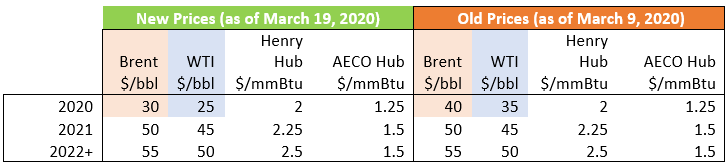

Changes to S&P Global Ratings Oil & Gas Price Assumptions

S&P Global Ratings lowered its Oil & Gas price assumptions on March 9, 2020 and followed this with a further downward assumption for Brent Crude and West Texas Intermediate (WTI) on March 19.

Table 1: S&P Global Ratings Oil & Natural Gas Price Assumptions

bbl--Barrel. mmBtu--Million British thermal units.

AECO—Alberta Energy Company. Prices are rounded to the nearest $5/bbl and $0.25/mmBtu.

Source: “S&P Global Ratings Cuts WTI and Brent Crude Oil Price Assumptions Amid Continued Near-Term Pressure”, S&P Global Ratings, March 19, 2020. For illustrative purposes only.

(Recently) Fallen Angels:

Given the change in assumptions, the following U.S. Oil & Gas issuers were downgraded to ‘BB+’ between March 25 and March 27, 2020

- Apache Corporation

- Occidental Petroleum Corp.

- Patterson-UTI Energy Inc.

- Continental Resources Inc.

- 1. Apache Corporation’s Peers:

Looking at Apache, one of the companies that was downgraded, S&P Global Ratings analysts identified a number of its peers:

- Noble Energy, Inc.

- Marathon Oil Corporation

- Devon Energy Corporation

- Hess Corporation

Source: RatingsXpress® on Xpressfeed™ Peers. This is a large database of current and historical credit ratings from S&P Global Ratings, with entity and security-level data in one schema, delivered via a powerful data feed management solution.

- 2. Snapshot of Apache’s Peers:

We look at the rating action for each of these peers.

Table 2: Peer Group

|

Issuer |

Rating |

Action |

Rating Date |

Last Reviewed |

Outlook |

Outlook Date |

|

Apache Corporation |

‘BB+’ |

Downgrade |

3/26/2020 |

3/26/2020 |

Negative |

3/26/2020 |

|

Noble Energy, Inc. |

‘BBB-’ |

Downgrade |

3/27/2020 |

3/27/2020 |

Negative |

3/27/2020 |

|

Marathon Oil Corporation |

‘BBB-’ |

Downgrade |

3/26/2020 |

3/26/2020 |

Negative |

3/26/2020 |

|

Devon Energy Corporation |

‘BBB-’ |

Outlook |

12/20/2019 |

3/27/2020 |

Negative |

3/27/2020 |

|

Hess Corporation |

‘BBB-’ |

Outlook |

2/2/2016 |

3/27/2020 |

Negative |

3/27/2020 |

Data as of April 13, 2020. Source: RatingsXpress. For illustrative purposes only.

Noteworthy points:

- All four peers are now rated ‘BBB-’ and are on Outlook: Negative. None are on CreditWatch.

- Devon and Hess were not downgraded and, accordingly, their respective Rating Dates haven’t changed. However, their Outlook changed to Negative, which changed the corresponding Outlook Date.

- The Last Review Date is now included in response to client requests to add this new data field to RatingsXpress. The date will be updated even if the Rating, CreditWatch, or Outlook don’t change.

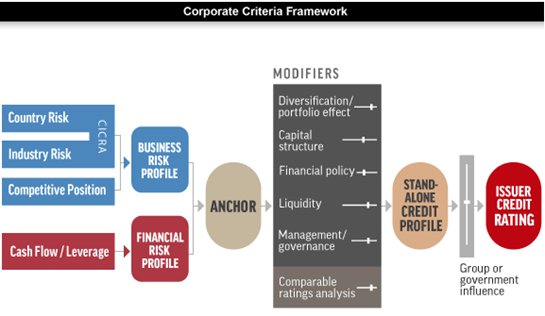

- 3. Look Under the Hood. Factors Underlying S&P Global Ratings Credit Ratings:

To assess the relative credit strength of the four ‘BBB-’ Outlook Negative U.S. Oil & Gas companies, we explore Factors and Scores (factor values) that are the building blocks of S&P Global Ratings credit ratings. Factors and Scores provide access to the underlying business, financial, industry, and economic risk factors and assessments, plus the stand-alone credit profile (SACP), for corporations and banks rated by S&P Global Ratings. Please refer to Appendix A for an illustration of Factors and Scores underlying ratings.

