Debt issuance by Asia-Pacific banks rebounded in November, with two mainland Chinese banks raising nearly half of the funds.

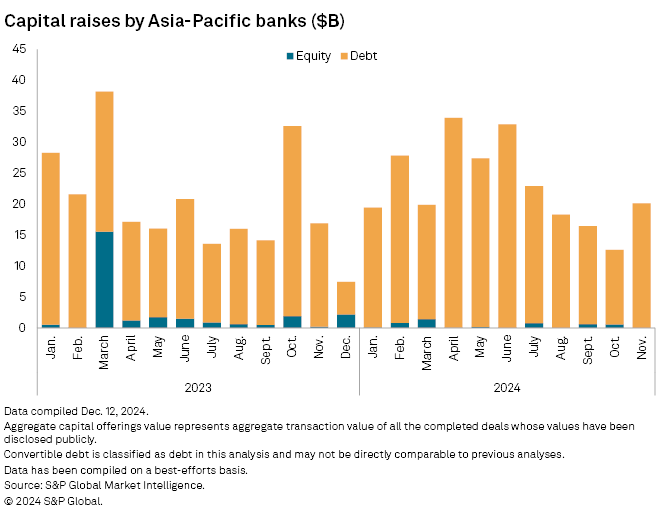

The region's lenders sold $20.12 billion of debt in November, a 59.42% jump from $12.04 billion in October, according to data compiled by S&P Global Market Intelligence on a best-efforts basis. The November debt issuance broke a four-month trend of declines since July.

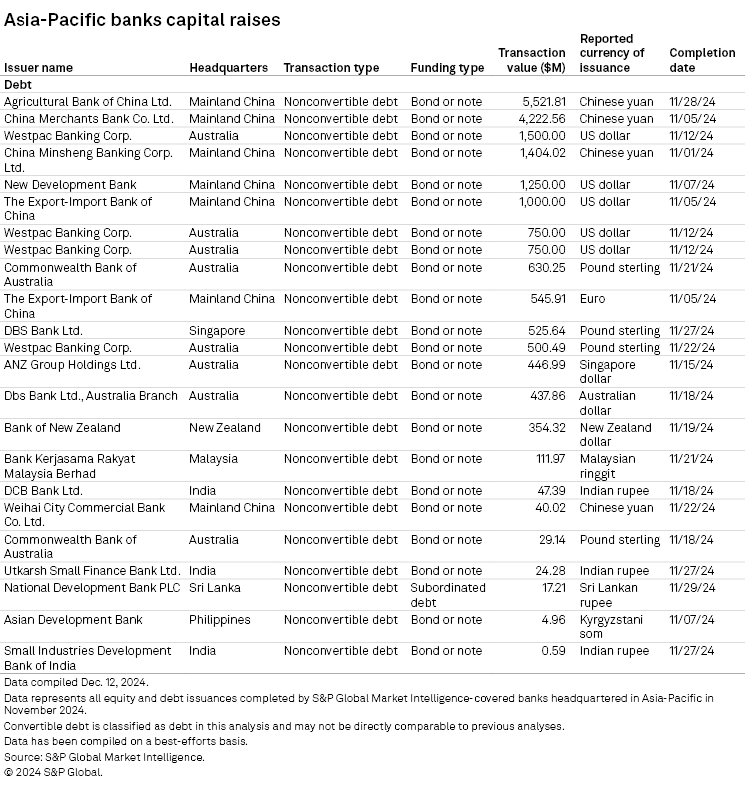

Capital raises increased 19.20% year over year from $16.68 billion in November 2023, according to data from S&P Global Market Intelligence. Agricultural Bank of China Ltd. raised $5.52 billion and China Merchants Bank Co. Ltd. raised $4.22 billion. Together, these two banks accounted for 48.42% of the total bonds issued in November.

"Several high-grade, blue-chip names have re-accessed the bond markets in recent months from mainland China particularly, which should pave the way for other credits to be next," Yves Shen, head of Debt Capital Markets, Asia-Pacific, at Natixis CIB said. "They took advantage of conducive market conditions, and wanted to get out before the US elections, which may cause more volatility."

The region's banks may continue to borrow, taking advantage of lower interest rates in key markets. China is expected to stay on a policy easing path, while central banks in India and Australia balance inflation and growth. Global interest rates are expected to fall further in 2025, though the pace of policy easing may slow after the US Federal Reserve signaled fewer rate cuts.

Big offerings

Chinese banks, which had largely stayed out of the capital markets in October, issued $13.98 billion in debt in November, accounting for 69.5% of the total raised by banks in Asia-Pacific.

Their Australian counterparts raised $5.05 billion, representing 25.07% of the total. Over 90% of Australian banks' debt portfolio comprised offshore lending, with issuances primarily in US dollars, British pounds and Singapore dollars. The largest issuer from Australia was Westpac Banking Corp., which issued $3.5 billion in debt in four tranches, making it the biggest non-Chinese issuer on the list.

The other banks in the region that issued $1 billion or more in debt were China Minsheng Banking Corp. Ltd., New Development Bank and The Export-Import Bank of China. Japanese and South Korean banks were notably absent, while Indian banks issued a small volume of debt during the month and larger lenders remained inactive. DCB Bank Ltd., a private commercial bank, raised $47.4 million Indian rupees, the largest issuance from India in November.

Unlike previous months, there were no equity offerings in November.