The largest banks in the Gulf Cooperation Council further grew their third-quarter main lending income year over year, defying a trend that has weighed on their peers elsewhere as major central banks start to ease monetary policy.

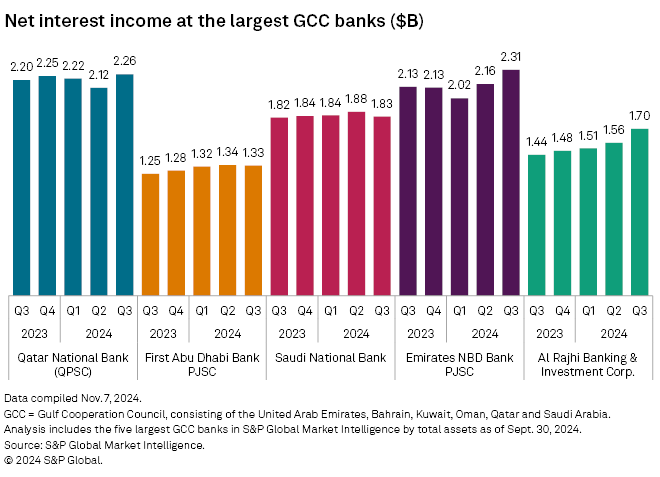

Qatar National Bank (QPSC) (QNB), First Abu Dhabi Bank PJSC, Saudi National Bank (SNB), Emirates NBD Bank PJSC and Al Rajhi Banking & Investment Corp. all booked higher third-quarter net interest income (NII), according to S&P Global Market Intelligence data.

Dubai, United Arab Emirates-based Emirates NBD booked the highest NII of about $2.31 billion. Net interest margin — a key measure for bank interest earnings — was 3.75% in the quarter, owing to "upside" in the group's Istanbul-headquartered DenizBank unit, CFO Patrick Sullivan said during an earnings call.

The currencies in the five banks' home countries are all pegged to the US dollar, and their central banks almost always mirror the monetary policy decisions of the US Federal Reserve. After a series of tightening, the US Fed made its first rate cut, 50 basis points, in September, meaning rates were higher for most of the third quarter.

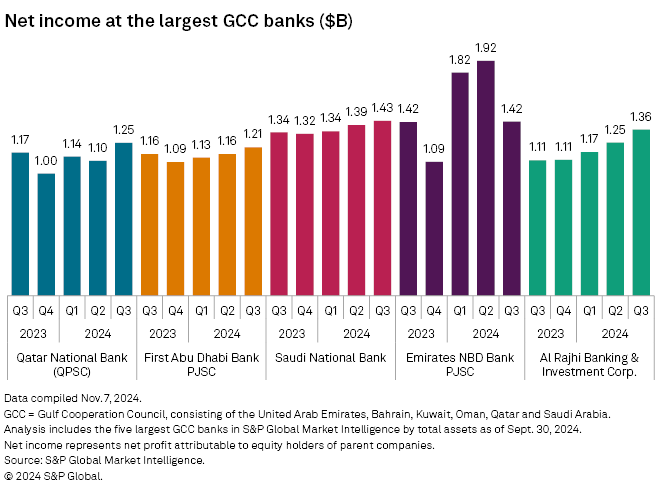

The continued NII increase allowed most of the five banks to report higher quarterly earnings. QNB, First Abu Dhabi, SNB and Al Rahji all saw net income growth year over year. Emirates NBD's net income was virtually flat.

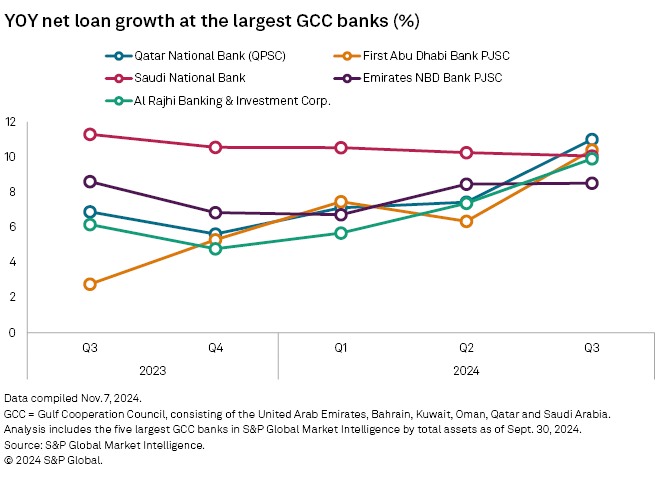

Continued loan growth

The banks also benefited from continued year-over-year loan growth in the period, with QNB booking the highest at 11%. For the full year, the bank upgraded its annual loan growth guidance, expecting between 5.5% and 7.5% versus its old guidance of 5% to 7%.

First Abu Dhabi and SNB also booked double-digit loan growth in the quarter, while Al Rajhi's was 9.90%. Emirates NBD's loan growth clocked in at 8.51%.

Looking ahead

Although the banks continued to enjoy higher NII in the quarter, experts expect a decline over the next few months as central banks continue to cut rates. Investor focus is now expected to quickly move to earnings expectations for 2025 "in an otherwise pressured NIM environment," Citi Research analyst Rahul Bajaj said in a note.

Rate cuts in the final three months of 2024 until 2026 will be negative for Gulf Cooperation Council banks as interest-earning assets will reprice faster than interest-bearing liabilities, according to Fitch Ratings. Banks in the United Arab Emirates are likely to be the most affected, while Saudi Arabian banks will likely be hit less due to their higher proportion of fixed-rate financing.

QNB expects central banks in advanced economies to take policy rates from "restrictive territory towards neutral and accommodative levels by mid-2025," Aves Akram, assistant vice president for financial strategy, said during the bank's earnings call.

The US Fed has since followed up its rate cuts, making a 25-basis-point reduction earlier in November.

In its October note, Fitch said it expects the US Fed to have cut rates by another 200 basis points by July 2026. The agency expects most Gulf Cooperation Council central banks to follow with similar reductions.

– View aggregate banking industry data for the UAE and Saudi Arabia.

– Access the latest earnings call transcript for Emirates NBD.

– Sign up to the Middle East and Africa Monitor, a weekly roundup of financial services news in the regions.