Banco Bilbao Vizcaya Argentaria SA

BBVA's push to take control of its midsize rival calls into question the future of TSB, which does not seem to fit the Spanish bank's strategy of becoming a leader in its key markets. BBVA is the biggest bank in Mexico by loan market share and ranks third in Spain by the same metric. It also holds market-leading positions in Peru and Turkey.

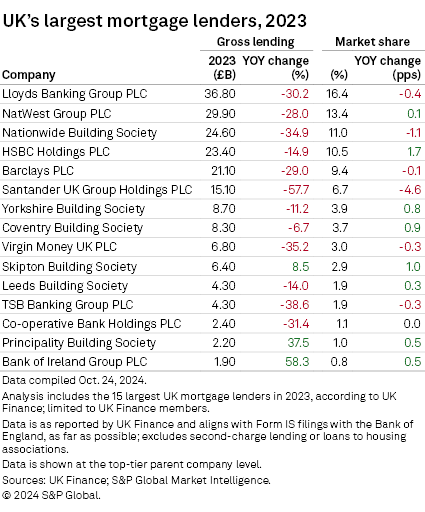

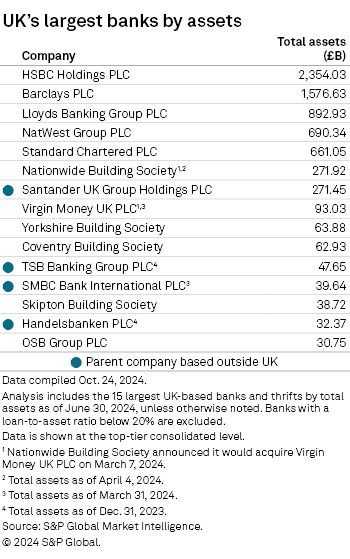

TSB is only the 11th biggest UK bank by assets, based on S&P Global Market Intelligence data, and ranks 12th in mortgage lending with a 1.9% market share in 2023, according to UK Finance.

Divesting TSB quickly after completing the Sabadell deal would free up a "reasonable amount of capital" for BBVA, said Benjie Creelan-Sandford, a European bank equity analyst at Algebris Investments.

"They're probably more in the offload bucket than the hold and invest bucket," Creelan-Sandford told Market Intelligence in an interview. "It might be just a handy way for them to recoup some of the cost of capital."

BBVA and Sabadell did not respond to Market Intelligence's request for comment.

BBVA is pursuing regulatory approval for its €12 billion takeover offer. It recently secured the UK Prudential Regulation Authority's nod to take indirect control of TSB, though Spain's competition authority has put the bid under a more extensive second round of review that could extend the deal process well into 2025.

BBVA is readying concessions to secure regulatory approval, though it reserves "the right to walk away if the value creation potential is compromised," Reuters reported, citing comments from BBVA CEO Onur Genҫ.

Sabadell reportedly considered selling TSB in 2020 after an earlier takeover bid by BBVA fell through at that time, but that plan did not materialize.

Johann Scholtz, bank equity analyst at Morningstar, also believes that BBVA would ultimately offload TSB, though finding a buyer could be challenging. Scholtz noted that Spanish peer Banco Santander SA has its own challenges with its British subsidiary, which ranks as the country's seventh-largest by assets.

The UK business has been "dragging down Santander's profitability for ages, and I think they've probably got the same challenge that they can't find a buyer," Scholtz said in an interview.

The scope of Santander UK remains "relatively narrow" compared to its peers, and its market share has plateaued over the past year and a half, S&P Global Ratings wrote in a report.

While TSB's mortgage-focused portfolio would be an "interesting" addition to BBVA, scaling up the business would take time, said Carola Saldias, senior director for financial institutions at Scope Ratings.

"To take it to a level that it would become one of the largest players, it's a long way considering that we have very strong and large UK players," Saldias said.

New leadership

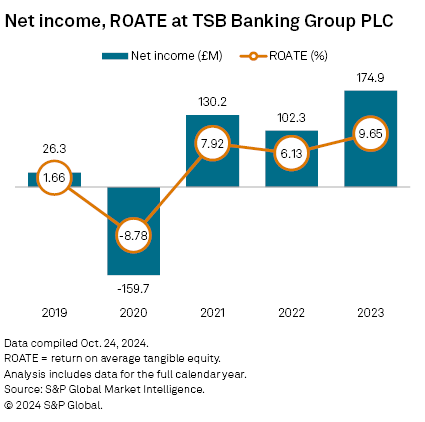

TSB accounts for less than a quarter of Sabadell's total net interest income and reported a 9.5% year-over-year drop in net profit for the first nine months of 2024.

It is rolling out cost-saving measures to improve profitability with a goal to cut total costs 3% in 2024 and another 3% in 2025. It expects to net interest income to grow at a compound annual rate in the "high single digits" in 2025 and 2026, while its return on tangible equity is poised to reach double digits starting in 2025, Sabadell CEO César González-Bueno said in an earnings call.

The bank will begin these changes under new leadership, following the recent hire of Marc Armengol as CEO.

"TSB is part of the group's present and future," González-Bueno said Nov. 29 following Armengol's appointment. "With Marc's leadership we will continue to advance the franchise's transformation and its contribution to our results."