This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

View our latest blog in this series from January 2022

Click hereThe impact of coronavirus (COVID-19) is visible around the world, from businesses struggling with cross-border supply chain issues to dampening global GDP growth prospects, just to name a couple of indicators. Following the World Health Organization’s announcement on March 11, which classified the virus a pandemic, we expect to see even broader ripple effects across governments and economies. How can companies, investors, and other market participants understand their exposures and stay ahead? In this blog, we discuss the top five industries globally that have been most impacted by the coronavirus in the last two months, from January 1 through March 2, 2020.

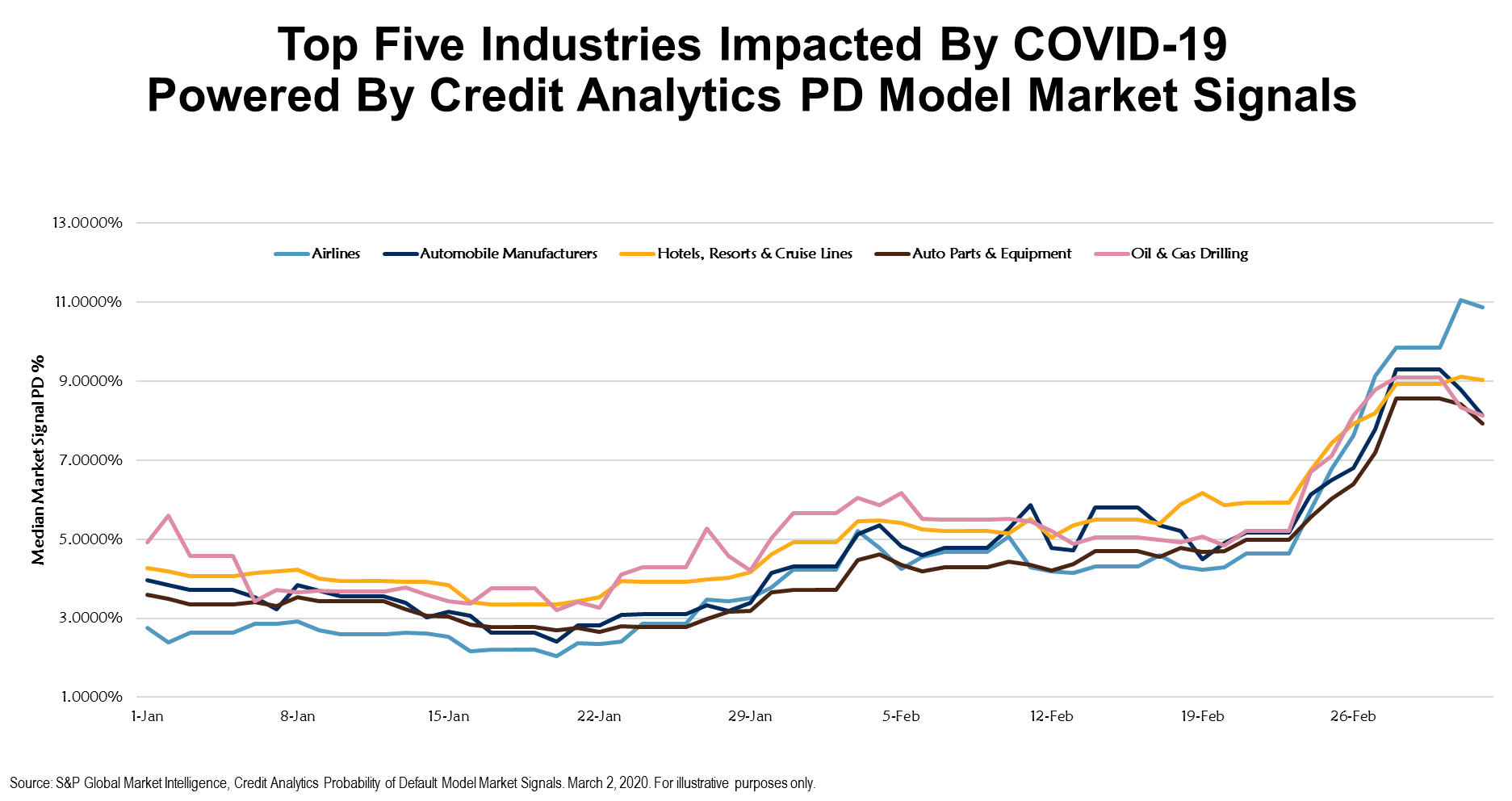

We conducted this analysis by generating industry medians from our Credit Analytics Probability of Default Market Signal model which uses stock price and asset volatility as inputs to calculate a one year Probability of Default (PD). This helps us understand which industries have experienced significant changes in default risk, based on market derived signals.

Based on our analysis, we see the biggest impact in the Airlines industry. The median PD in the beginning of January is around 2.75% which maps to b+ credit score. It drops by one notch to single-b range by the end of January and stays there for most of February before we see a massive jump to 10% which is equivalent of ccc+ score at the end of February. The main reason for this big jump is the fear of spreading coronavirus impacting both business and leisure travel. Many companies have cancelled non-essential travel and conferences have been cancelled world-wide. The Global Business Travel Association estimates a loss of $560 billion for the industry in a year if this trend continues[i]. This will clearly have an impact on stock performance and PD of Airlines.

For similar and related reasons around fear of travel, Hotels, Resorts and Cruise Lines is also one of the top five impacted industries. We noticed the PD increased from 4.2% which maps to single b score at the start of January to 9% which maps to ccc+ at the end of February. With some cruise lines being quarantined, this change is somewhat to be expected.

Another heavily impacted industry is the automobile sector. Automobile Manufacturers have been particularly hard hit, but also Auto Parts and Equipment saw large increases in the median PD in the period. Both these industries started the year in single b score range and decreased to ccc+ by the end of February. For both these industries, we see major supply chain issues, caused by factories in China, South Korea, Japan and other countries to temporarily shut. As a result of a shortage of parts and factory closures, companies have been adjusting production and delivery timelines, negatively impacting sales and worsening financials.

