KPMG LLP anticipates a surge in tech M&A and IPOs in 2025, driven by favorable market conditions.

During a media roundtable, the US audit, tax and advisory firm's technology sector leaders cited a robust equity market, improved financing options and a renewed focus on growth as key factors expected to boost deal activity over the next year.

Beyond 2025, the outlook becomes less certain. KPMG is assessing how President-elect Donald Trump's policies on tariffs and immigration could influence inflation and interest rates, potentially impacting longer-term deal flow.

"We know corporates and private equity have felt pressure to do deals for a number of reasons," said Tim Lashua, KPMG partner and US accounting advisory services leader for the technology, media and telecommunications (TMT) industry. "And we think that they are seeing that window of opportunity present itself now and through '25."

Going public

KPMG estimates that about 450 technology companies with valuations exceeding $1 billion have remained in private equity (PE) portfolios for three to five years, delaying their IPOs.

"The increase [in] private capital has allowed private companies to stay private for longer," said Anuj Bahal, a KPMG partner and deal advisory and strategy leader for TMT. "There's less of a need to go IPO."

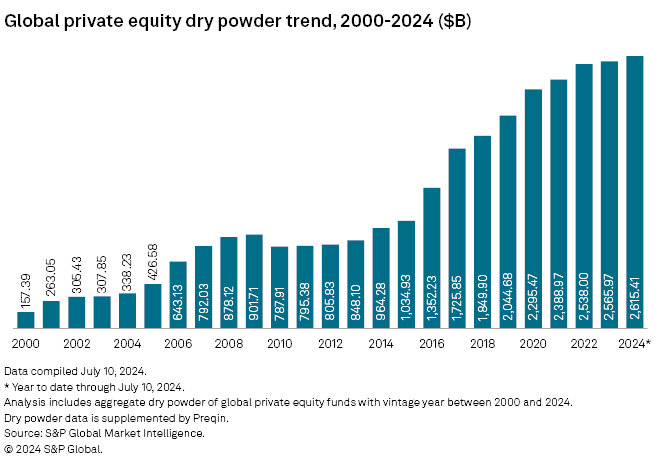

Global PE and venture capital funds are holding record levels of uninvested capital, or dry powder, as higher interest rates and stagnating valuations stall dealmaking. At the end of the first half, funds held about $2.620 trillion in uncommitted capital, according to data from S&P Global Market Intelligence and Preqin.

For technology companies held in PE portfolios for three to five years, pressure to pursue an exit — either through a sale or an IPO — is mounting, according to Bahal.

"Time is not necessarily your friend in the PE world," Bahal said. "At some point, those companies need an exit."

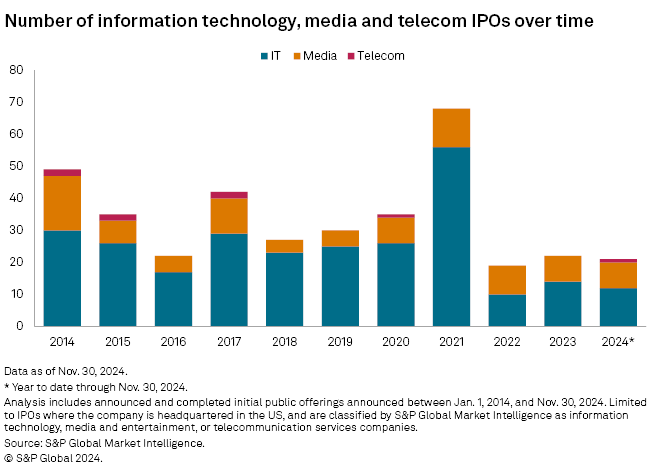

Bahal anticipates a return to a more typical pace of tech IPOs, supported by strong public markets. "Historically, a good year for tech companies would see about 40 [IPOs], give or take," he said. For 2024, the figure stands at around 20. "So we're at kind of half the rate, and there should be some growth there coming into '25."

As of November, S&P Global Market Intelligence counted 21 announced or completed IPOs among US TMT companies in 2024. This aligns with the totals from 2023 and 2022 but remains significantly below the pre-pandemic annual average of 34.

The largest TMT IPOs in 2024 by transaction value included data management software maker Rubrik Inc., social media platform Reddit Inc. and chipmaker Astera Labs Inc., according to Market Intelligence.

Let's make a deal

KPMG's Bahal expects a "more gradual" increase in M&A deal activity, with the first half of 2025 outperforming the latter half of 2024. "We're going to start seeing some ramp-up," he said.

The expected growth will be driven by both strategic and financial buyers. According to KPMG's midyear M&A Pulse, 52% of corporate respondents and 58% of PE respondents plan to pursue at least one strategic, transformational M&A deal in 2025, referring to transactions that fundamentally alter a company's business model.

This outlook aligns with Market Intelligence's Big Picture 2025 M&A Outlook, which highlights several factors likely to accelerate M&A activity in 2025. PE buyers will likely play a key role, supported by lower interest rates and higher stock valuations bridging the gap between buyer bids and seller expectations.

"The rate-cutting cycle that started in 2024 should pave the way for greater M&A activity," Market Intelligence experts wrote. "Lower interest rates and higher stock valuations will help bridge the gap between buyers' bids and sellers' expectations."

For strategic buyers, Bahal identified growth and competition as the primary drivers. While major tech firms have recently emphasized profitability — Meta Platforms Inc. CEO Mark Zuckerberg dubbed 2023 the "year of efficiency," with layoffs continuing into 2024 — growth remains critical for investor confidence.

"For some of the larger tech companies, if you're growing sub-10%, that's a tough place to be," Bahal said. "If you're trying to get to double-digit growth and sitting below 10%, M&A should figure into that as a solution."

Competition, particularly in the rapidly evolving AI sector, is also accelerating M&A decisions. Companies must weigh the trade-off between building and buying, with time often being the deciding factor.

"You may be able to build it, but your other variable is time," Bahal said. "If you're going to build it too late and can't get it to market fast enough, that's where M&A is again going to play a role."

Farther out

While factors support strong dealmaking in 2025, activity may slow in 2026 depending on policies enacted that year, according to Lashua.

Lashua highlighted the potential impact of former President Donald Trump's proposed tariffs and immigration policies on consumer prices. Trump has pledged a 60% tariff on Chinese imports and blanket tariffs of 10% to 20% on other imports.

More recently, Trump posted on on the social media platform Truth Social about plans for a 25% tariff on goods from Mexico and Canada, along with an additional 10% tariff on Chinese products. He also suggested 100% tariffs on BRICS nations if they adopt or create a new currency to replace the US dollar. The BRICS bloc, originally comprising Brazil, Russia, India and China, now includes Egypt, Ethiopia, Iran, South Africa and the United Arab Emirates under the BRICS+ designation.

KPMG expects the Trump administration to pursue at least some of these tariff proposals. But Lashua said it remains unclear which measures are most likely and which may serve as negotiating tactics.

"It's going to be very important how they target these, how they'll be applied and when they'll come into effect," Lashua said.

"We're closely monitoring whether these policies could spark new inflation, potentially slowing interest rate cut forecasts — or even requiring rate hikes — as we move into 2026."