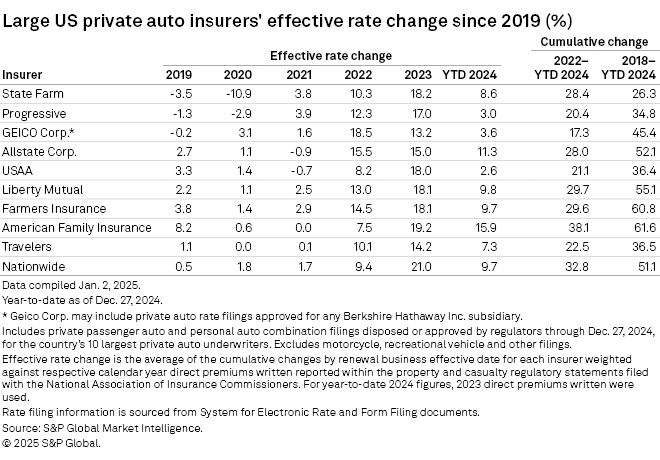

Rate increases in the US private auto insurance market softened for most of the largest companies in 2024, but American Family Insurance Group and The Allstate Corp. still posted double-digit percentage rate increases, much higher than their peers, according to S&P Global Market Intelligence's RateWatch.

American Family's calculated weighted average rate increase of 15.9% was the highest among the nation's 10 largest private auto insurers. The Wisconsin-based insurer's 2024 rise in rates was about 3.3 percentage points lower than the 19.2% effective rate change seen in 2023.

Overall, American Family raised its private auto rates by double digits in 30 states and Washington, DC, in 2024. The calculated weighted average increase of 46.4% across all of its units in California was the highest for the company as well as in any state among the leading private auto writers.

Meanwhile, Allstate received approval from regulators to boost its rates across 47 states and in the Washington, DC, with 19 of them having a calculated weighted average change of greater than 10%. The insurer's three largest effective rate increases occurred in Nevada at 35.4%, New Jersey at 29.1% and California at 26.4%.

The rate information is sourced from disposed private passenger auto rate filings collected by S&P Global Market Intelligence that are submitted to the Department of Insurance in various states. The analysis is limited to rate filings of each state's 10 largest private auto underwriters based on 2023 direct premiums written plus any of the country's 10 largest private auto underwriters outside the state's top 10.

The effective rate change is the average of the cumulative changes by renewal business effective date for each insurer weighted against respective calendar year direct premiums written reported within the National Association of Insurance Commissioners property and casualty regulatory statements. For year-to-date 2024 figures, 2023 direct premiums written were used. The calculations are based on rate filings entered into the database through Dec. 27, 2024, for 49 states plus Washington, DC. Wyoming has been excluded as a limited number of rate filings are available within the database.

Read more about S&P Global Market Intelligence's RateWatch.

The remaining largest US private auto insurers all had a calculated increase in the single digits in 2024, compared to their double-digit increase during the prior year. United Services Automobile Association had the smallest calculated effective rate change during the period at 2.6%, followed by The Progressive Corp. with 3% and Berkshire Hathaway Inc.'s Geico Corp. with 3.6%.

USAA had the lowest number of states with a calculated change during 2024. In total, the analysis reflects a rate increase calculated in 15 states plus Washington, DC, and three states showing a small decrease. The 17.6% effective rate change in Vermont was the largest for the Texas-based insurer. The insurer raised rates by over 10% in six other states — Delaware (15%), Washington (14.9%), Nevada (13.2%), Hawaii (12%), Wisconsin (11.5%) and New Hampshire (11.3%) — as well as in Washington, DC (16.3%). Its largest calculated decrease of 1.7% occurred in North Carolina.

USAA was not the lone private auto insurer seeking rate decreases in select states across the US as underwriting performance improved in the key business line. GEICO saw a calculated rate decrease in 21 states plus Washington, DC, the most among its largest peers. The insurer's introduction of a "welcome factor" has contributed to the calculation, with the three largest weighted average decreases occurring in Iowa (4.8%), Kansas (4.5%) and Colorado (4.3%).

Progressive executives noted during its earnings calls in 2024 that the company had begun seeking small rate decreases across numerous states in 2024. In total, the country's second-largest private auto underwriter had calculated rate decreases in eight states in 2024. The calculated weighted average decrease ranged from 6.2% in Iowa to 0.5% in Mississippi.

– Download a document with the top private auto insurers 2024 effective rate changes by state.

– Download a template to analyze rate filings across select entities, lines of business, and state over selected period of time.

