Participate in the 2025 Private Equity and Venture Capital Outlook Survey to gain insights into private market sentiment for the upcoming year from global private equity, venture capital and limited partner professionals.

_____________________________________________________

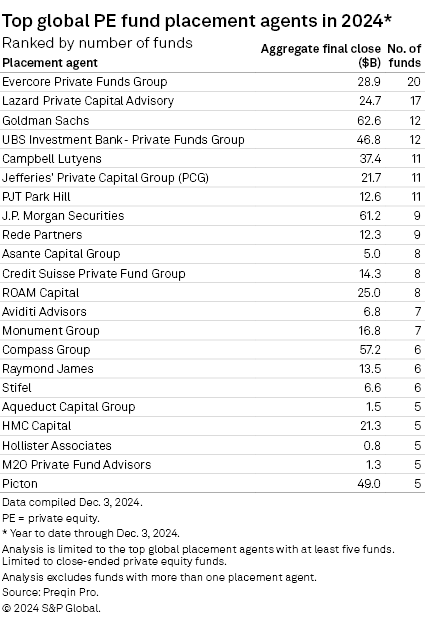

Evercore Inc. has been the most active private equity placement agent worldwide so far in 2024, in what has been a difficult year for fundraising.

Through Dec. 3, private equity fundraising has amounted to $962.13 billion across 2,010 funds, according to Preqin Pro data. That figure is 28.1% lower than the $1.34 trillion amassed by 3,517 funds in 2023.

Evercore sits in the top spot in 2024 after ranking second in 2023 and 2022. Through Dec. 3, the firm participated in 20 private fund closes this year and recorded an aggregate fund close value of $28.9 billion, according to Preqin Pro. The $4.5 billion Nautic Partners XI LP buyout fund was the largest fund closed in 2024 that Evercore worked on.

Lazard Group LLC climbed to second place with 17 funds closed after ranking third in the two prior years. The largest fund Lazard worked on that has closed this year is the Kohlberg Investors X LP buyout fund, with a size of $4.3 billion.

Goldman Sachs Group Inc., the most active private equity placement agent in 2023, fell to third place but still raised the highest aggregate value of capital this year with $62.6 billion. It is followed closely by J.P. Morgan Securities Inc., which posted an aggregate final close amounting to $61.2 billion.

– Download a spreadsheet with data featured in this article.

– Catch up on private equity funding rounds in November.

– Learn about private equity trends in the US solar industry.

Seven placement agents were tied with four funds each that closed between Jan. 1 and Dec. 3. One notable inclusion in that list is Morgan Stanley Smith Barney LLC, with $19.6 billion of aggregate capital closed, the highest among those seven.

Denominator effect no longer an issue

Asante Capital Group LLP, in 10th place with eight funds closed and an aggregate value of $5 billion, believes the so-called "denominator effect" that served as a brake on fundraising earlier this decade is no longer an obstacle. The denominator effect is a portfolio imbalance most prevalent among public pension funds holding both public and private assets.

"The denominator effect has, since mid-2023, been really nonexistent," Asante Capital's Managing Partner Fraser van Rensburg told S&P Global Market Intelligence. "Public markets have been good now for 18 months, and the denominator effect is not something people really talk about."

Asante Capital expects gradual improvement in M&A in 2025, a necessary step in the market before a recovery in private equity fundraising, which has been on a yearly decline since 2021.

"Until the M&A market picks up, private equity groups are sitting on lots of dry powder and not doing deals as quickly and they're also not exiting deals as quickly," van Rensburg said. "By the end of 2025, we think we'll probably be close to or at a good fundraising environment again."