We also noticed a big increase in PD for the Oil & Gas Drilling industry sector. The median PD in the beginning of January was around 5% which maps to singe b credit score, and jumped to 9% or ccc+ score at the end of February. The coronavirus impact is visible here, mainly because of a decrease in demand for oil based products like jet fuel. Oil consumption has dropped bringing physical and stock prices down resulting in higher PDs.

With so many market-moving events lately, it’s helpful to see a point-in-time view of credit risk at a micro and macro level.

To summarize, through March 2, the five industries most impacted by coronavirus are as follows:

- Airlines

- Automobile Manufacturers

- Hotels, Resorts and Cruises

- Auto Parts and Equipment

- Oil & Gas Drilling.

With governments increasing efforts to slow the contagion, and companies reacting to the situation, we’ll examine the impact that some of these social distancing measures and responses are having on industries in our next blog.

Copyright © 2020 by S&P Global Market Intelligence, a division of S&P Global Inc.

These materials have been prepared solely for information purposes based upon information generally available to the public and from sources believed to be reliable. S&P Global Market Intelligence, its affiliates, and third party providers (together, “S&P Global”) do not guarantee the accuracy, completeness or timeliness of any content provided, including model, software or application, and are not responsible for errors or omissions, or for results obtained in connection with use of content. S&P Global disclaims all express or implied warranties, including (but not limited to) any warranties of merchantability or fitness for a particular purpose or use.

S&P Global Market Intelligence’s opinions, quotes and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

S&P Global keeps certain activities of its divisions separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain divisions of S&P Global may have information that is not available to other S&P Global divisions.

S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

S&P Global provides a wide range of services to, or relating to, many organizations. It may receive fees or other economic benefits from organizations whose securities or services it may recommend, analyze, rate, include in model portfolios, evaluate, price or otherwise address.

[i] Admin. “The Coronavirus has the Potential to Jeopardize the Global Business Travel Industry.” Global Business Travel Association Blog, 27 Feb. 2020, www.gbta.org/blog/the-coronavirus-has-the-potential-to-jeopardize-the-global-business-travel-industry/.