Australia's biggest banks demonstrated resilience in their financial results for the recently concluded fiscal year, reflecting robust capital levels amid intense competition.

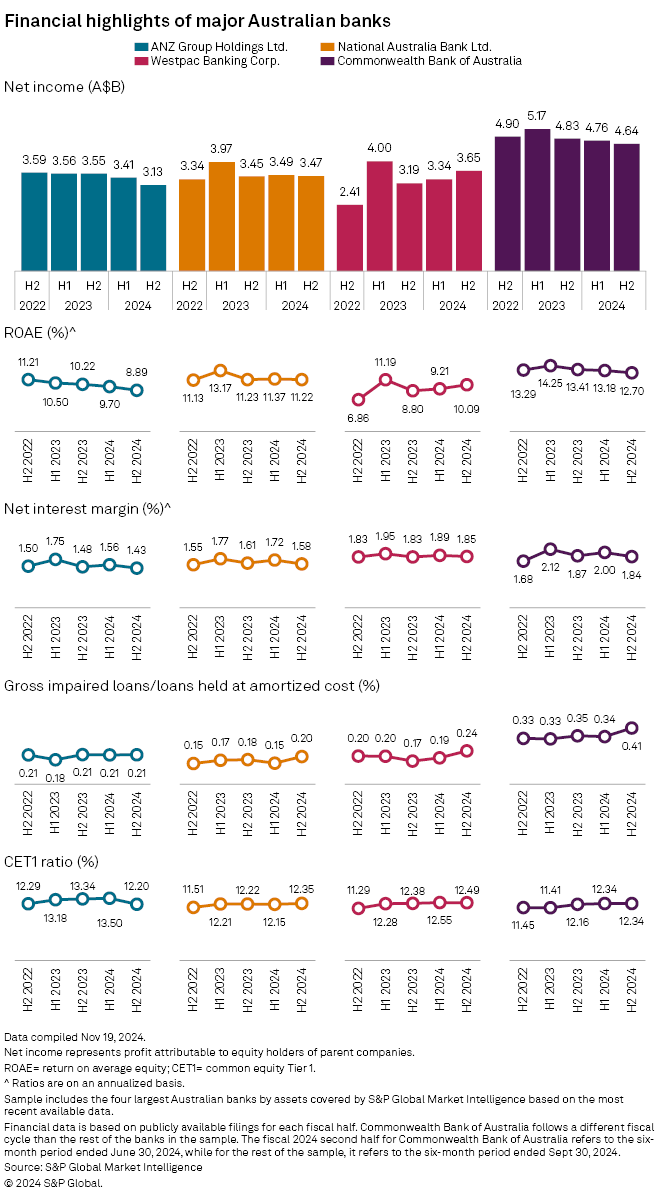

The country's four major lenders reported a decline in their net profits for the fiscal year ended Sept. 30, as net interest margins (NIMs) narrowed with the Reserve Bank of Australia maintaining its benchmark cash rate at 4.35%. Despite this, three of the four banks improved their common equity tier 1 (CET1) ratios over the past two years. ANZ Group Holdings Ltd. was the exception, recording a slight decline, according to S&P Global Market Intelligence data.

"Despite FY'24 being one of the best results for the majors in recent memory, it also showed how the significant increase in cash rates since 2022 has provided no lasting respite from the extent of competition in Australian banking," Sam Garland, banking and capital markets leader at PwC Australia, said in a Nov. 8 report.

Australian banks have faced higher operating costs and tougher competition in the mortgage market. Efforts to attract new loans and higher payouts to depositors have compressed margins. ANZ's NIM fell to 1.43% from 1.50% in the prior year, while Westpac Banking Corp.'s margin declined to 1.85% from 1.83%. In contrast, National Australia Bank Ltd. (NAB) reported an increase to 1.58% from 1.55%, and Commonwealth Bank of Australia's margin rose to 1.84% from 1.68%.

These results reflect how competitive pressures continue to shape profitability in Australia's banking sector.

Profits squeezed

ANZ reported an 8% year-over-year decline in net profit to A$6.54 billion for the fiscal year ended Sept. 30, down from A$7.11 billion. NAB posted a 6.1% drop in full-year net profit to A$6.90 billion from A$7.41 billion, while Westpac's net profit fell 3% to A$6.99 billion from A$7.20 billion.

Commonwealth Bank of Australia, which operates on a fiscal year ended June 30, reported a 6% decline in full-year net profit to A$9.39 billion from A$10 billion. In the second fiscal half, the lender's net income fell to A$4.64 billion from A$4.90 billion.

For the second half of the fiscal year, NAB and Westpac posted gains in net income. NAB's second-half net income rose to A$3.47 billion from A$3.34 billion, and Westpac's increased to A$3.65 billion from A$2.41 billion. In contrast, ANZ's second-half net income fell to A$3.13 billion from A$3.59 billion.

"The banking sector globally is facing significant pressure as results become squeezed from both ends — intensified competition across a more concentrated set of profit pools, while costs have seen no structural shift as investment needs from technology and regulation endure," Garland said.

Australian banks have faced slower cash earnings growth this year, following robust gains in 2023.

"Our results this year are lower compared with the strong outcome in FY'23. However, it has been pleasing to see some improvement over the second half, reflecting good execution and a more stable operating environment than we experienced in the first six months of the year," NAB CFO Nathan Goonan said during the bank's Nov. 6 earnings call.

Tough environment

The CEOs of Australia's major banks highlighted the challenging economic conditions impacting their operations.

"We've long believed that banking is challenged by greater customer regulatory and community expectations, sharper competition and higher costs," ANZ CEO Shayne Elliott said during the bank's Nov. 7 earnings call.

Outgoing Westpac CEO Peter King reflected positively on the bank's performance in fiscal 2024. "Financially, we were disciplined with margin management to highlight, and the balance sheet is in a strong position. We've grown in all our key segments off the back of improving customer service," King said during his final earnings call Nov. 3. Anthony Miller is set to succeed King as CEO on Dec. 16.

S&P Ratings said in separate notes that the country's big banks would likely maintain stable credit profiles in the coming years, supported by strong capital levels.

"Credit losses over the next two years should remain low and close to pre-pandemic levels, in line with those for other major Australian banks," Ratings noted in a Nov. 8 report on ANZ's results. But the agency's analysts cautioned that Australian banks, including ANZ, face risks from elevated household debt, high interest rates and global economic uncertainties.