Global private equity and venture capital investments in mainland China and India fell in 2024, contrasting sharply with the 25% annual increase in global private equity deal value.

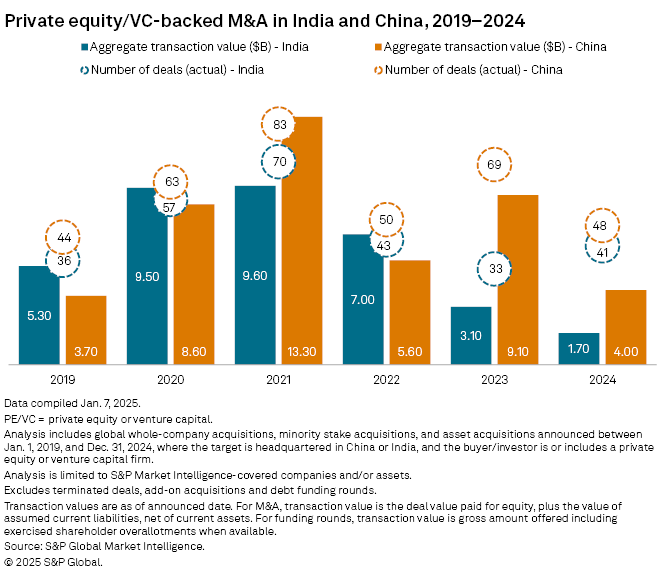

For full year 2024, mainland China had 48 private equity-backed acquisitions — excluding funding rounds — totaling $4 billion, a 56% drop from the $9.10 billion across 69 deals in the prior year, according to S&P Global Market Intelligence data.

India recorded 41 private equity deals amounting to $1.70 billion in 2024, about 45% lower than the $3.10 billion from 33 deals in 2023.

Venture capital pullback

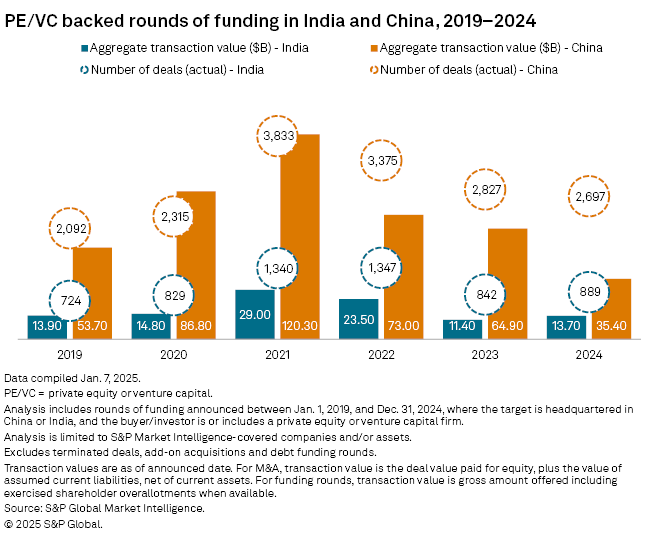

Rounds of funding in mainland China dropped 45% year on year to $35.40 billion, resulting in a three-year decline. Investment in mainland China has been the target of US government executive actions and investment rules to mitigate risks associated with technological competition and national security threats. In 2024, US venture capital investment in mainland China was on track for the lowest total value in a decade.

In India, however, total rounds of funding reached $13.70 billion, slightly higher than the $11.40 billion the prior year.

The median deal size for private equity-backed deals in mainland China, including funding rounds, ticked down to $13.9 billion from $14 billion in 2023, and in India, the median increased to $3.6 billion from $2.6 billion, Market Intelligence data shows.

| – Download a spreadsheet with data featured in this article. – Read up on worldwide private equity deals in 2024. – Learn more about the private equity megadeals of 2024. |

