Global private equity fundraising declined for the third straight year in 2024, largely due to a weak exit environment that constrained liquidity.

Private equity funds worldwide secured $680.04 billion in 2024, a 30% decrease from about $966.37 billion raised in 2023, S&P Global Market Intelligence data shows. The amount of capital raised has declined since 2021, when it peaked at about $1.119 trillion.

The annual fundraising total was at its lowest level since 2015, when it was $502.26 billion.

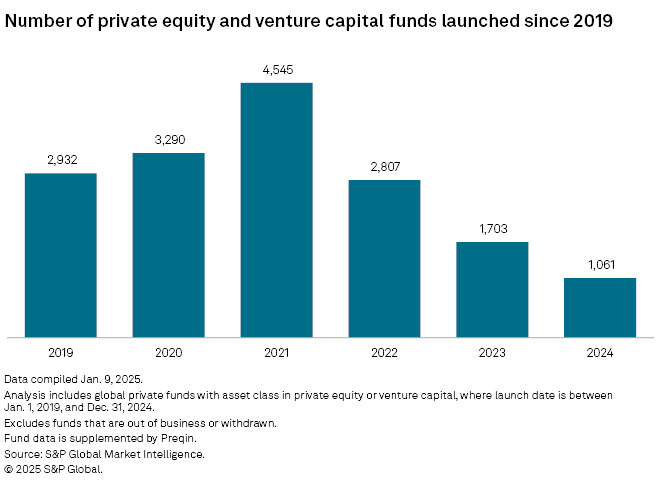

In 2024, 1,783 private equity funds closed, a 40% year-over-year decrease. Fund closings began declining after peaking at 6,132 in 2021.

Private equity fundraising remained lukewarm in 2024 due to liquidity issues and weak exit activity, said Jonathan Bray, partner at Clifford Chance.

"Investors have been liquidity constrained; they haven't had a lot of cash coming back from their existing fund positions. And so they haven't felt under pressure to start redeploying that capital," Bray told Market Intelligence in an interview.

Global private equity exits fell to a five-year low of $392.48 billion in 2024, primarily because of a mismatch in valuation expectations between buyers and sellers.

The average holding period in 2024 was 6.1 years, longer than the average between 2018 and 2022.

Smaller private equity funds struggled to raise capital or did not return to the market in 2024, while larger, established players performed better, Bray said. Meanwhile, midmarket funds managed to close and build their assets under management.

"The market and the industry have grown up. Inevitably, given the incredible growth in AUM over the last decade, there is a lot of consolidation in the market. Investors are having to make a bigger ticket and tending to do that to a smaller number of managers."

– Download a spreadsheet with data in this story.

– Read about global private equity megadeals in 2024.

– Catch up on a ranking of the largest private credit managers globally.

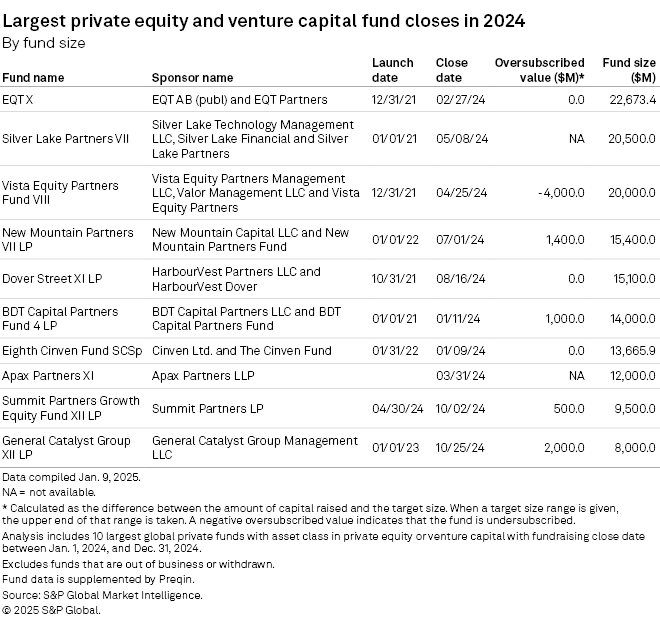

Biggest funds

EQT AB (publ) closed the largest private equity fund in 2024, securing $22.67 billion for its EQT X fund. The flagship fund invests mainly in the healthcare technology and technology-enabled service sectors in Europe and North America.

Market Intelligence data shows the Government Pension Investment Fund of Japan was the largest limited partner, committing more than $500 million.

Silver Lake Technology Management LLC raised $20.5 billion at the final close of its Silver Lake Partners VII fund, the second-largest private equity fund close in 2024.

Washington State Investment Board was the biggest limited partner of the fund, with $500 million in committed capital, according to Market Intelligence data.

Fund launches

Global private equity fund launches declined for the third consecutive year in 2024, totaling 1,061. Bray attributed the decline to the market's growing maturity.

"The size of the funds is growing more quickly than the size of the market due to the natural consolidation. That's why you continue to see that year-over-year decline in the absolute number of funds being raised. It's just a more efficient way to raise capital as well."

Outlook

Bray anticipates stronger private equity fundraising activity in 2025 than the previous year as signs of a more active M&A environment emerge.

"Pricing expectations are becoming just more consistent across the board, coupled with a slightly lower interest rate environment and expectations on that side. People are expecting to become more comfortable with the global macroeconomic and political environment, too," the Clifford Chance partner said.

Jeffrey Diehl, managing partner and head of investments at Adams Street Partners LLC, also believes the expected increase in market activity will stimulate fundraising efforts among private equity managers.

However, Diehl noted that the current investment landscape for buyouts differs from the past decade.

"Competition has intensified, and interest rates remain higher than in recent years, potentially staying elevated for an extended period," Diehl said.

"Consequently, buyout returns may not benefit from the same tailwinds from low interest rates as before. Instead, we expect returns to increasingly depend on private equity managers' ability to generate alpha through fundamental revenue growth and EBITDA expansion at their portfolio companies."