Constellation Energy Corp. stock popped 25% on Jan. 10 after the independent power producer announced plans to acquire privately owned Calpine Corp. for $26.6 billion from a consortium led by Energy Capital Partners LLC, forming a nuclear and natural gas generation giant.

The cash-and-stock transaction is valued at an equity purchase price of approximately $16.4 billion, comprising 50 million Constellation shares and $4.5 billion in cash, plus the assumption of Calpine's approximately $12.7 billion net debt.

As the share price climbed in pre-market trading ahead of the Jan. 10 opening, Constellation President and CEO Joseph Dominguez emphasized to investors and analysts that unprecedented electricity demand forecasts are already translating into financial commitments from large tech companies.

"We can all raise questions about the ultimate magnitude of these increases. Do we believe all of it is real? It's hard to say, really," Dominguez said on a conference call following the announcement of the deal. "What's more compelling to me than the ultimate amount of projected growth, which is, again, something we could always debate, is that we're seeing year-over-year increases to the annual forecast."

"We're seeing a lot of activity on the ground," Dominguez continued, citing Microsoft Corp.'s plans to invest $80 billion in fiscal 2025 to develop AI-enabled datacenters globally, with over half of the expenditure allocated to the US.

Independent power producers in 2024 saw a financial resurgence due in large part to emerging forecasts for exploding load growth into the next decade from hyperscaler customers.

"The impetus for the acquisition is clearly Constellation's bullish view on power demand from datacenters, and they must have significant insight into Big Tech's power needs given they own the largest nuclear fleet and are fielding calls on supply agreements," analysts at CreditSights wrote Jan. 8, following reports that a deal was imminent.

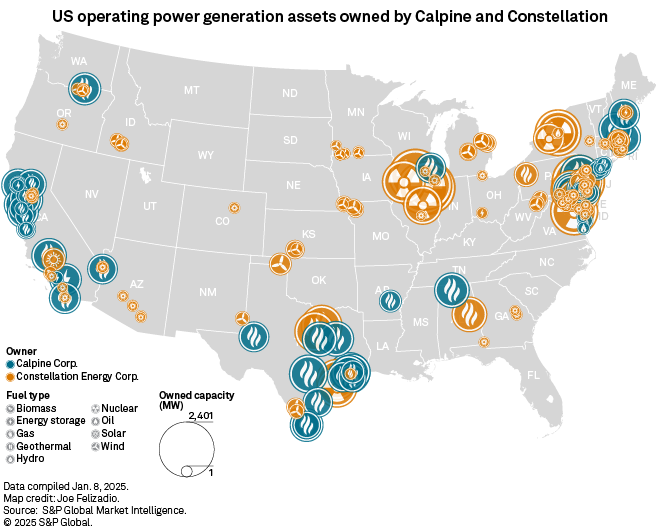

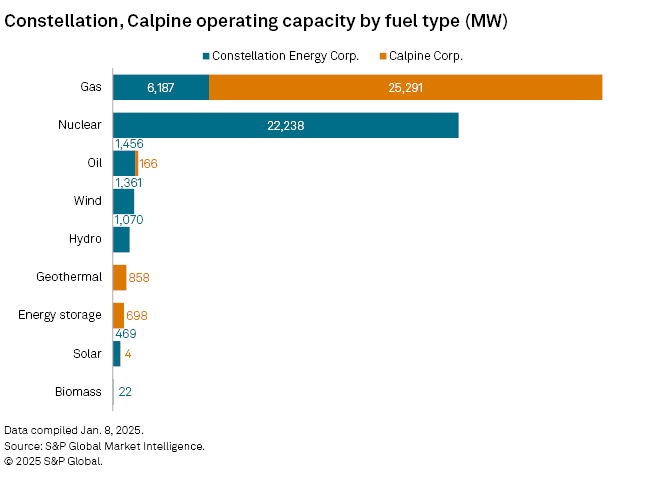

The combined company will own 60,000 MW of operating capacity, according to S&P Global Market Intelligence data, including 31,478 MW of gas generation and 22,238 MW of nuclear generation.

As Constellation looks to add more than 25 GW of gas capacity to its existing, approximately 6-GW gas fleet, analysts asked about the appetite by prospective nuclear supply customers for potential colocated gas capacity or other transactions.

"The data economy as it is, is being powered right now by a lot of natural gas assets. So I don't think it's a new conversation we need to start," Dominguez said. "But based on what we know, this is going to provide a great opportunity, right? We're going to be able to partner and offer these blended solutions that will satisfy their needs for sustainability and also for energy."

