Editor's note: This article is published quarterly with current data available at that time.

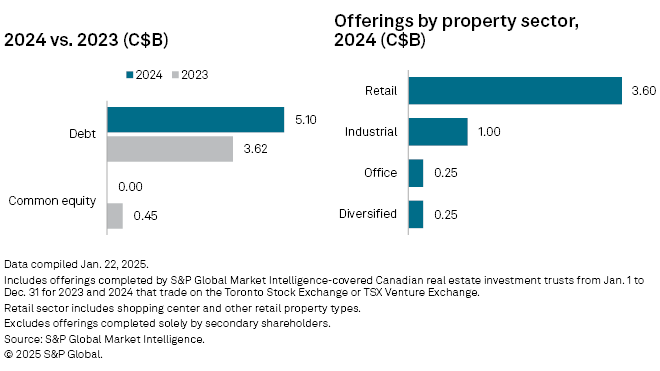

Publicly traded Canadian real estate investment trusts pulled in a total of C$5.10 billion through capital offerings in 2024, up 25.2% from C$4.07 billion a year earlier.

All the capital raised in the year came from debt offerings.

Retail REITs bag almost 80% of total capital

Only four property sectors in Canada raised capital in 2024. The retail sector — comprising shopping centers and other retail properties — accounted for the biggest share of capital raised, at C$3.60 billion, representing 70.6% of the year's total offerings. The industrial segment came in second at C$1.00 billion, followed by the diversified and office sectors, collecting C$250 million each.

– Set email alerts for future Data Dispatch articles.

– Access a spreadsheet listing the offerings completed in 2024 by publicly traded Canadian real estate investment trusts.

– For further capital offerings research, try the Global Real Estate Capital Offerings Activity template.

RioCan collects the most capital

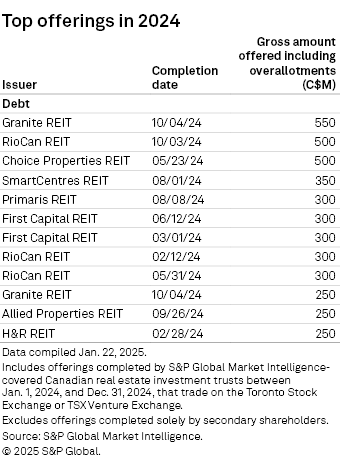

The single largest debt offering for 2024 was industrial-focused Granite REIT's 4.348% series 9 senior unsecured debentures worth C$550 million, which was completed Oct. 4, 2024.

Shopping center-focused RioCan REIT collected the most capital overall through five debt offerings valued at an aggregate C$1.45 billion. Another shopping center REIT First Capital REIT followed, with a total of C$800.0 million raised through three debt offerings.

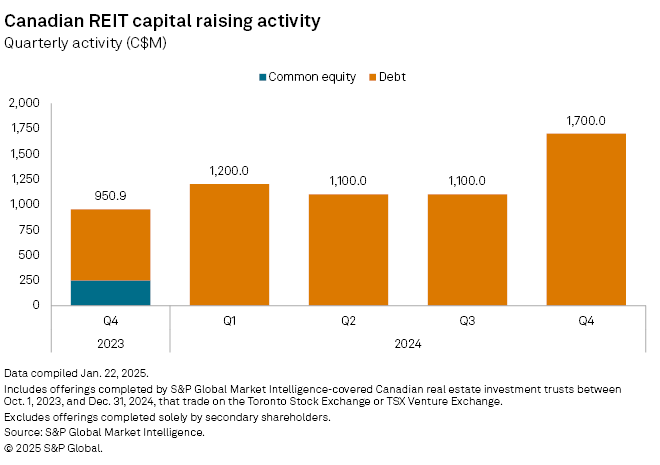

Capital offering activity grows more than 70%

After a static third quarter, capital market activity increased during the fourth quarter of 2024, bringing in a total of C$1.7 billion for Canadian REITs. The total amount represents a 54.5% hike from the previous quarter and a 78.8% increase from the C$950.9 million collected during the fourth quarter of 2023.

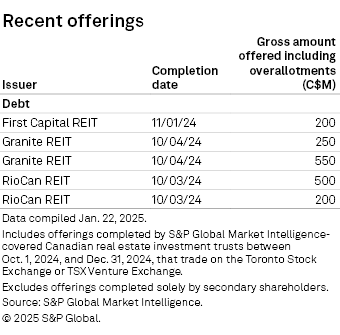

During the fourth quarter of 2024, industrial-focused Granite REIT sold C$550.0 million of 4.348% series 9 senior unsecured debentures due Oct. 4, 2031, and C$250.0 million of 3.999% series 8 senior unsecured debentures due Oct. 4, 2029. The REIT intended to use the net proceeds from the sale to refinance existing debt, including its US$185 million senior unsecured nonrevolving term facility, and for general corporate purposes.

RioCan REIT sold C$500.0 million of 4.623% series AL senior unsecured debentures due Oct. 3, 2031, and C$200.0 million of 4.004% series AM senior unsecured debentures due March 1, 2028. The company said at the time that it will use the net proceeds in large part to repay its existing debt, including the redemption of C$300 million of its 6.488% series AI senior unsecured debentures.

During the fourth quarter, shopping center-focused First Capital REIT sold C$200.0 million worth of 4.513% series D senior unsecured debentures due June 3, 2030. The transaction closed Nov. 1, 2024, and the net proceeds were allocated for existing debt repayment and general business purposes.