| US President-elect Donald Trump dons a coal miner's helmet during a rally in West Virginia during his 2016 campaign for president. The coal industry would like to see changes to domestic energy policy during the second Trump presidency. Source: The Washington Post via Getty Images. |

The US coal sector is optimistic that incoming President Donald Trump will roll back regulations to alter the future of the diminished industry.

Saving coal was a banner issue for the Trump administration during the 2016 presidential campaign, but coal production and employment subsequently dwindled as market factors pressured coal-fired power plants. Despite hearing relatively little about coal from Trump during the 2024 campaign, coal supporters would like to see the Trump administration roll back regulations implemented during the Biden administration, against a backdrop of rising energy demand from the tech sector.

"What we foresee is a new approach to domestic energy that reembraces energy abundance and works to remove hurdles to domestic energy production, rather than raising them," Conor Bernstein, a spokesperson at the National Mining Association trade organization, told S&P Global Commodity Insights.

Karoline Leavitt, a Trump-Vance transition spokesperson, did not directly address coal or offer up specific actions that could benefit the coal sector in a statement to Commodity Insights. Instead, Leavitt said Trump will "make America energy dominant again" and work to lower consumers' cost of living.

"Families have suffered under the past four years' war on American energy, which prompted the worst inflation crisis in a generation," Leavitt said. "Voters reelected President Trump by a resounding margin, giving him a mandate to implement the promises he made on the campaign trail, including lowering energy costs for consumers."

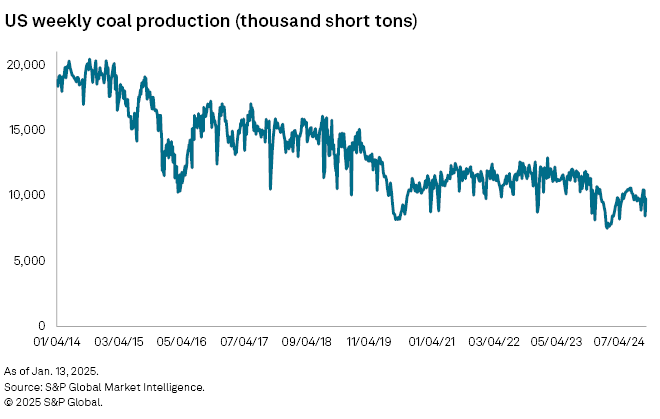

Coal production decreased during the first Trump administration, hitting a low during the COVID-19 pandemic when electricity demand cratered. Output bounced back somewhat in the early days of the Biden administration but has since been declining again.

US coal plants may benefit from rising demand, Trump

Burning coal, without costly mitigation technology, is one of the most emissions-intensive ways commonly used to generate electricity. The Trump administration could help the coal sector right away by starting the work of undoing US Environmental Protection Agency rules on greenhouse gas emissions, Bernstein said.

"Rolling back that regulatory mandate and refocusing the nation's energy policy on the twin crises of eroding reliability and rapidly rising electricity prices will bolster the coal fleet," Bernstein said.

Repealing EPA regulations on greenhouse gas emissions would remove a lot of pressure for coal-fired power plants to install carbon capture equipment or face early retirement, said Robert Johnston, senior director of research at the Center on Global Energy Policy at Columbia University.

"That's pretty significant, seeing that the domestic demand for coal is so heavily concentrated in the power sector, which is smaller than it used to be, obviously, but still important," Johnston said in an interview.

During Trump's first term, his administration made numerous efforts to preserve the coal industry. There is a wave of coal plant retirements expected in 2028 due to a Trump-era special exemption to effluent rules that allows plants to keep waste in surface-level ponds as long the plant retired by the end of that year.

Changes in permitting, leasing

Another priority could be reversing the Biden administration's plans to restrict federal coal leasing, Bernstein said. Much of the US coal supply comes from the Powder River Basin, where most mine operations sit on federal lands for which the US government leases mineral rights.

In 2024, offices of the Bureau of Land Management in Wyoming and Montana proposed management plans that would make no federally owned coal available for leasing. However, the administration made moves to approve an expansion of an existing lease in Montana earlier this year.

"With domestic electricity demand soaring and global coal use once again reaching a new high in 2024, the federal coal leasing program should remain a foundational piece of the nation's all-of-the-above energy strategy and an economic engine for mining states," Bernstein said.