In a note following the call, CreditSights analysts wrote, "clearly their $29 [billion] acquisition means Big Tech wants natural gas."

Financial highlights

The acquisition will be accretive to Constellation's EPS in 2026 by more than 20%, management said, and by at least $2.00 per share. Adding Calpine will also increase free cash flow by at least $2 billion annually, before other planned growth initiatives, according to the company.

And Dominguez asserted the price Constellation is paying, at a multiple of 7.9x of Calpine's 2026 enterprise value to EBITDA, represents a bargain.

"Outside of Constellation, we believe that Calpine would have traded at the best multiples in the business had it pursued an alternate path to an IPO, all of which makes the 7.9x EV-to-EBITDA acquisition multiple on '26 earnings extremely compelling," he said.

Constellation initiated a 2025 adjusted operating earnings guidance range of $8.90 to $9.60 per share, with base earnings expected at $6.70 to $6.80 per share. Looking ahead, Constellation plans to maintain growth of at least 13% from 2024 through 2030, off a base EPS target of $5.45-$5.55.

Deal drivers

Calpine's lower-emitting, coal-free generation fleet met "a bright line in our M&A strategy and a very bright line for many of our owners as well," Dominguez said. He also noted that Calpine is the largest geothermal operator in the US, with the 725-MW Geysers complex, and the largest cogeneration operator, with a portfolio of approximately 6,000 MW.

"And Calpine also brings a pipeline of battery storage and solar projects that could be also pursued," Constellation Executive Vice President and CFO Daniel Eggers said.

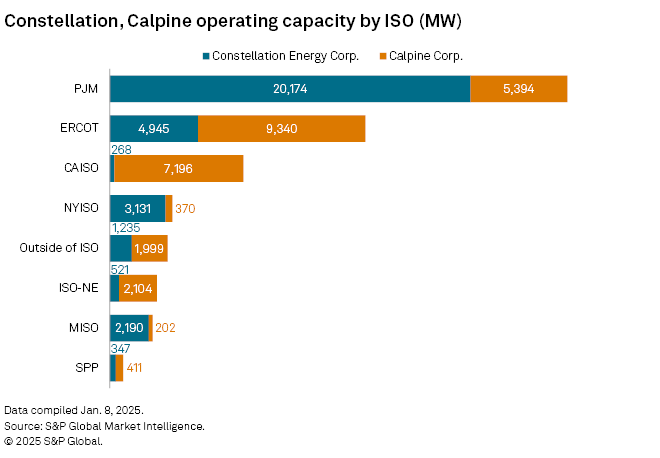

Another key driver for the deal is that it will increase Constellation's Texas presence, growing its exposure in the Electric Reliability Council of Texas Inc. from 11% of its generation fleet currently to 23% post-acquisition. The combined business will also have 49% of its generation located in the PJM Interconnection LLC market.

"If I'm going to be honest, what we didn't have is enough exposure to Texas, which has been the fastest-growing market in the US. It's been a place where many of our national customers have grown and they want to continue to grow," Dominguez said. "Through this combination, our owners will have better upside exposure to growth in Texas, will diversify geographic risk."

In a Jan. 10 report, S&P Global Ratings affirmed that "the dramatic increase in the digital economy has extended the asset lives of Calpine's gas generation fleet well into the 2040s, in our opinion.

Timing

Dominguez also spoke to concerns about the independent power producer sector's previous cycle of cost-cutting, refinancing and divesting generation assets following a period of growth.

"It's very different than any period of time, including the period of time that NRG Energy Inc. made its decisions and others have made their decisions historically," he said. "We're seeing what, frankly, I haven't seen in my career in this business, a growth in the sector that many haven't witnessed in the lifetime, and that requires us to consider the options to to expand the portfolio to fully take advantage of that."

Constellation Executive Vice President and Chief Legal and Policy Officer David Dardis added that the company will propose "some asset sales" in PJM where Constellation and Calpine overlap.

Analysts at Jefferies, however, anticipate some pushback.

"Given the increased political and overall attention on power demand, we would expect a protracted process and likely opposition from stakeholders, including regulated utilities," they told clients Jan. 10.

Constellation plans to close the deal with the consortium, which also includes Access Industries Inc. and Canada Pension Plan Investment Board, in the fourth quarter of 2025.