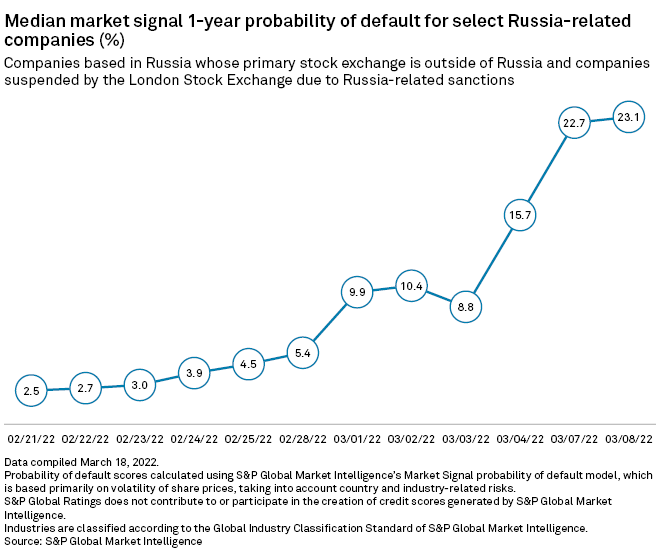

The risk of default for Russian companies listed primarily on international stock exchanges has skyrocketed in the wake of the invasion of Ukraine.

The median one-year market signal probability of default for 22 Russia-related companies leapt to 23.1% on March 8 from just 2.5% on Feb. 21, according to S&P Global Market Intelligence data.

The analysis includes 16 companies headquartered in Russia that are listed in the U.K., U.S., Singapore and Australia, as well as another six companies headquartered outside Russia that primarily trade on the London Stock Exchange and were suspended March 3 over their ties to Russia. The Nasdaq and New York Stock Exchange halted trading of Russian stocks March 1.

The analysis calculates the likelihood that a company will default based primarily on movements in the share price. The dramatic spike in risk came as the price of shares of Russian companies including agriculture giant Don Agro International Ltd., online recruitment company HeadHunter Group PLC

The broad-based rise in default risk comes as Russia's own creditworthiness has suffered. S&P Global Ratings on March 17 downgraded the country's foreign and local currency credit ratings to CC from CCC-. The move occurred just two weeks after Ratings downgraded Russia into junk territory, citing increased default risk related to the conflict.

The materials sector accounted for eight of the 22 companies included in Market Intelligence's probability of default analysis along with four from the consumer staples sector and three from industrials.

The probability of default scores for all but two of the companies were in single-digit percentages just a couple of weeks prior, and now the scores range from 7.60% to 57.57%.

The corresponding change in implied credit scores has been equally dramatic, with one company falling seven rating spots from bb to ccc-. An additional nine companies dropped five or six implied rating scores.

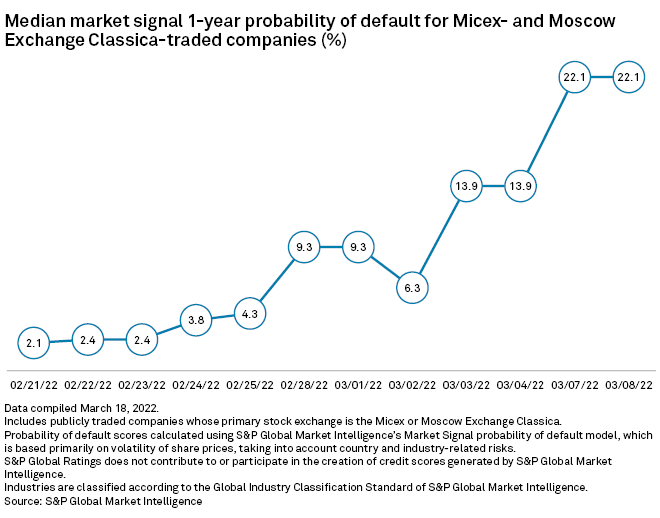

Pause in Russia

Moscow-based stock exchanges closed in late February

Editor's note: S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence probability of default scores from the credit ratings issued by Ratings.