Bernstein said the Trump administration and a Republican-dominated Congress could also streamline permitting, adding that the administration and Congress will be receptive to the industry's case for investing in infrastructure to increase coal exports to other countries, which is a growing segment of many US coal companies' balance sheets.

"There are many ways to streamline permitting, reduce regulatory barriers and increase the competitiveness of the US mining and energy industries," Bernstein said. "We look forward to working closely with the Trump administration and Congress to undo the damage of the Biden administration and ensure the energy security and affordability Americans voted for can be achieved."

Trump's creation of the National Energy Council, an effort aimed at advancing his "energy dominance" policies, should also help federal agencies align and be a positive development for the coal sector, said Michelle Bloodworth, president and CEO of the America's Power industry group. Members of the group are optimistic the trend in coal plant retirements can be reversed, Bloodworth said.

"Meeting America's growing energy demands will require an 'all of the above' strategy that includes existing resources like coal," Bloodworth said. "This also means that we need a healthy coal supply chain. We believe the Trump administration understands these challenges and will address them."

Datacenters give, take away hope

Coal will account for 15% of power generation in both 2025 and 2026 as a nearly two-decade trend of steady US electricity demand switches to a trend of 2% annual growth starting in 2024 due to datacenter demand increases, according to a US Energy Information Administration forecast released Jan. 14. The EIA forecast also suggests the country's efforts to mitigate climate change by slowing carbon dioxide emissions will stall, with emissions holding at 4.8 billion metric tons annually in 2024, 2025 and 2026.

Owners of coal-fired power plants have already responded to the changing demand picture. Utilities are retiring 3.0 GW of coal-fired capacity in 2024, the lowest level since 2015, according to a recent Commodity Insights report. Several power companies have already delayed previously announced plans to retire parts of their coal fleet as rising demand from datacenters drives the need for more power.

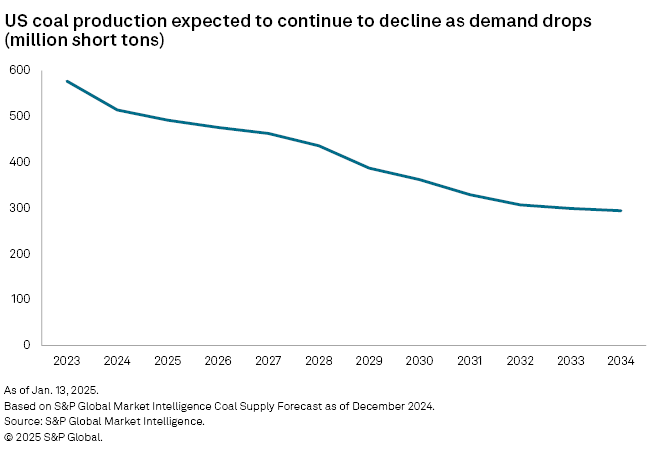

Despite the rising demand, the S&P Global Market Intelligence Power Forecast indicated that coal plants will account for only 5.8% of total power generation by 2035, according to a Jan. 7 report.

"I don't think [datacenter demand] will lead to a lot of new-build coal-fired generation, but I think it's important in terms of providing market support for existing coal if [Trump] does encourage more electricity demand by sort of fast-tracking approvals of these big datacenters and hyperscalers that will keep some of these coal plants going," Johnston said.

"Between gas, renewables and nuclear, it just doesn't seem like that leaves a lot of space for policy to make a difference in building more coal-fired plants," Johnston said.

Many of the companies building the datacenters that are thirsty for more energy must also balance the need for energy with their climate commitments, said Patrick Drupp, director of climate policy at the Sierra Club.

"So, keeping a coal plant online to build a datacenter for a big tech company does not match what the tech companies are saying they want to do," Drupp said. "There are other solutions. We're going to keep on pushing to make as much of this load growth as clean as possible."

The Sierra Club, a green group with a dedicated campaign to eradicating coal power, is carefully watching the president's energy actions on several fronts. The group aims to separate what actions the president will actually take from what is simply "rhetoric" or "bluster," Drupp said.

"Trump might certainly try to bolster the coal industry, [but] I think that's certainly not the future," Drupp told Commodity Insights. "Those plants are so dirty and so uneconomic, they make almost no sense in virtually any scenario."