Fears over the Joe Biden tax plan have yet to materialize in equity markets.

Despite the former U.S. vice president's surge in the polls, many of the stocks most vulnerable to his proposal to partially roll back corporate tax cuts have outperformed the market.

Moreover, Biden's emergence as the front-runner in November's presidential election has done little to slow a broader rally in stocks that has seen the S&P 500 recoup this year's losses even as the coronavirus pandemic crushed the U.S. economy in the second quarter.

It may only be a matter of time. Biden's tax proposals will likely cause a severe hit to U.S. equity markets, but investors are reluctant to price in the risk of an uncertain policy now, said Arthur Laffer Jr., COO at Laffer Tengler Investments.

"Policy changes won't happen until the coming year," Laffer said in a July 9 interview. "So you've still got time to figure this out."

If Biden defeats Trump in November, he plans to raise the U.S. corporate tax rate to 28% from 21%. The tax had been dropped to 21% from 35% under the Tax Cuts and Jobs Act of 2017, arguably the signature legislative accomplishment of the Trump presidency.

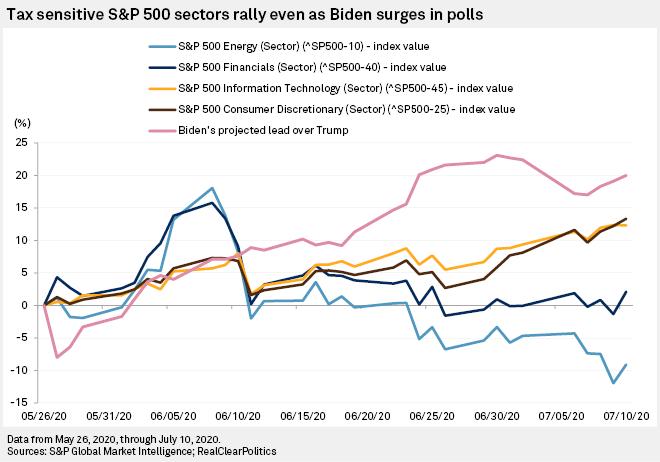

Should they be enacted, Biden's tax policies will hit technology, consumer discretionary and financials stocks hardest, according to asset manager Amundi Pioneer. Yet, technology and consumer stocks have been some of the best performers in recent months as Trump's 8-point lead May 26 turned into a 20-point deficit July 13, according to RealClearPolitics.

The S&P 500 consumer discretionary index jumped by over 11% in that period, the information technology gauge increased nearly 12% and financials by more than 2%, while the broader S&P 500 increased by about 5.5%.

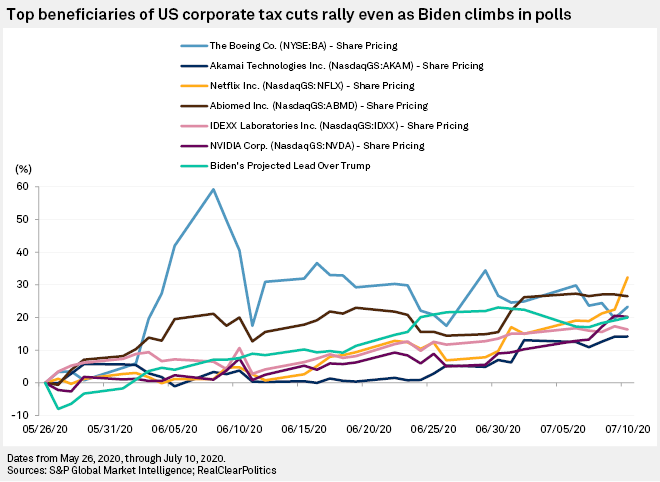

A similar pattern can be seen in individual stocks.

Goldman Sachs analysts led by chief U.S. equity strategist David Kostin looked at a basket of stocks that were the top beneficiaries of the 2017 tax cuts after their effective tax rates were reduced by between 10 and 18 percentage points. Those "tax-sensitive" stocks have outperformed the market in recent months even as Biden surged in the polls, the Goldman Sachs analysts found.

Boeing Co., for example, saw its effective tax rate reduced from 29% to 13% after the legislation, but has seen its stock increase by 23% during the Democratic candidate's recent run up in the polls. Netflix Inc., which had its effective tax rate reduced to 7% from 23%, saw a more than 32% jump in its share price as Biden's popularity among the electorate grew.

If history is a guide, stocks may not react to a change in tax regime until it is an absolute certainty that it will pass.

"In late 2017, high-tax stocks outperformed sharply only once the [tax cut] legislation reached its final stages of Congressional ratification despite months of negotiation and drafting beforehand," the Goldman Sachs economists said.

"Today, investors face not only uncertainty regarding the specifics of potential tax reform but also four more months of market volatility before the resolution of a close political race that could eliminate the likelihood of tax reform altogether."

Incumbent rally

The rally in the price of stocks is also not unusual during a presidential reelection campaign, rather than an open presidential election in which two new candidates vie for the White House, according to a July 9 note from John Hancock Investment Management.

"This may be due to an incumbent implementing policies that are accretive for the markets or the economy just prior to election day, in order to flatter his chances of serving another term," the analysts said. "This may be the case in 2020 as policymakers continue to push forward an historic amount of fiscal stimulus in response to the COVID-19 crisis, which has been one of the key elements underpinning markets."

Depending on the post-pandemic economic recovery, the party for stocks may be over next year.

Goldman Sachs said Biden's tax plan, if imposed, would reduce S&P 500 earnings for 2021 by an estimated $20 per share, from about $170 to $150.

The corporate tax increase could have "significant” impacts on U.S. equity markets, said Chris Dyer, director of global equity at Eaton Vance, in a July 10 interview. The 2017 tax cuts boosted earnings and gave companies more cash for investments and investor distribution.

"That was obviously a tailwind for these companies,” Dyer said. "The expectation that it will even be partially reversed will be a headwind."