A complex review of car finance commission payments in the UK has created uncertainty for the country's biggest banks heading into 2025.

Key decisions from the Financial Conduct Authority (FCA) and the Supreme Court next year could result in billions of pounds in compensation payments and costs to banks related to resolving complaints over past car-lending practices. Lloyds Banking Group PLC, Santander UK PLC, Barclays PLC and Close Brothers Group PLC are among the institutions likely to be the most affected, according to current market estimates.

A wide range of analyst estimates regarding the size of the potential redresses underscores the difficulty of assessing the industry impact while court and regulatory decisions are still pending. Current base case estimates range from £5.9 billion by analysts at RBC Capital Markets to as much as £44 billion in an estimate from analysts at HSBC.

Banks may set aside additional provisions to prepare for the potential compensation costs, which could affect share buyback plans, Vitaline Yeterian, senior vice president, European financial institution ratings at Morningstar DBRS, said in an interview.

"There is a high level of uncertainty around the size and timeline of the redress at the moment," said Yeterian. "It will take some time until we actually get a better understanding of the magnitude of the impact of a potential compensation scheme on UK banks."

Adding to the uncertainty is an October court ruling that potentially broadened the scope of claims. The ruling "creates an invest-ability problem" for the financial services sector and the UK more broadly, said Lloyds CEO Charlie Nunn at the FT Global Banking Summit on Dec. 4. The executive said he had personally heard from more than 100 investors in recent weeks who were concerned about the situation.

"Consumer finance is fundamental to any economy, but really important to the British economy and for this sector," Nunn said.

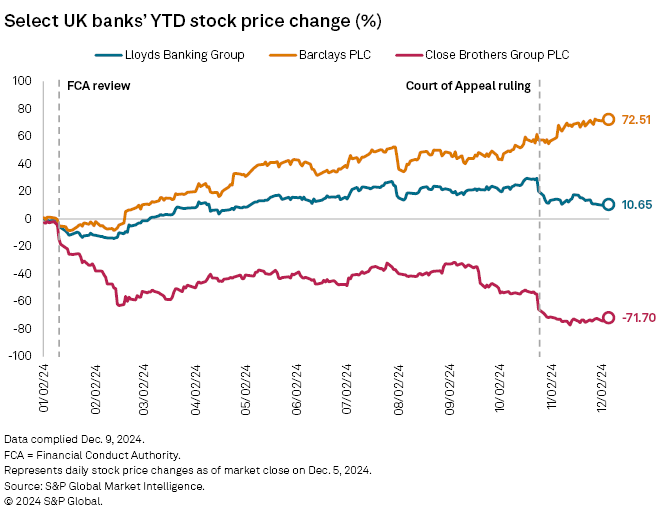

Close Brothers, which has a fifth of its loan book tied to motor finance, is the hardest hit among exposed banks for the year to date: Its stock has fallen more than 70%, according to S&P Global Market Intelligence data. Larger groups like Lloyds and Barclays, which are considered to be in a better position to absorb added costs, are still trading in positive territory.

Court rulings

Car lenders have been under review by the FCA since January for potentially overcharging customers through past uses of discretionary commission arrangements (DCAs), a practice banned in 2021. The regulator said its review, which is due to be complete May 31, 2025, could include a consumer redress scheme as a possible resolution.

Estimates on the potential compensation increased after a Court of Appeal ruling on Oct. 25 that declared it unlawful for car dealers to receive a commission from the bank providing a loan without the customer's explicit informed consent.

The ruling challenges widespread industry practices and could lead to significant redress costs, said Maria Rivas, senior vice president, European financial institution ratings at Morningstar DBRS, in an interview.

Moody's, which earlier estimated that industry redress following the FCA review could range from £8 billion to £21 billion, said it expects £9 billion in additional costs following the court ruling. That brings the potential total exposure to £30 billion, according to Moody's.

The October ruling expands the scope of the FCA review and could potentially apply to other financial products, such as insurance premiums, according to a Nov. 5 analysis by regulatory experts at UK-based accounting firm Grant Thornton.

Banks received a reprieve Dec. 11 when Close Brothers obtained permission to appeal the October Court of Appeal judgment. The London branch of South Africa's FirstRand Ltd. also sought permission for an appeal and an expedited decision, in a move backed by the FCA. The regulator said FirstRand's appeal would help "in securing legal certainty for the market."

The FCA extended its deadline for lenders' final response on DCA-related complaints to Dec. 5, 2025, a move intended to give lenders more time to process the growing number of complaints. The FCA is also considering extending the deadline for responses to non-DCA-related complaints to either May 31, 2025, or Dec. 5, 2025.

The FCA and the Financial Ombudsman Service (FOS) are consulting on ways to reform the redress system, which may not be fit for handling "sudden and significant increases in complaints" in its current form, the authorities said Nov. 15.

Car finance-related consumer complaints to the FOS surged to 11,817 in the third quarter of 2024, up from 4,622 in the prior-year period. The FOS expects more than 47,000 such complaints in its next fiscal year.

Sector response

In January, Lloyds, which operates the UK's largest motor finance provider, Black Horse, made a £450 million provision after the FCA review was announced. The group has not yet made further provisions but is evaluating the implications of the October court ruling and awaiting the outcome of appeal applications to the Supreme Court, it said in a statement.

After the October court ruling, Morgan Stanley cut its estimate for Lloyds' annual buybacks in 2024/25 to £1.5 billion from £2 billion, assuming the bank will announce an additional £500 billion provision with its fourth-quarter results for 2024. Analyst Alvaro Serrano said the uncertainty after the ruling makes the motor finance liability "difficult to size." Given the wide range of possible outcomes, Morgan Stanley also downgraded Lloyds' stock recommendation to equal-weight from overweight.

