S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Although there was a rebound in the total value of private equity deals in 2024, transaction values in India and China fell.

Global private equity deal value jumped 24.7% year over year in 2024. But the private equity-backed dealmaking trend ran in the other direction for India, where deal values fell 45% from the prior-year total, and for mainland China, which experienced a 56% year-over-year decline in transaction value, according to S&P Global Market Intelligence data.

The prospects of a 2025 turnaround in private equity deal value are particularly dim for mainland China amid swirling geopolitical tensions, potential tariff action by the US and domestic economic issues.

Exits are another story. In 2024, the value of private equity exits in India more than doubled year over year. In China, the total exit value rose nearly seven times above the prior year.

Read more about private equity dealmaking in India and mainland China in 2024.

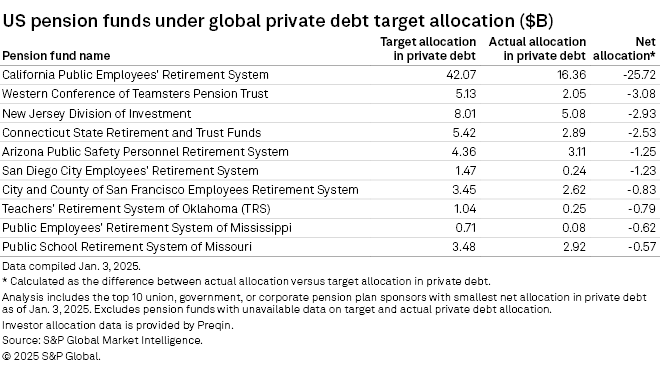

CHART OF THE WEEK: US pension funds fall short on private debt allocations

⮞ US pension funds are boosting their allocations to private debt, yet a majority — 77 out of 118 pension funds — are short of their targets for the asset class, according to Market Intelligence data.

⮞ The funds' median target allocation to private debt — also referred to as private credit — was $175.5 million, but the actual median allocation stood at $147.5 million as of Jan. 3.

⮞ The difference between target allocation and actual allocation shrank to just $28 million as of Jan. 3, 2025, from $76 million in August 2024, suggesting that US pension funds as a group are progressing toward the aggregate median target.

TOP DEALS AND FUNDRAISING

– Funds managed by Blackstone Inc. and Vista Equity Partners Management LLC acquired the AI-assisted work management platform Smartsheet Inc. for $8.4 billion.

– AE Industrial Partners LP is selling aerial vehicle manufacturer Edge Autonomy Operations LLC to Redwire Corp. for more than $900 million.

– KKR & Co. Inc. entered into an agreement to acquire UK-based asset leasing company Dawson Group Inc., as part of the private equity firm's global climate strategy.

– Ardian raised €3.2 billion for the Ardian Expansion Fund VI. The fund will invest in mission-critical, high-growth small and medium-sized enterprises in Europe.

– Fengate held the final close for Fengate Infrastructure Fund IV at $1.1 billion.

– Novacap Management Inc. raised more than $1 billion for Novacap Digital Infrastructure Fund I. The fund will target equity investments in North American lower-middle-market companies.

MIDDLE-MARKET HIGHLIGHTS

– NexPhase Capital LP sold Synergy HomeCare Franchising LLC, an in-home care service provider, to Levine Leichtman Capital Partners LLC.

– Gainline Capital Partners LP added M&M International, a stainless-steel tubing manufacturer, to its portfolio.

– Ridgemont Equity Partners made an investment in IT support service provider Strata Information Group Inc., marking an exit for Fort Point Capital LLC.

FOCUS ON: APPLICATION SOFTWARE

– An investor group comprising Lightspeed Ventures LLC, Khosla Ventures LLC and Webb Investment Network agreed to sell AI-native conversation data analysis platform Cuein Inc. to ServiceNow Inc.

– Sofindev Management NV will sell Companyweb, a financial data platform for Belgian companies, to Dun & Bradstreet Belgium NV in a deal expected to close by mid-March.

– Sem Parar Instituição de Pagamento Ltda. agreed to acquire Brazil-based software solutions provider Gringo Agência de Serviços Relativos a Automóveis Ltda. from an investor group including OneVentures, Global Founders Capital Management GmbH, Piton Capital LLP, Kaszek Management SA and Valor Capital.

– Retail company Cpg.Io acquired software-as-a-service donation platform Niche Interactive Media Inc. The sellers were Tuesday Capital, The Twenty Minute VC and Sugar Capital.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter