Europe's retail sector faces a decisive few months. Having just found its feet after COVID-19 lockdowns forced large swathes of the sector to shut up shop, recent surges in infection numbers will have many looking ahead nervously.

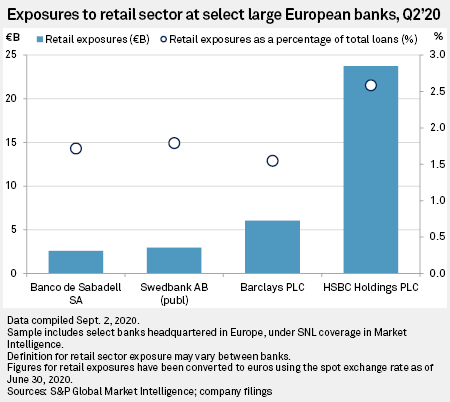

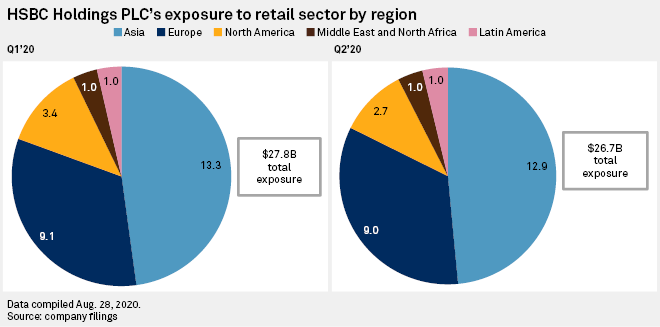

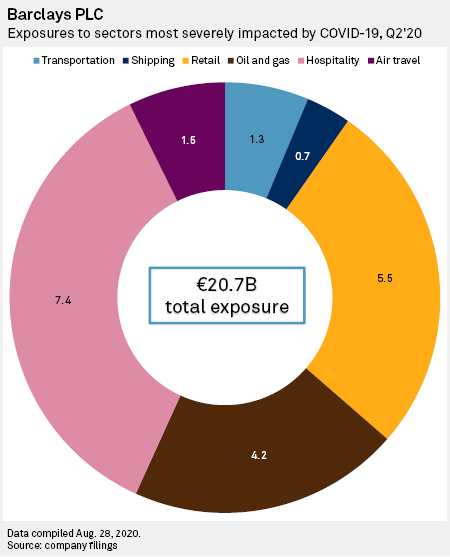

So too their banks. Lending to the sector is unsurprisingly substantial given its sizable role in Europe's consumer-driven economies. Most of the region's largest banks have billions in exposure to the sector — and have made significant provisions in preparation for some of those loans turning sour.

But the unpredictability of how the pandemic will progress, when or if a vaccine will be available, and the lasting impact it will have on the retail sector and wider economy, means the outlook of banks' loan books to the sector are shrouded in uncertainty.

"Clearly, retail is one of a number of areas of concern, but what's very difficult to say is whether banks have provided enough for that risk or not," said Gary Greenwood, a U.K. banking sector equity analyst who covers banks including HSBC Holdings PLC, Barclays PLC and Standard Chartered PLC at Shore Capital.

Some areas of the retail sector are more exposed than others. Online retailers such as Amazon.com Inc. and primarily brick-and-mortar retailers with a strong online operation benefited from the lockdowns as consumers shopped from home. Supermarkets such as Carrefour SA had revenues boosted by reduced competition for nonfood items and public stockpiling of products in preparation for lockdowns.

Many listed retailers have also come through the crisis well, according to John Stevenson, who covers most of the major U.K.-based quoted retailers as an equity analyst for Peel Hunt. Listed retailers cut dividends shortly after the pandemic hit, made use of government support schemes, tend to have strong online operations that performed well during lockdown, and have seen sales boosted since stores have reopened, he said.

"The quoted retailers are actually in a very good place," Stevenson said. "And a number of them are probably profiting from the demise of privately owned retailers."

The first wave of distress in the retail sector is likely to emerge in the coming weeks, according to Stevenson. At this point in the year, many nonfood retailers will find themselves in a position where much, if not all, of their stock bought for spring and summer remains unsold, while stock for autumn and winter must be purchased, he said.

"The squeeze on working capital between August and the end of September is going to be huge," Stevenson added. "That is our primary concern. If retailers are going to fall over, it is now that is going to be that pinch point."

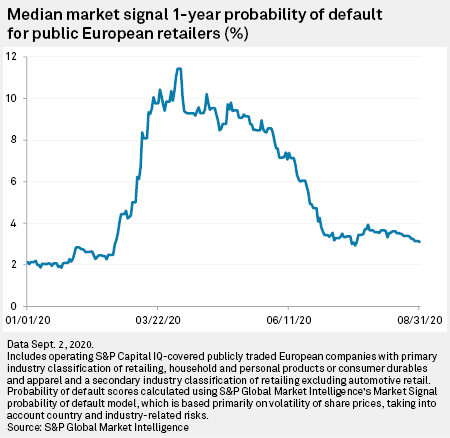

The risk of default among listed European retailers has fallen since the early months of the pandemic, but remains higher than before the crisis, according to S&P Global Market Intelligence's Market Signal probability of default data.

Government support measures, such as business loans and legislation to protect commercial tenants, have partly insulated the European retail sector from the full impact of the pandemic. The U.K. and Germany are among the countries that imposed temporary bans on the eviction of commercial tenants affected by the crisis. Such measures have already been or are likely to be withdrawn in the coming months.

This "cost holiday" for retailers has created a "very artificial world where reality has been suspended," according to Richard Hyman, an independent retail analyst who has advised some of the U.K.'s largest retailers and retail landlords. "From a banking perspective, you could say that the real pressure, the real implications of their exposure have yet to be seen and, therefore, understood and appreciated."

Government support in the form of guaranteed loans provided through banks has also complicated the picture of lenders' true exposure to the sector, Greenwood said. "Under normal circumstances, you'd have expected banks to really tighten the amount of credit that they're issuing in a downturn this severe," he said. "But, obviously, the government support distorts that somewhat."

For those retailers who have been laboring under significant debt burdens in recent years, the withdrawal of support and harsh reality of the economic climate ahead may be too much, said Stevenson. "If you are indebted, it does becomes a death spiral quite quickly," he said.

Before anyone had heard of COVID-19, European retail was already in turmoil. The rapid growth of e-commerce has transformed the sector, killing off businesses that failed to adapt quickly enough.

The U.K. has led the continent in e-commerce adoption, with penetration approaching 20% of total retail sales even before the pandemic hit, according to online data portal Statista. The country's enthusiasm for online shopping has contributed to a surge in insolvencies among traditional brick-and-mortar retailers in recent years, leading to thousands of store closures and plummeting retail rents and property values.

Markets on the continent have been slower to embrace e-commerce, but there have been signs recently that its largest economies are reaching a tipping point long past by the U.K. Online sales as a percentage of total retail sales reached 15.9% in Germany and 10.9% in France in 2019, Statista data shows.

National e-commerce penetration in 2020 is forecast to jump to 26.2% in the U.K., 19.9% in Germany and 14.3% in France due to the impact of the pandemic, according to Statista.

"That shift online has been immense," said Stevenson. "And, yes, there's now an element of consumers coming back to shop in store. But, fundamentally, people are online first. And for retailers that aren't online first, they are going to struggle."

The difficulty for European banks in the months and years ahead will be identifying which retailers are most likely to survive both the accelerating shift to online and the impact of the pandemic. Retailers should expect to see banks tighten their underwriting criteria in response to the economic shock inflicted by the pandemic, and become more discriminating between those retailers prominent in the booming online space and those more reliant on store operations, said Greenwood.

"When you see a shift in the relative prospects of the two, then you would expect to see a shift in the relative lending appetite," he added.