|

| The spillover of the cryptocurrency crash to Singapore's financial system has been limited, the Monetary Authority of Singapore said. Source: tampatra / iStock / Getty Images Plus via Getty Images |

Asia's friendliest country for cryptocurrency innovation will continue to restrict retail access to the risky alternative to money, even as it seeks to position itself as a financial technology hub.

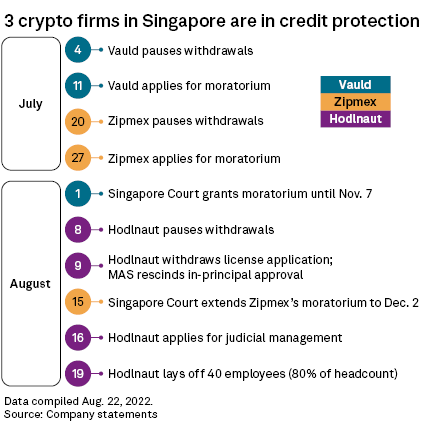

Singapore may allow more financial technology companies to use the deep pockets of liquidity and talent available in Southeast Asia to develop crypto-based products, undeterred by the recent collapse of Hodlnaut Pte. Ltd., Zipmex Pte. Ltd. and Vauld amid a steep fall in the cryptocurrency market. The Monetary Authority of Singapore, or MAS, the nation's financial regulator, will likely widen the scope of cryptocurrency regulation to protect individual investors.

"We can see that the industry has certainly begun to work at a quicker pace to ensure that appropriate safeguards are put in place," said Irfan Ahmad, digital product lead for Asia-Pacific at financial services provider State Street Corp. "There have been a number of public consultations put forward by a wide array of regulatory authorities as they further traverse this new space and look to place pragmatic guardrails in place that protect end-investors and allows for innovation to flourish."

Singapore has largely been regarded as a fintech hub in Asia-Pacific due to its friendly regulations, strong government endorsement and investor interest. Initiatives including sandboxes offering an isolated testing environment have birthed fintechs such as private securities exchange HGX Pte. Ltd. and cryptocurrency custodian Propine Technologies Pte. Ltd.

"Generally, regulatory sandboxes serve as the foundation for fintech development, with digital asset initiatives as a key focus," Ahmad said.

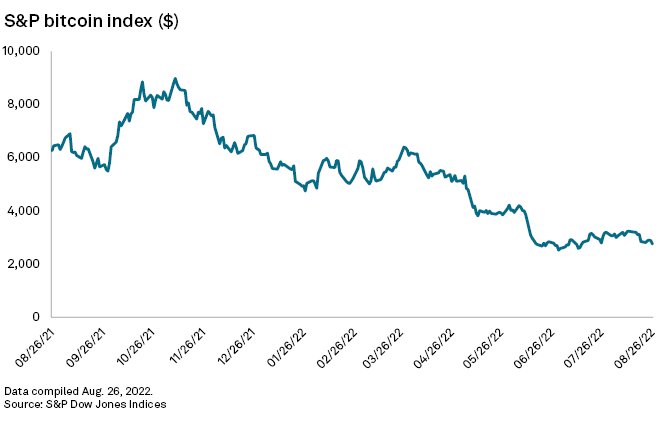

The cryptocurrency market was not immune to the economic downturn, with the price of various coins taking a plunge since March when some investors started to cash out and others became pessimistic on the valuations of the speculative asset class. Apart from putting cryptocurrency companies in distress, the crash caused currencies such as bitcoin to drop to about $20,188 as of Aug. 29 from a high of about $67,554 in November 2021, according to CoinDesk. It also wiped out paired tokens such as terraUSD and luna.

"MAS regards cryptocurrencies as unsuitable for use as money and as highly hazardous for retail investors," Ravi Menon, MAS managing director, said Aug. 29 in an industry event. "It is very risky for the public to put their monies in such cryptocurrencies, as the perceived valuation of these cryptocurrencies could plummet rapidly when sentiments shift. We have seen this happen repeatedly."

The turmoil in the cryptocurrency market has not posed financial stability risks in Singapore, a MAS spokesperson said in a prior statement emailed to S&P Global Market Intelligence. "Spillover to the domestic financial system has been very limited as our key financial institutions do not have significant exposures to either distressed cryptocurrency firms or cryptocurrencies," MAS said.

The central bank is looking to widen the scope of cryptocurrency regulations in Singapore to cover consumer protection, market conduct and reserve backing for stablecoins, said Yuankai Lin, partner at RPC Premier Law Singapore. Prior to the cryptocurrency crash, regulations in Singapore and other jurisdictions primarily focused on anti-money laundering and counterterrorism, Lin said. The two use cases were major concerns for the anonymous nature of cryptocurrency.

"It is a general concern, not just in the crypto industry but for any emerging technology, that over-regulation may stifle innovation," Lin said, adding that it may be overly simplistic to say that more regulations alone could have prevented the cryptocurrency crash and its consequences.

"The MAS has always been aware of these risks and has taken the unequivocal position that cryptocurrencies are not suitable as investments for retail investors as they are subject to sharp price swings," Lin said.

Despite the volatility, the popularity of cryptocurrency has warranted it to be an asset class that is in need of regulatory approvals before financial institutions can more confidently adopt it. Regulators around the region, including cryptocurrency-friendly markets such as Singapore and Dubai, face the same challenge of how to enable innovation, yet ensure consumer protection, said Zennon Kapron, director of financial technology research and consulting firm Kapronasia.

"Crypto, like any asset class, goes up and down, which is something that investors should be aware of and can prepare for," Kapron said. "What regulators need to do, regardless of economic conditions, is ensure that the platforms that consumers use are fit for purpose."