S&P Global Market Intelligence presents In Play Today, a periodic summary of potential private equity deal activity, including rumored transactions. This summary is based on information obtained on a best-efforts basis and may not be inclusive of all potential deal activity.

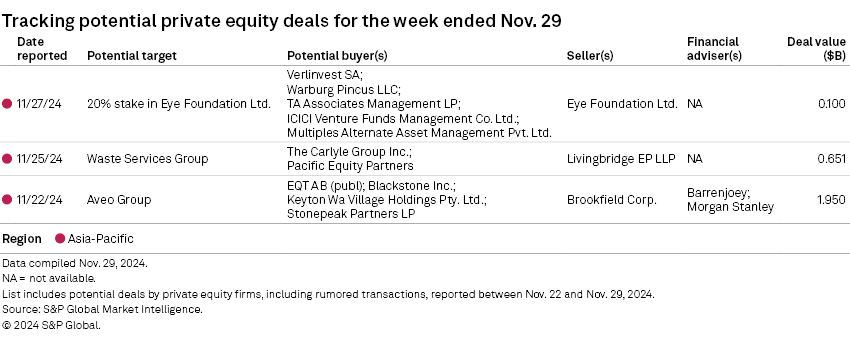

– Verlinvest SA is in pole position to acquire a 20% minority stake in Indian eye hospital chain Eye Foundation Ltd. for about $100 million, The Economic Times reported, citing unnamed sources. The stake acquisition involves purchasing existing shares from the founder and subscribing to new shares, the report added. Warburg Pincus LLC, TA Associates Management LP, ICICI Venture Funds Management Co. Ltd. and Multiples Alternate Asset Management Pvt. Ltd. reportedly were among the other investors that offered to buy a stake in the business.

– The Carlyle Group Inc. is in the lead to acquire Australia-headquartered trash collector Waste Services Group in a deal expected to exceed A$1 billion, The Australian reported. The final bidding stage includes Pacific Equity Partners and another undisclosed private equity firm, the report added.

– EQT AB (publ) and Blackstone Inc. are evaluating a potential acquisition of Australian retirement village operator Aveo Group from Brookfield Corp., The Australian reported. Keyton Retirement Villages and Stonepeak Partners LP are also assessing a possible acquisition of the more than A$3 billion business, the report added.

To view potential M&A in other regions, click here.