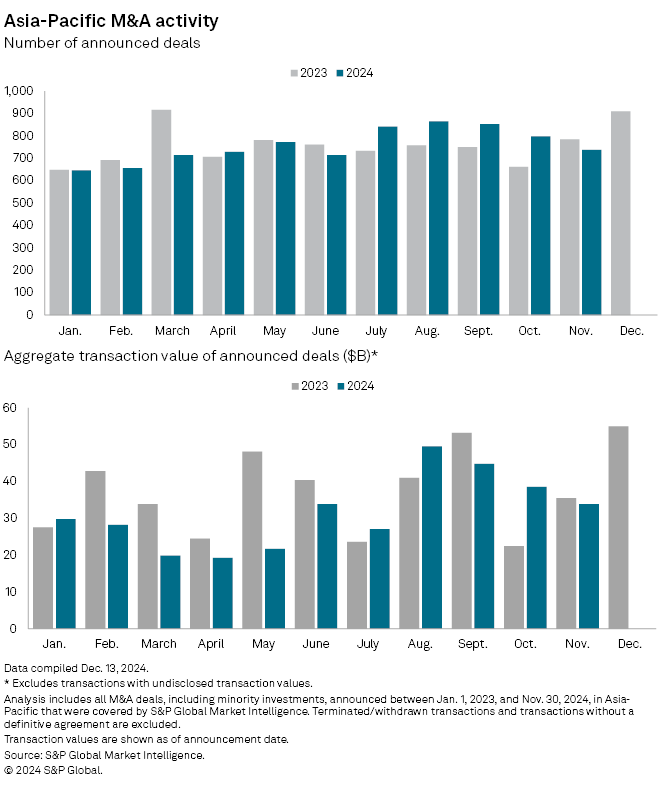

The aggregate transaction value of M&A in Asia-Pacific ground slower in November in the absence of large deals.

At $33.88 billion, the November aggregate transaction value in the region was 12.1% lower than the month before, according to S&P Global Market Intelligence data, marking a third consecutive monthly decline. The aggregate transaction value of the deals was down 4.6% year over year.

The number of deals also declined, with 737 completed in November, versus 798 in October and 784 a year earlier, Market Intelligence data shows.

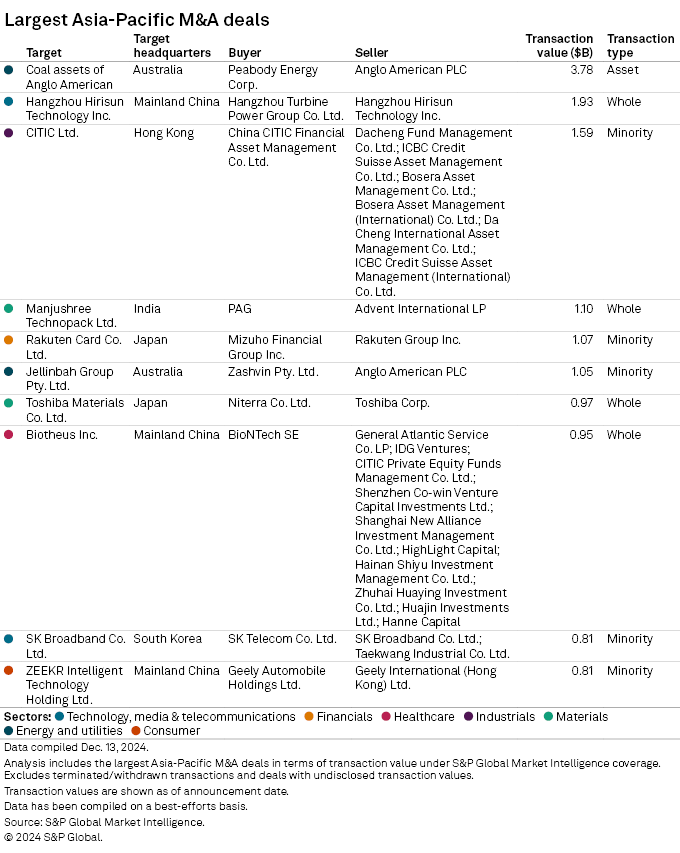

London-based Anglo American PLC's $3.78 billion sale of coal assets was the largest deal in the month, the data shows. St. Louis-based Peabody Energy Corp. was the buyer.

The second-largest deal was the $1.93 billion merger of power information system integration service provider Hangzhou Hirisun Technology Inc. and Hangzhou Turbine Power Group Co. Ltd., according to Market Intelligence data. Both companies are listed in Shenzhen, China.

The decline in aggregate deal value followed a busy September, which included the announced merger of Chinese brokerage firms Guotai Junan Securities Co. Ltd. and Haitong Securities Co. Ltd., valued at $24.15 billion, and the acquisition of Australia-based AirTrunk Operating Pty. Ltd.

M&A activity in the region faces headwinds including geopolitical tensions and the uncertainty over US President-elect Donald Trump's second term. Many analysts expect Trump to escalate trade tensions with major partners, including China. Slowing economic growth in China, the world's second-largest economy, could negatively impact deals.

Six of the top 10 deals in November were valued at more than $1 billion, including the minority share acquisitions of Citic Ltd., Rakuten Card Co. Ltd. and Jellinbah Group Pty. Ltd., and the sale of Indian packaging company Manjushree Technopack Ltd. by US private equity firm Advent International LP to fellow private equity firm PAG.

Among the four that fell short of the $1 billion mark was Niterra Co. Ltd.'s purchase of Toshiba Materials Co. Ltd. from Japan's Toshiba Corp. for $0.97 billion. Another deal to fall short of $1 billion was Geely Automobile Holdings Ltd.'s sale and purchase agreement to buy an additional 11.30% stake in ZEEKR Intelligent Technology Holding Ltd., a unit of Chinese automaker Zhejiang Geely Holding Group Co. Ltd., for $0.81 billion.