Table 3: Selected Factors and Scores

|

Issuer |

Business Risk |

Financial Risk |

Anchor |

Comparable Ratings Analysis |

Standalone Credit Profile |

|

Apache |

Satisfactory |

Significant |

bb+ |

Neutral (no impact) |

bb+ |

|

Noble Energy, Inc. |

Strong |

Significant |

bbb |

Negative (-1 notch) |

bbb- |

|

Marathon Oil |

Satisfactory |

Significant |

bbb- |

Neutral (no impact) |

bbb- |

|

Devon Energy |

Satisfactory |

Significant |

bbb- |

Neutral (no impact) |

bbb- |

|

Hess Corporation |

Satisfactory |

Significant |

bbb- |

Neutral (no impact) |

bbb- |

Data as of April 13, 2020. Source RatingsXpress: S&P Global Ratings’ Scores & Factors. For illustrative purposes only.

Takeaways:

- Noble Energy appears stronger than others from a credit standpoint, based on a stronger Business Risk Score. Please refer to Appendix B for a breakdown of the components of the Business Risk Score for each of the five issuers mentioned above.

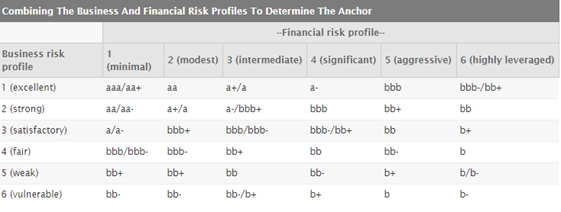

- As illustrated in Table A2 in Appendix A, the combination of Business Risk Score (‘Satisfactory’) and Financial Risk Score (‘Significant’) may result in an Anchor Score of bbb- or bb+. The final determination of the Anchor Score is based on the business risk within its score category (refer to article 30 in Criteria: General Corporate Methodology, November 2013).

- 4. Foreshadowing Downgrades:

Forward-looking statements in S&P Global Ratings analysis, sourced from RatingsXpress: Research, indicate conditions and thresholds that may trigger a downward rating action, as shown by the comments below.

Noble Energy, Inc.

March 27, 2020

We could lower the rating if we project leverage to weaken beyond our current projections, such that FFO to debt declines below 20% and debt to EBITDA remains above 4x on a sustained basis, likely as a result of drilling or project costs exceeding expectations, larger-than-expected production declines on U.S. properties, or weaker-than-expected commodity prices.

Marathon Oil Corporation

March 26, 2020

We could lower our ratings on Marathon if we expected FFO/debt to approach 20% on a sustained basis. This could occur if crude oil prices fail to improve, most likely due to a prolonged Saudi-Russia price war and/or continued demand destruction from the coronavirus pandemic

Devon Energy Corporation

March 27, 2020

The negative outlook reflects the potential for a downgrade if we expected FFO/debt to fall below 30% for a sustained period, which would most likely occur if oil or natural gas prices averaged below our current price assumptions and the company did not take further steps to reduce capital spending

Hess Corporation

March 27, 2020

We could lower the rating if we project leverage to weaken beyond our current projections, such that FFO to debt declines below 20% and debt to EBITDA rises above 3x on a sustained basis, likely as a result of drilling or project costs exceeding expectations, larger-than-expected production declines on U.S. properties, or weaker-than-expected commodity prices

Takeaways:

- FFO/ Debt and Debt/ EBITDA are key financial metrics that could lead to rating actions by S&P Global Ratings for the above credits.

