| Bauxite arriving at Alcoa Corp.'s Wagerup alumina refinery in Western Australia. Alcoa and other bauxite and alumina producers have been cutting Russian ties, and the Australian government on March 20 banned aluminum ore exports to Russia. |

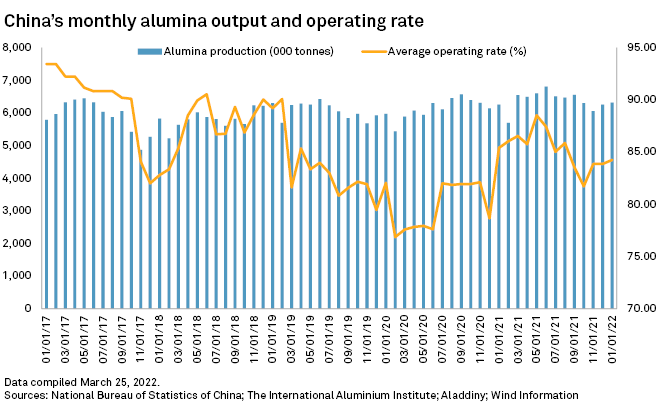

Even Russia's allies, such as Kazakhstan, Guinea and Jamaica, will need months to ramp up production to match the loss from Australia. While China is capable of producing additional alumina for export, it would be a short-term solution, as China uses much of its alumina domestically. That will leave Rusal and Russia struggling to maintain normal aluminum production levels.

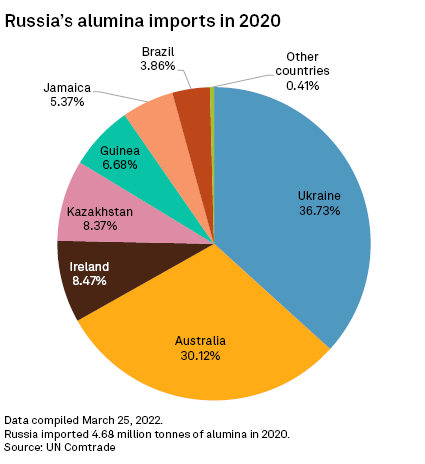

Russia's invasion of Ukraine on Feb. 24 resulted in aluminum prices reaching a record high as of March 7, as Russia imports nearly a third of its alumina, the raw material that goes into aluminum, from Australia, according to UN Comtrade data. Rusal is the world's largest alumina consumer outside China, and the company said March 30 that alumina exports from Australia account for almost 20% of its demand. Combined with the absence of alumina from its Ukraine refinery, Rusal may be unable to source 3.2 million tonnes of alumina, which equates to 42% of its needs for aluminum production, a bank analyst told S&P Global Commodity Insights.

"Assuming Rusal can shift its overseas alumina output to feed its own primary aluminum smelters, these domestic smelters are still facing at least 1.2 million tonnes of alumina shortage [in the short term] and it has to source from other countries," Wang Yue, a Shanghai-based analyst at East Asia Futures, told Commodity Insights.

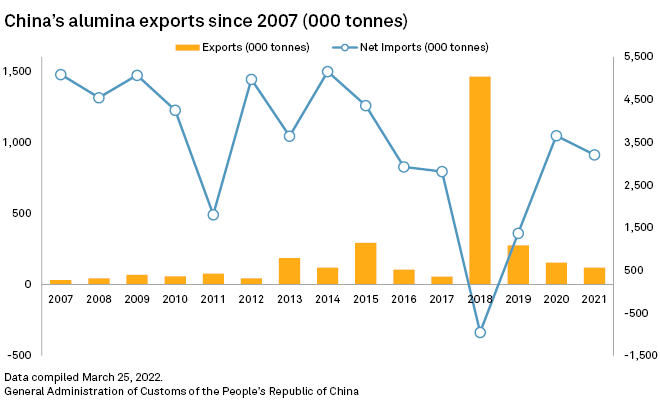

China, the world's biggest alumina producer and consumer, could try to step up, but analysts say it would not be enough to fill the gap. Comtrade data shows China's alumina exports to Russia surged 52 times year on year when the U.S. sanctioned Rusal in 2018, the toughest penalties since Moscow's 2014 annexation of Crimea. However, alumina from China only accounted for less than 2% of Russia's total alumina imports in 2018.

"China's alumina exports window has opened" as domestic prices are 1,500 Chinese yuan cheaper than oversea prices, Wang said. And while Russia's other allies have the potential to increase exports to the country, "it will take a few months for those countries to increase output and exports and it's less likely to fill the gap in the short term."

|

Supply shock

The Australian exports ban is another bump in the road for Rusal, which has already seen production curtailments and financial sanctions.