Private equity exits in mainland China, India jump

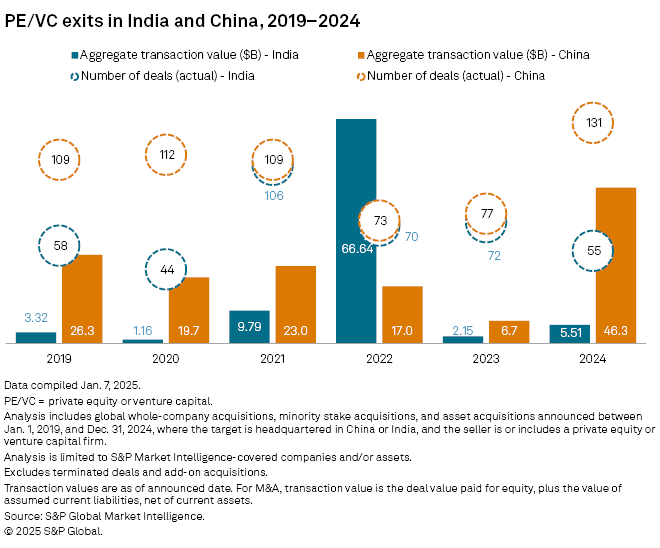

A bright spot for the two large economies has been exits, contrasting with worldwide private equity exits, which fell to a five-year low in 2024.

Mainland China recorded 131 private equity exits in 2024, which amounted to $46.3 billion, nearly seven times the $6.7 billion of exits in the prior year and the highest exit count and value since 2019.

Mainland Chinese firms, alongside Hong Kong-based investors, which have traditionally invested locally in recent years, also increased their investments in funds that target Western markets in 2024. The high exit values coinciding with rising Chinese investments in Western markets may indicate that Chinese investors, to an extent, are not reinvesting their new capital into local businesses.

Exits in India totaled $5.51 billion, up 156% from the prior year, although starting from a low base. The 2024 exit total was far from India's outsized year of 2022, driven by one deal, Premji Invest's $61 billion sale of housing financier Housing Development Finance Corp. Ltd. to HDFC Bank Ltd.

Hermes GPE LLP Head of Asia-Pacific Investments Sean Yoo highlighted India's favorable exit environment, driven largely by IPOs and a strong public market.

"India has seen increasing interest due to strong deal flow and an active exit environment, especially in sectors with strong macro tailwinds such as consumer, healthcare and IT services," Yoo told Market Intelligence.

Fundraising remains subdued

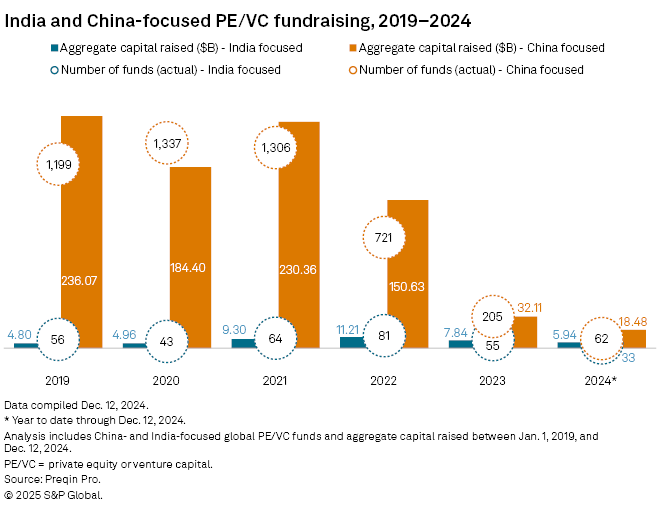

Fundraising for India- and mainland China-focused funds decreased, following the global three-year trend.

Funds focused on mainland China fell 42% to $18.48 billion compared to 2023. India-focused private equity funds raised $5.94 billion, down year over year from $7.84 billion, according to Preqin Pro data.

Yoo expects Asia's fundraising market to improve after what has been a tough few years of securing capital.

"Interest rates were high in the US, so global investors felt more comfortable investing in the US market. Asian currencies as a result weakened over the past several years," Yoo said.

If rates continue trending downward, he believes investors will develop a stronger risk appetite and increased interest in emerging markets.

Private equity investors are likely to direct capital away from Asia's largest economy and toward other Asian markets in 2025, Yoo said.

Geopolitical tensions, possible tariffs, regulatory risks for certain sectors, a property sector meltdown and weakened consumer confidence are headwinds for mainland China.

"Investors are likely to focus on markets and sectors that offer stability and growth potential outside of China while seeking better control over value creation and the exit process," he said.