Private equity and venture capital investments in generative artificial intelligence startups are getting bigger and more targeted as investors' strategies evolve with the technology.

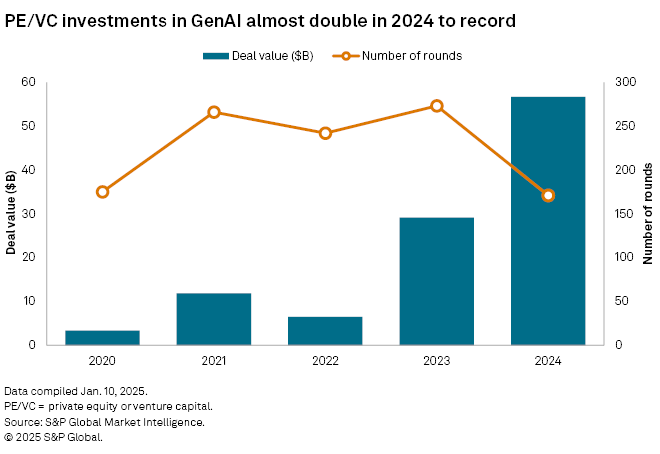

Funding in GenAI exceeded $56 billion in 2024, according to data from S&P Global Market Intelligence. That was up almost double from 2023, when GenAI companies attracted approximately $29 billion.

But while the overall total value of the investments grew, the record funding amount supported fewer companies than the previous year, indicating a trend of investors consolidating around select winners. There were 171 rounds of investment in GenAI in 2024, down from 273 in 2023. Additionally, the average funding round size in 2024 soared to $407 million, compared to $133 million in 2023 and $33 million in 2022.

GenAI infrastructure

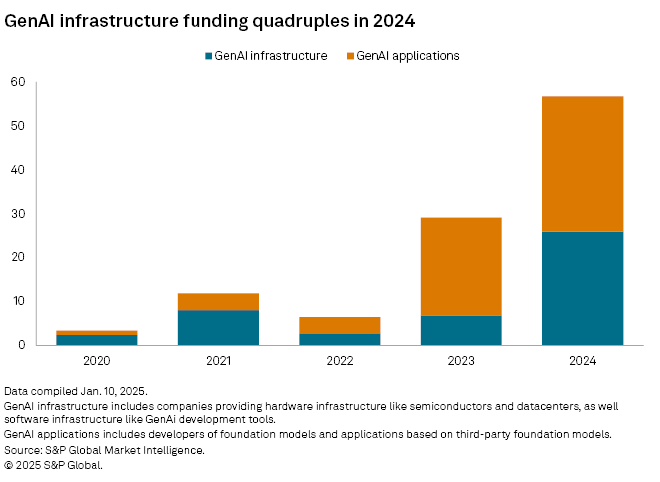

An area of growing interest for investors is the infrastructure layer, which includes semiconductor manufacturers, graphics processing unit (GPU) cloud providers and software tool developers for GenAI applications. Investment in GenAI infrastructure nearly quadrupled in 2024 to almost $26 billion, up from $6.86 billion in 2023.

The investment comes as companies within the GenAI infrastructure layer experienced robust growth in 2024. Billion-dollar funding rounds for companies like Databricks Inc., a provider of data manipulation tools for AI, and CoreWeave Inc., a GPU cloud provider, propelled funding for the year, according to S&P Global Market Intelligence. The clear winners in the GenAI space are AI infrastructure providers, experiencing growing demand as Big Tech hyperscalers and startups invest heavily to establish themselves in this emerging category.

Additionally, enterprises have recognized that deeper integration of artificial intelligence across various organizational functions — such as finance, marketing and HR — requires modernizing the entire infrastructure stack.

This realization is reflected in how enterprises are allocating their IT spending. According to a study by S&P Global Market Intelligence 451 Research, the US Technology Demand Indicator, cloud infrastructure and cybersecurity were the highest spending priorities in the fourth quarter of 2024, followed by AI technologies. The TDI is a survey-backed composite of US intent to spend on technology and typically predicts revenue performance for tech vendors by up to a few months.

Application layer

The increasing interest in infrastructure is accompanied by robust investment in the application layer, encompassing foundation model creators and vertical applications. Investments in the application layer rose to over $30 billion in 2024, up from $22 billion, according to Market Intelligence data.

Despite strong growth, foundation model providers continue to grapple with questions about the profitability and acceptable margins of their business models, as training and inference costs remain prohibitive. Over time, compute costs are expected to decrease as NVIDIA Corp. and other companies develop more efficient chips. Currently, however, most of these startups are rapidly burning through cash. “We have a cost-ticking time bomb. A lot of the cost to use LLMs one way or another is subsidized. No one is really paying the real cost,” Philippe Meda, founder of tech consultancy Innovation Copilots, told S&P Global Market Intelligence.

As the race intensifies and costs rise, some foundation models may exit the competition to build mainstream models due to insufficient customer usage, or they may consolidate, be acquired, or undergo acqui-hiring. Privately held foundation model providers appear to have a complex relationship with hyperscalers, simultaneously partnering and competing with them. Microsoft and Amazon.com Inc., having invested in and partnered with OpenAI and Anthropic respectively, are discreetly developing their own foundation models.

The competitive battle in GenAI has decisively shifted to the enterprise sector from the consumer market. The enterprise sector offers the most use cases for enhanced productivity, with buyers willing to pay a premium for superior GenAI capabilities, such as reasoning or agents, which have become more proficient at executing complex instructions.

“Many organizations are experimenting with agents, which have the potential to automate some aspects of the business processes,” said Chris Darvill, EMEA solutions engineering vice president at Kong Inc. an API platform provider. For instance, a logistics company that Kong is working with is looking into how it can automate the customs documentation that is required to import-export parcels, which involves language translation, Darvill told Market Intelligence.

Competition among various AI models and services in the enterprise space is intense. A Kong survey found that OpenAI LLCs ChatGPT leads with 27%, followed by Azure AI, Microsoft Corp.'s platform for custom AI model creation, at 18%, and Alphabet Inc.'s Gemini at 17%.

"Key factors influencing foundation model choice are use cases, plus cost, accuracy and control,” Darvill said.