On March 1, Rusal shut down its Nikolaev alumina refinery in Ukraine, the key supplier of the company's Russian smelters, due to "unavoidable logistical transport challenges on the Black Sea and surrounding area," the company said in its earnings report. The Nikolaev refinery produced 1.8 Mt of alumina in 2021, which represents 21.7% of Rusal's total alumina output, according to Commodity Insights calculations.

The company may "face difficulties in supply of equipment, which may lead to the postponement of investment projects," after international financial sanctions against Russia. In the domestic market, historic-high interest rates and the Russian government's plans to control metal prices are likely to hurt its profitability, according to the report.

A meeting between Russia's deputy minister for industry and steel companies' representatives March 10 revealed the government had directed steel and other metal producers to reduce their profit margins on domestic sales to a maximum of 20%-25% to keep local prices low.

Rusal is still "evaluating the exact effect of the announced measures on the company," a spokesperson told Commodity Insights in a March 25 email.

Demand pressure building

Amid all this supply-demand disruption, the International Aluminium Institute expects the transportation, construction, packaging and electrical sectors to continue to drive demand up by almost 40% by 2030, two-thirds of which will come from China. The aluminum sector will need to produce an additional 33.3 Mt to meet demand growth in all industrial sectors, from 86.2 Mt in 2020 to 119.5 Mt in 2030.

Prices will be further supported by the global aluminum market deficit rising by up to 500,000 tonnes in 2022 to between 1.6 Mt and 1.7 Mt, Rusal said Feb. 9.

Significant political challenge

Russia could redirect alumina feeds and boost imports from China, but it is less likely to cover the supply gap, analysts said.

"Such options [for redirecting feeds] are quickly vanishing because of record-high energy prices, which will significantly increase processing costs for aluminum smelters," analysts from ANZ Research said in a March 25 note.

China can't help for long

"Exports of alumina from China are possible, as seen back in 2018, but any potential spike in exports is unlikely to be sustained," Yao Wenyu, senior commodity strategist at ING Bank, said in a March 23 note. "As Chinese smelters seek steady restarts to take advantage of the decent margins right now, their demand for alumina is poised to rise, supporting the raw material's pricing in the onshore market."

Meanwhile, China is not expected to ease the global supply shortage of aluminum.

"It will be difficult to arrest the fall in supply growth after subdued investment over the past few years," ANZ Research analysts said. They expect the growth of China's aluminum output to cool to 3.5% in 2022 from 5.4% in the five years prior to the COVID-19 pandemic.

"With China unlikely to offset more curtailments in Russia and European supply, the [global aluminum] deficit could widen to more than 2.5 Mt this year," the analysts estimated.

China has long been a net importer of alumina thanks to the government's efforts to rein in excess capacity, but its total exports soared by more than 25 times in 2018 when the U.S. imposed sanctions on Rusal.

Values-based decision

Australian alumina and bauxite producers were ahead of the government in cutting ties with Russia.

Rio Tinto Group announced March 10 that it was terminating commercial relationships with any Russian business. Rusal will not be allowed to import alumina from Queensland Alumina Ltd., its joint venture with Rio Tinto in Australia, of which Rio Tinto owns 80%.

Rio Tinto's spokesperson said its priority "remains the well-being of our people, our communities and the continued safe operation of our businesses, in full compliance with all governmental directions, including the Queensland Alumina Ltd. joint venture."

Australian alumina producer South32 Ltd. made the "values-based decision at the outset to cease commodity sales to Russian entities" in response to the invasion of Ukraine, a spokesperson told Commodity Insights. "And we have been working through the commercial implications ever since."

The company decided earlier in March that it would not enter into any new transactions or business relationships with Russian entities, the spokesperson said.

"South32 does not have any alumina sales contracts with Russian businesses and was not exporting alumina to Russia at the time of the [Australian] federal government's announcement. Our broader commodities sales exposure to Russia has historically been limited," the spokesperson added.

South32 said March 7 that it would not go ahead with the sale of the South African Metalloys manganese alloy smelter to Satka Investments Ltd., one of the world's largest producers of ferromanganese with operations in Russia and Ukraine, citing a "failure to satisfy certain commercial conditions to the agreement."

"In keeping with this decision, Alcoa of Australia does not have any sales contracts for the supply of alumina with Russian entities, and we have processes in place to ensure we comply with trade sanctions imposed by governments around the world, including Australia," an Alcoa spokesperson told Commodity Insights in a statement.

As of March 30, US$1 was equivalent to 6.35 Chinese yuan.

S&P Global Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.