- Commodity prices aside, production declines, capital spending, drilling, or project costs and erosion in demand stemming from the COVID-19 fallout are key drivers that could affect the financial metrics.

- 5. Current Versus Threshold Financial Metrics:

We dig further by looking at Funds for Operations (FFO), debt, and EBITDA.

Table 4: Metrics

|

Current (as-of April 13, 2020) |

S&P Downside Threshold |

|||

|

Issuer |

FFO/Debt |

Debt/ EBITDA |

FFO/Debt |

Debt/EBITDA |

|

Noble Energy |

32.34% |

3.12 |

20% |

4x |

|

Marathon Oil |

56.23% |

1.52 |

20% |

|

|

Devon Energy |

37.31% |

1.81 |

30% |

|

|

Hess Corporation |

24.13% |

2.19 |

20% |

3x |

Data as of April 13, 2020. Source: S&P Global Market Intelligence RatingsXpress – Creditstats DirectTM. For illustrative purposes only.

Creditstats Direct provides adjusted financial statement data, including criteria, research, credit ratings, credit-adjusted financials, and ratios. FFO/Debt values are annualized. Higher values of FFO/Debt and lower values of Debt/EBITDA are associated with lower credit risk.

Takeaways:

- Hess has the lowest FFO/Debt and, consequently, appears to have the least distance from the threshold. As a result, the other ratio (Debt/ EBITDA) assumes considerable significance.

- Marathon Oil has the highest FFO/Debt ratio and the lowest Debt/EBITDA ratio.

Summary of steps to design a relative-assessment framework:

- 1. For relevant credit exposures, identify peer entities as identified by S&P Global Ratings analysts.

- 2. Create cohorts by industry, geography, and rating category.

- 3. Build a comparison framework of Factors and Scores underlying ratings. Assess relative strength and the credit sensitivity of Factors/Scores for particular issuers.

- 4. Extract and review “downside scenario” texts from S&P Global Ratings research articles, noting conditions and thresholds that could lead to rating actions.

- 5. Compare current values of credit-adjusted ratios with threshold values to determine relative strength and vulnerability.

Get a demo of RatingsXpress and see how you can enhance your analysis with S&P Global Ratings credit ratings for nearly one million securities and 9,500 Global Issuers,[1] including extensive coverage by sector.

Also check out RatingsXpress: S&P Global Ratings Factors and Scores to see how you can bring greater transparency to your credit risk modeling and assessments with access to the underlying business, financial, industry, and economic risk factors and assessments, plus the SACP, for corporations and banks rated by S&P Global Ratings.

RatingsXpress: Criteria, Research and Commentary are available in XML and PDF formats for bulk-access in enterprise use-cases on our Secure FTP site. Contact us to learn more here.

Appendix A: Illustration of Factors and Scores – Building Blocks of Credit Ratings from S&P Global

Diagram A1: Outline of Factors Underlying S&P Global Ratings Credit Ratings

Source: Criteria: General Corporate Methodology, November 2013. For illustrative purposes only.

Table A1: Framework to Determine the Anchor Score

Appendix B: Business Risk Scores

Table B1: Business Risk Scores

|

|

|

Components of Business Risk |

|||

|

Issuer |

Business Risk |

Industry Risk |

Country Risk |

CICRA |

Competitive Position |

|

Apache Corporation |

Satisfactory |

Intermediate Risk |

Low Risk |

Intermediate Risk |

Satisfactory |

|

Noble Energy, Inc. |

Strong |

Intermediate Risk |

Low Risk |

Intermediate Risk |

Strong |

|

Marathon Oil Corporation |

Satisfactory |

Intermediate Risk |

Low Risk |

Intermediate Risk |

Satisfactory |

|

Devon Energy Corporation |

Satisfactory |

Intermediate Risk |

Very Low Risk |

Intermediate Risk |

Satisfactory |

|

Hess Corporation |

Satisfactory |

Intermediate Risk |

Low Risk |

Intermediate Risk |

Satisfactory |

Data as of April 13, 2020. Source: RatingsXpress: S&P Global Ratings’ Scores & Factors. For illustrative purposes only.