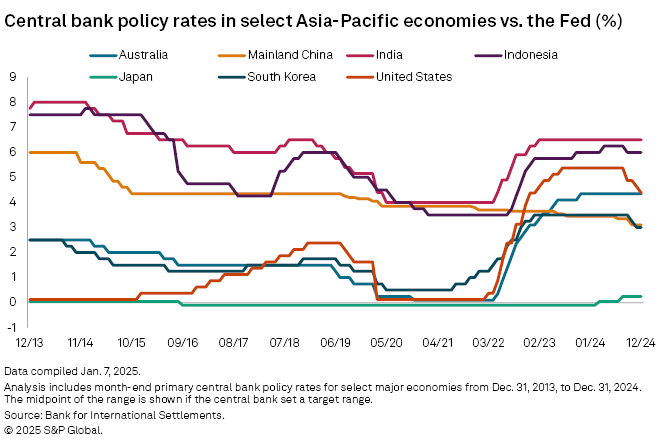

Central banks in Asia-Pacific will have less room to ease monetary policy as the US Federal Reserve is expected to reduce the pace of rate cuts following US President Donald Trump's stated intent to impose higher tariffs.

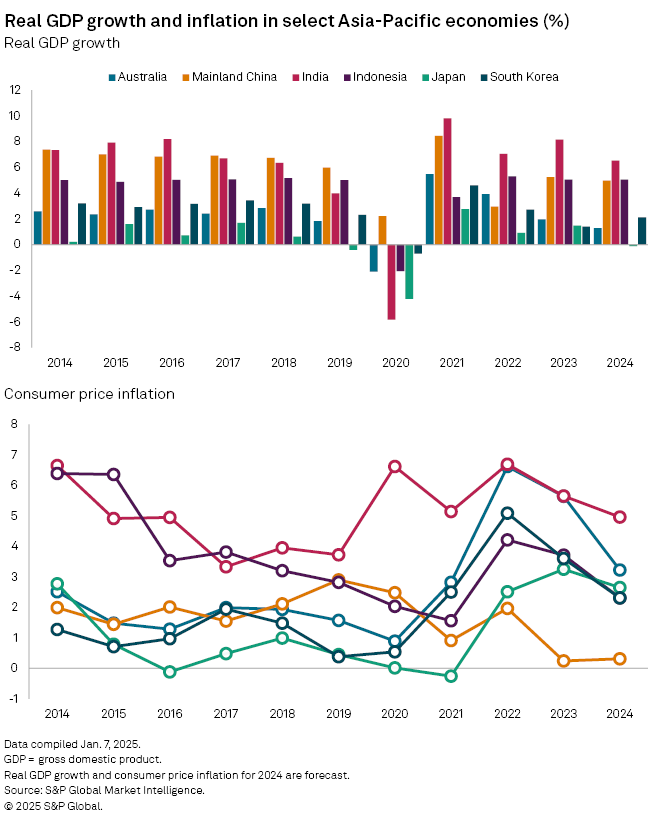

Potentially higher tariffs can create inflationary pressures in the US economy and push the Fed to slow its easing cycle that started in July 2024. Analysts believe India and Australia may start cutting rates only in the second quarter, while the Bank of Japan may announce its third rate increase this week since it ended its negative interest rates policy in March 2024.

While higher tariffs were not a part of President Trump's day one agenda after his inauguration on Jan. 20, an announcement could be imminent. "We're thinking in terms of 25% on Mexico and Canada. I think we'll do it Feb. 1," Trump told reporters while signing televised executive orders that included steps to curb immigration. The new US president mentioned tariffs on imports from a slew of countries, including China and India, during the election campaign.

"You are mistaken if you think Trump will ease his protectionist policy, including imposing tariffs on other countries," said Takahide Kiuchi, executive economist at Nomura Research Institute.

Inclined to cut

Asian central banks were inclined to cut rates, according to Kiuchi. "However, they may turn out to be reluctant if capital outflows increase from those countries to the US," the analyst said.

