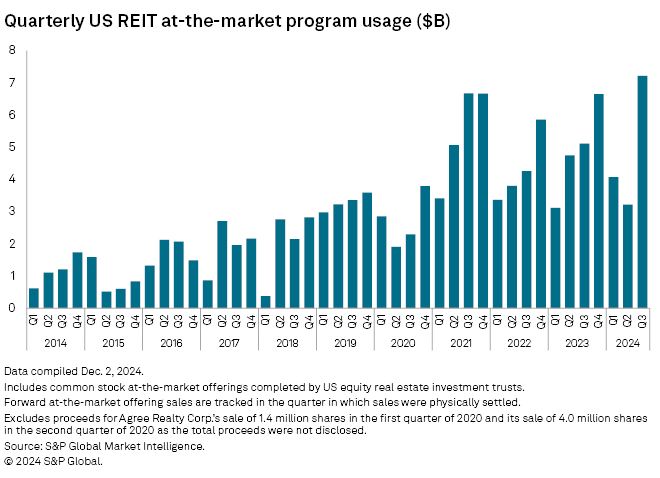

Beginning with S&P Global Market Intelligence's second-quarter 2019 analysis of at-the-market program usage by real estate investment trusts, Market Intelligence included forward at-the-market sales settled during the respective quarter as part of the total capital raised. Forward sales conducted during the quarter but not yet settled as of quarter-end were not included in the quarterly total. Because of this methodology change, prior quarterly totals presented in this article may not match historical articles published by Market Intelligence.

Total proceeds raised by US equity real estate investment trusts through at-the-market offering programs rocketed to an all-time high in the third quarter.

US REITs raised an aggregate of $7.21 billion in proceeds through their at-the-market (ATM) programs during the quarter, more than double the $3.22 billion raised the quarter prior and up 41.1% year over year, according to an analysis by S&P Global Market Intelligence.