Washington rises above the rest

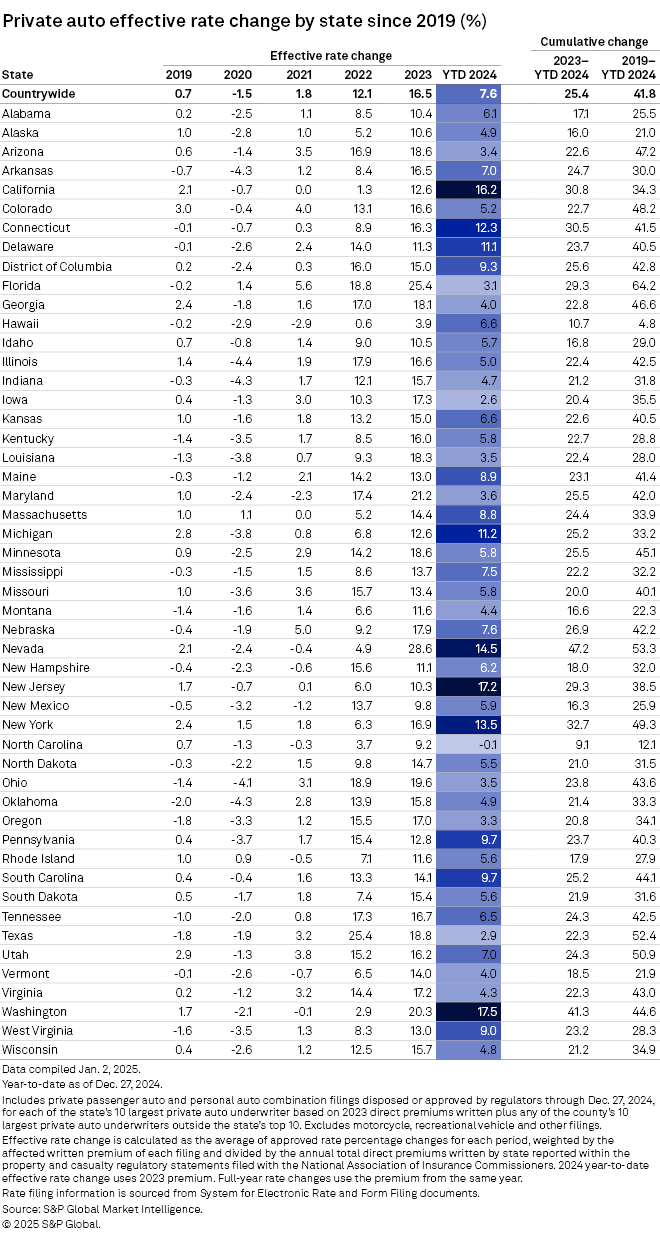

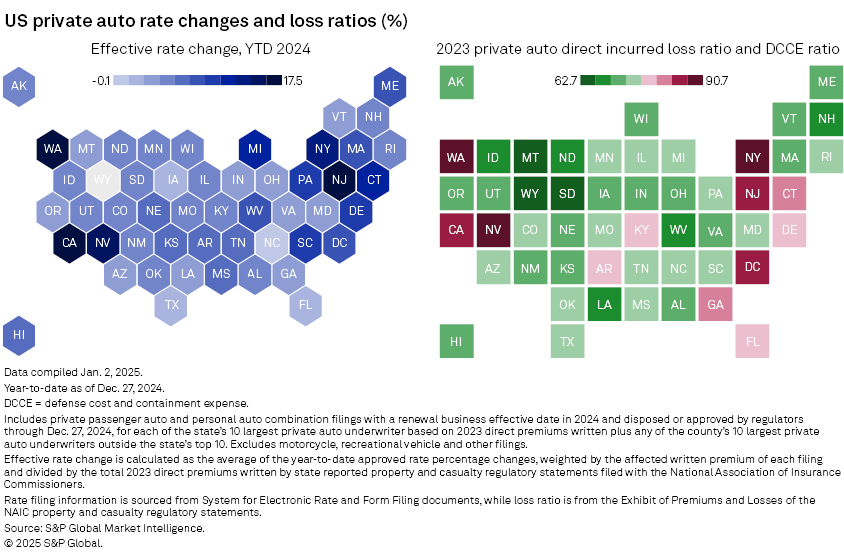

The largest private auto insurers in Washington collectively boosted their rates by a weighted average of 17.5% through Dec. 27, the highest calculated increase in the US. A 17.2% change in New Jersey was the second-largest increase, followed by a 16.2% rise in California. In total, five other states have seen a double-digit increase in their private auto rates. The states with the lowest weighted average increase 2024 were Iowa (2.6%) Texas (2.9%) and Florida (3.1%).

At the other end of the spectrum, North Carolina was the only state with a calculated effective rate decrease at 0.1%. Farmers Insurance Group of Cos. had the largest year-to-date effective rate decrease in any state. An overall rate change of about 17.5% approved in August 2024 in North Carolina went into effect Nov. 27 for its renewal business.

From a countrywide calculated effective range of 1.8% in 2021, the 2022 nationwide calculated weighted average effective rate change for private auto insurance spiked to 12.1%. These double-digit rate increases continued in 2023 with a 16.5% effective rate change before dropping almost half to 7.6% in the most recent year as the sector shows signs of softening.