to handle some of these E- and S-related risks.

Other Asset Classes

Of course, ESG credit factors can influence other asset classes, but they have different credit metrics, such as capital and solvency for financial institutions. With financial institutions, banks in particular, the E risks are relevant to exposures to counterparts in the loan and investment portfolios, not necessarily the bank’s physical assets itself. The S will relate to such things as privacy protection, access, and affordability, while G will relate to transparent reporting, risk management, culture, and oversight.

So, how do we translate that into a credit risk assessment? We have a Bank Credit Assessment Scorecard with ESG factors that can influence multiple areas of credit analysis. There are three key areas that are affected. One is the banking, industry, and country risk assessment (BICRA) that looks at all the attributes from an economic and industry risk standpoint for one banking industry versus another from country to country, and then goes further into entity-specific areas.

Banks are highly regulated with institutional frameworks and banking supervisory initiatives and some negative governance can be related to the banking environment itself. It can be driven by systemic issues or country-level weaknesses in both regulatory and reporting standards, especially in emerging markets. We've obviously seen some money laundering cases for certain institutions and certain geographies over the last 10 to 20 years.

The key thing to underscore is that ESG credit factors impact all asset classes. They go beyond traditional corporates to financial institutions to sovereigns to project finance. Going forward, there will be more transparency and a bigger view around how ESG impacts other asset classes.

ESG Credit Metrics

The Credit Assessment Scorecards produce a credit scores mentioned earlier, which can be mapped to long-term through-the-cycle PDs. We can also generate ESG credit metrics scores. These are an alphanumeric quantification of the expected impact of an ESG credit factor on the final score or on the final credit assessment itself. They are ranked from 1 to 5, where 1 is considered positive, 2 neutral, and 3, 4, and 5 different levels of negativity. The metrics provide an additional level of assessment on a continuous scale to be able to provide a view of the impact of E, S, and G useful for both internal and external requirements.

Expect More Advances

The thinking around ESG issues will continue to evolve with better data helping to advance the analysis. Many countries in APAC are moving to mandatory disclosure that will enable more information to be shared and compared to fuel the credit assessment process.

[1] “Report on management and supervision of ESG risks for credit institutions and investment firms”, EBA, 23 June 2021.

[2] Source: “ESG in Credit Ratings”, S&P Global Ratings, www.spglobal.com/ratings/en/research-insights/special-reports/esg-in-credit-ratings.

[3] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.