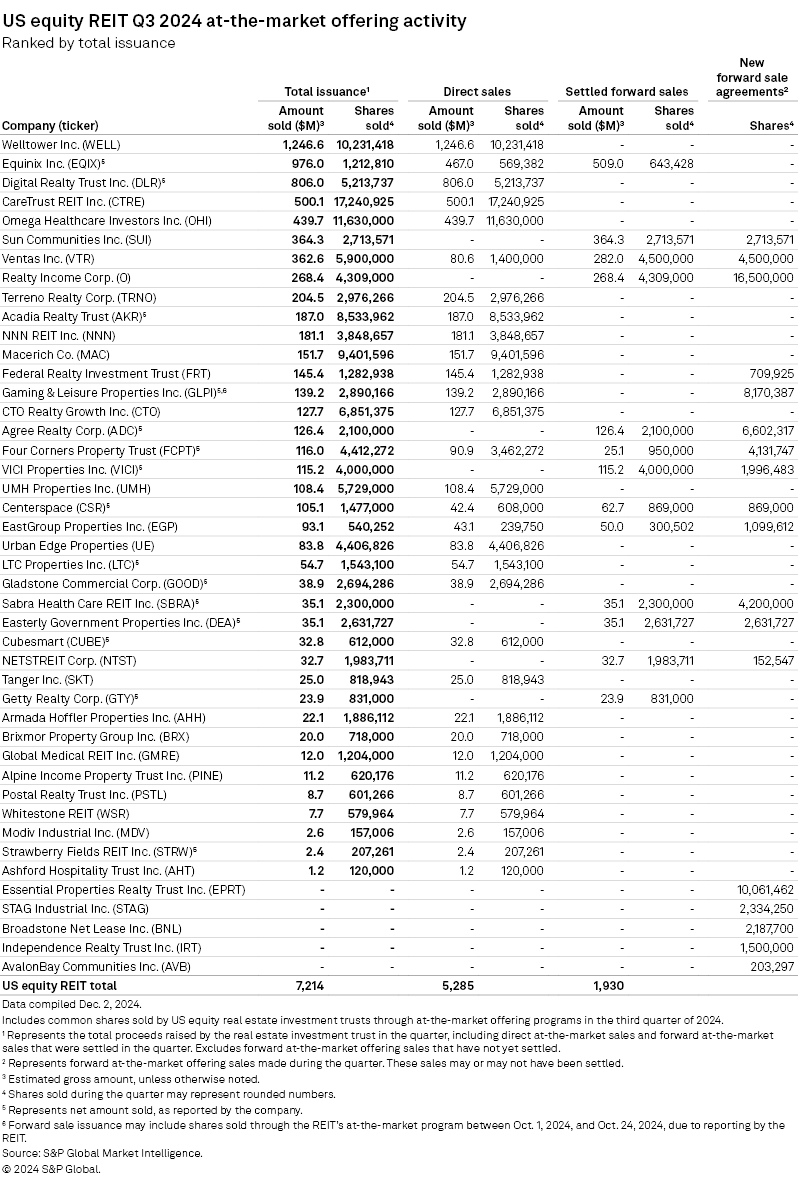

Healthcare REIT Welltower Inc. raised $1.25 billion in gross proceeds through its ATM program in the third quarter, the most of any US equity REIT.

Datacenter REIT Equinix Inc. sold 569,382 shares of common stock through its ATM program for $467 million in net proceeds in the third quarter. The REIT also settled its remaining 643,428 shares of outstanding forward-sale agreements for $509 million in net proceeds.

Digital Realty Trust Inc., another datacenter REIT, sold 5.2 million shares through its ATM program during the quarter for $806 million in net proceeds.

Two healthcare REITs — CareTrust REIT Inc. and Omega Healthcare Investors Inc. — followed, raising $500.1 million and $439.7 million, respectively, through their ATM programs during the quarter.

– Download data featured in this story in Excel format.

– For further capital offerings research, try the Excel template for Global Real Estate Capital Offerings Activity.

– Set email alerts for future Data Dispatch articles.

A significant number of REITs sold common shares on a forward basis through their ATM programs during the quarter.

Single-tenant retail REIT Realty Income Corp. sold 16.5 million shares on a forward basis in the third quarter, the largest share count of any REIT. Additionally, Realty Income settled 4.3 million of its outstanding forward-sale agreements for $268.4 million in gross proceeds. As of Sept. 30, 16.8 million shares of common stock subject to forward-sale confirmations had been executed but not settled, representing $958.1 million in net proceeds. Realty Income expects to fully settle its outstanding forward-sale agreements by year-end.

Essential Properties Realty Trust Inc., another single-tenant retail REIT, sold more than 10 million common shares on a forward basis through its ATM program in the third quarter, representing $312.4 million in gross proceeds, all of which remained outstanding as of Sept. 30. In total, 22,937,762 shares of forward sales remained unsettled as of Sept. 30, for estimated net proceeds of $626.0 million.

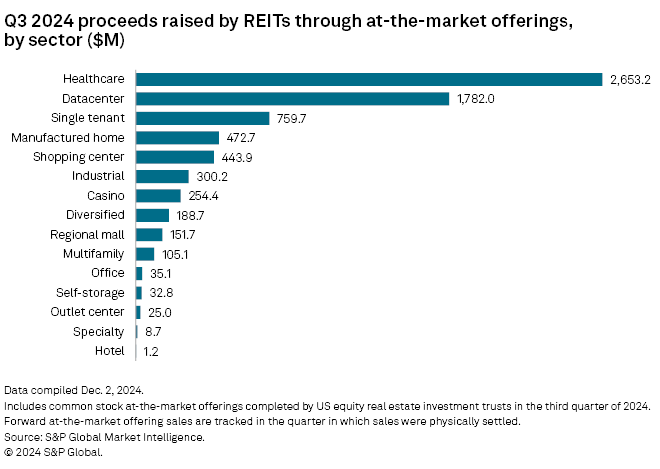

By property sector, healthcare REITs raised the most capital through their ATM programs during the quarter, at $2.65 billion. The datacenter sector followed with $1.78 billion raised.