Santander UK announced a £295 million provision with its third-quarter results in November in a response to the Court of Appeal's ruling. A spokesperson for the bank did not comment on whether another provision is planned for the fourth quarter. "We will update the provision if and when more information becomes available which would change our assessment," the spokesperson told Market Intelligence.

Barclays, which exited the motor finance market in 2019 and is seen as less exposed to the ongoing reviews, has not announced a provision yet. A spokesperson declined to comment on future provision plans.

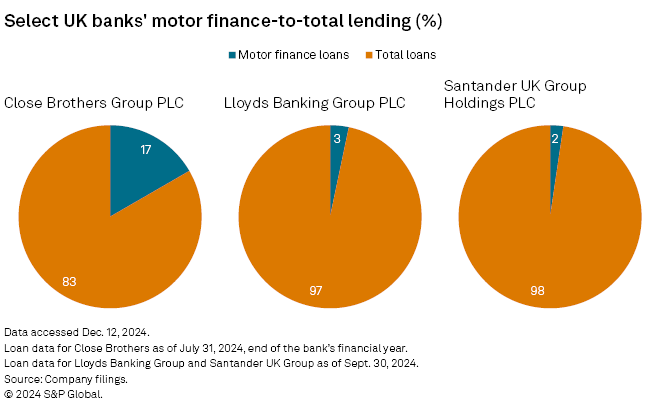

Close Brothers had the highest share of car-to-total loans among the exposed banks, with about 20%. It also had the lowest core capital ratio. The bank has taken steps to strengthen its capital position and aims to further optimize risk-weighted assets, a spokesperson told Market Intelligence.

So far, Close Brothers has not taken any provisions for a potential redress scheme, pending the ongoing FCA review and Supreme Court decision, the spokesperson said.

After a temporary suspension of its motor finance lending following the Oct. 25 court decision, Close Brothers has resumed "a significant portion of this business" since Nov. 2 and expects "full resumption in the very near future," the spokesperson said.

UBS analysts hiked their provision assessment for Close Brothers to £400 million from £280 million despite an assumption that the Supreme Court will overturn the Court of Appeal's decision. Time delays "increase the interest component of the potential redress amount and we expect a higher claim rate given the level of public discussion," the analysts said in a Nov. 28 note.

Strong foundations

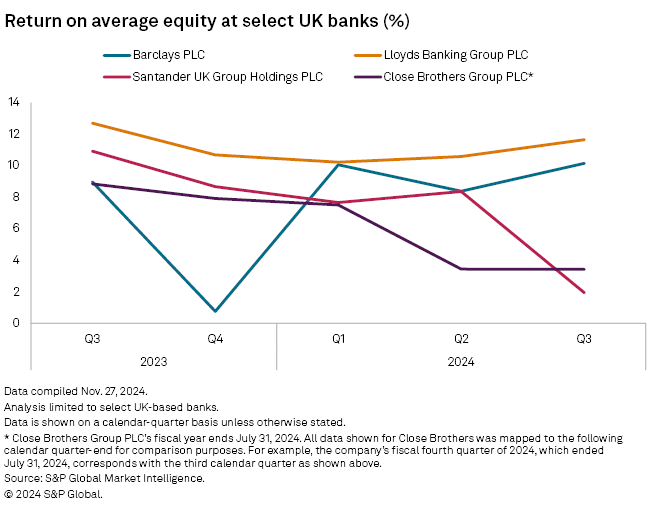

The car finance probe comes as UK banks have capitalized on higher interest rates to post booming profits. Lenders' hedging programs mean they are also well positioned to adapt to a lower-rate environment in the coming quarters.

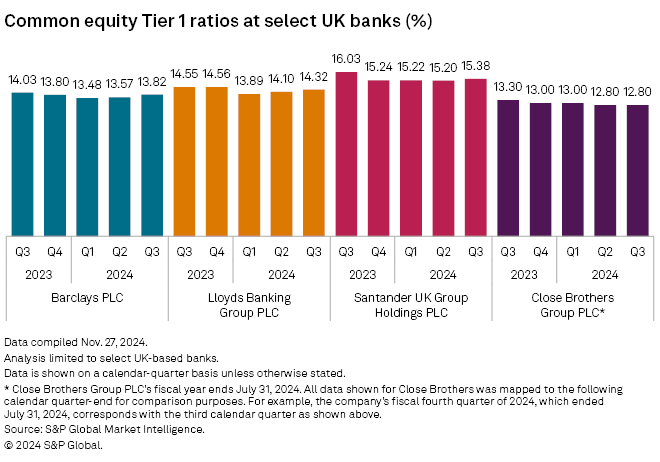

Big UK banks can "absorb potential redress payments with a minimal impact on their capital ratios thanks to their strong underlying earnings," S&P Global Ratings said in a Nov. 20 bulletin.

"If there is a redress scheme for motor finance, the length of time it takes for lenders to recognize the costs will depend on the scheme parameters set by the FCA and lenders' ability to forecast those costs," Ratings credit analyst Richard Barnes said in an emailed comment.

The impact of any scheme would likely be spread out over time, which would also help the banks tackle the costs and provisions, Morningstar DBRS' Yeterian said.

Scope Ratings analysts also consider rated large UK banks, including Lloyds, Barclays and Santander, well equipped to deal with potential fallout from the motor finance probes. Car finance loans account for just 3.4% of total lending at Lloyds and 2.2% at Santander UK, credit analyst Alvaro Dominguez Alcalde said in an emailed comment.