India and Australia are among the major economies in Asia-Pacific where interest rates remained unchanged at the high levels set during the 2023–2024 period of monetary policy tightening as global central banks sought to tamp down inflationary pressures following economic recovery from the COVID-19 pandemic.

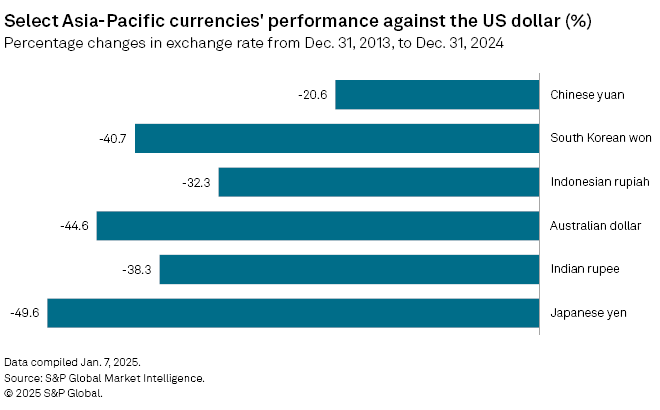

The Indian rupee declined nearly 3% against the US dollar over the last two months and is hovering at an all-time low. With the lower rupee making imports, including crude oil, more expensive, the Reserve Bank of India may hold rates higher for a bit longer. "We push back our call for 50 basis points of [the benchmark] repo rate cuts to April–June from February–April," Standard Chartered said in a note in early January, attributing the delay partly to external sector volatility.

The Reserve Bank of Australia may cut rates around May, according to My Nguyen, deputy head of finance and senior lecturer in finance at RMIT University. Slower-than-expected economic growth and inflation rates moving within the central bank's target range of 2% to 3% prepared the grounds for lower rates, Nguyen said.

The Bank of Japan (BOJ) will likely remain an outlier as Governor Kazuo Ueda seeks to normalize monetary policy after Japan ended its experiment with negative interest rates in March 2024. The BOJ, which is currently reviewing its monetary policy, could raise its benchmark rate to as high as 0.5% from 0.25% on Jan. 24 due to a favorable cycle of inflation and wage increases. The Japanese central bank could continue tightening to reach a terminal rate of 1.0% by 2026, analysts said.

"The Fed's slowing rate cuts will put downward pressure on the yen and support the BOJ's rate hikes," said Tsuyoshi Ueno, senior economist at NLI Research Institute.

Stimulus measures

China did not raise rates as a multiyear downturn in the housing sector weighed on the world's second-biggest economy. The People's Bank of China will likely maintain easy monetary conditions after GDP grew 5.0% in 2024, matching the official aim.

"Further stimulus to support growth and consumption are likely, including an interest rate cut in the first quarter," said Jean Chia, global chief investment officer at Bank of Singapore, at a Jan. 20 conference.

China will have to stay on a path of monetary easing not only because of potential US tariffs but also because of its own problems, including the sluggish housing sector and local government debt, according to Daisy Li, fund manager at the Hong Kong unit of Swiss financial group EFG International.

"We expect 50- to 60-basis-points [of] cuts in China policy rates in 2025," Li told S&P Global Market Intelligence on the sidelines of a Jan. 21 conference. However, aggressive cuts will not be likely, given the severe interest spread between China and the US, Li said.

The Fed, which cut the federal funds rate for the third time in 2024 by 25 basis points on Dec. 18 to a range of 4.25% to 4.5%, expects fewer rate cuts in 2025. According to its latest quarterly summary of economic projections, the median view among Fed officials is a longer-run federal funds rate of 3%, up from 2.5% a year earlier and at its highest since 2018.

Now, as the Fed shifts from tightening policy to fight soaring inflation to easing to prevent deterioration in the surprisingly resilient labor market, the neutral rate target has proven increasingly tenuous. In announcing the rate-cut decision, Fed Chair Jerome Powell cautioned that as rates move toward neutral, it is unclear how long it will take to get there and exactly where that figure is. "There is no real certainty," Powell said during a press conference.