U.S. wind power capacity additions in the first quarter dipped compared to the year-ago period as the industry remained buffeted by soaring prices of key commodities such as steel as well as supply chain disruption and rising freight rates.

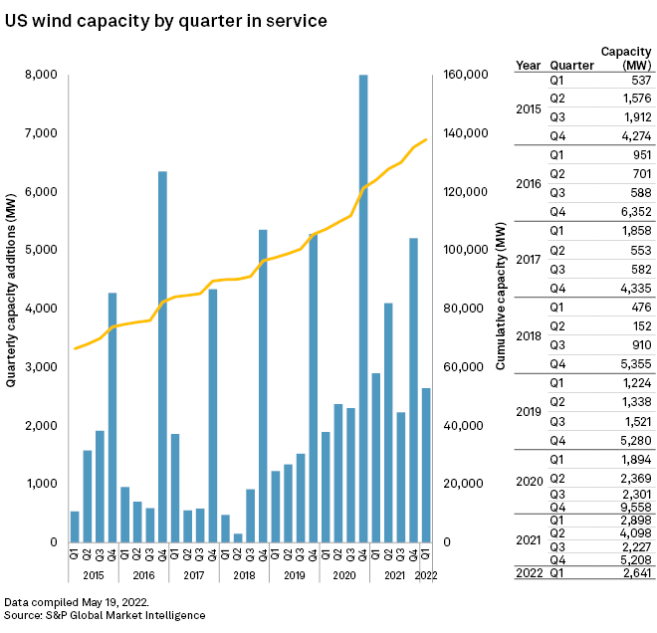

Wind developers connected 2,641 MW of wind power capacity to U.S. grids from January to March, a decrease of 8.9% from 2,898 MW of wind capacity that came online in the comparable quarter of 2021, according to S&P Global Market Intelligence data. The first-quarter 2022 total is a 49.3% decline from the strong fourth quarter of 2021, when the U.S. added 5,208 MW of wind power capacity.

U.S. developers of wind, solar and battery storage projects faced delays at 1,830 MW of projects originally scheduled to come online in 2022 and 2023, the American Clean Power Association said in a Feb. 15 report. Those delayed projects are in addition to 11.4 GW of wind, solar and battery storage projects initially planned for completion in 2021 but also pushed back.

As of the end of the first quarter, the U.S. had a cumulative wind power capacity of 137,909 MW, Market Intelligence data shows.

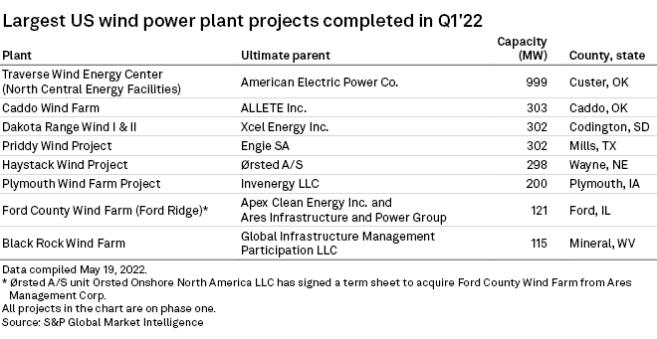

American Electric Power Co. Inc. utility subsidiaries Southwestern Electric Power Co. and Public Service Co. of Oklahoma completed the largest project of the quarter, the 999-MW Traverse Wind Energy Center in Custer County, Okla. The facility, which is connected to the Southwest Power Pool grid, is the third and final project belonging to the North Central Wind facilities developed by Invenergy LLC and GE Renewable Energy, each of which was sold to the AEP utilities once in service.

ALLETE Inc.'s 303-MW Caddo Wind Farm in Caddo County, Okla., Xcel Energy Inc.'s 302-MW Dakota Range Wind I & II in Codington County, S.D., and Engie SA's 302-MW Priddy Wind Project in Mills County, Texas, were among the other large wind projects completed during the first quarter.

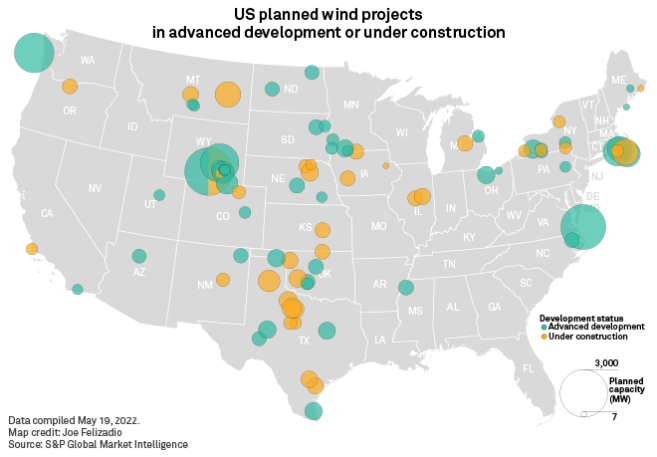

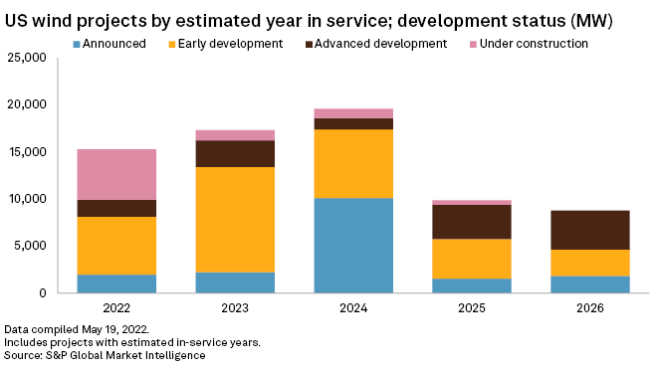

Despite a lackluster first quarter, the U.S. has a strong wind project development pipeline, with 70.9 GW through 2026, according to Market Intelligence data. Of that total, 30% is in advanced development or under construction. For 2022, 15.3 GW is in various stages of development, with almost 5.4 GW, or 35%, under construction and another nearly 1.8 GW, or 12%, in advanced development.

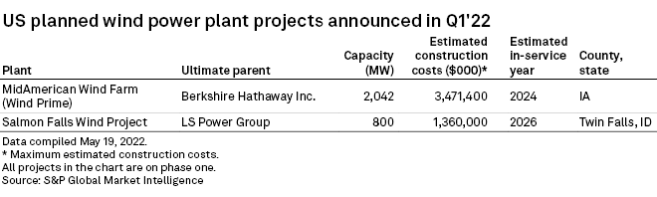

Berkshire Hathaway Energy subsidiary MidAmerican Energy Co.'s 2,042-MW MidAmerican Wind Farm, also referred to as the Wind PRIME project, in Iowa topped the list of announced projects in the first quarter. If approved by the Iowa Utilities Board, the planned $3.9 billion project is expected to come online in late 2024.

Elsewhere, LS Power Group affiliate Magic Valley Energy LLC proposed building the 800-MW Salmon Falls Wind Project in Twin Falls, Idaho. The project has an estimated cost of $1.36 billion, with completion expected in 2026.

Wyoming continued to lead the nation in wind projects in advanced development or under construction, with 6,529 MW of capacity in the late project stages, though some of the projects have been pending for years. Texas came in second, with 3,705 MW of such projects. Virginia was third with 2,640 MW, though there the resources are offshore wind.