The 2024 Global Real Estate Sustainability Benchmark scores were stable for the majority of US equity real estate investment trusts scored by GRESB BV.

However, the results did show more declines than increases.

Global Real Estate Sustainability Benchmark (GRESB) scores capture information on environmental, social and governance performance and sustainability best practices for real estate companies, covering more than 2,200 property companies, REITs, funds and property developers worldwide.

Narrowing the scope to just US REITs that trade on the NYSE, Nasdaq or NYSE American, 66 participated with GRESB in 2024 and received a GRESB Participant Score evaluating their ESG efforts.

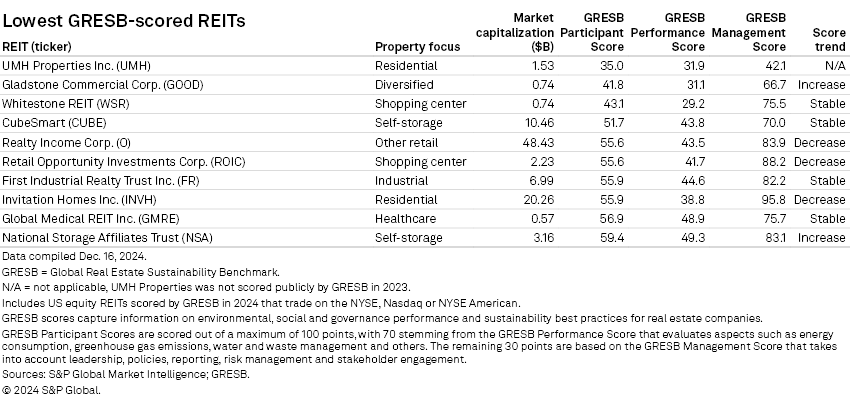

GRESB participants are scored out of a maximum of 100 points, with 70 points stemming from a performance component that evaluates aspects such as energy consumption, greenhouse gas emissions, and water and waste management, among others. The remaining 30 points are scored based on the company's management, taking into account leadership, policies, reporting, risk management and stakeholder engagement.

GRESB also takes into account characteristics unique to different property types.

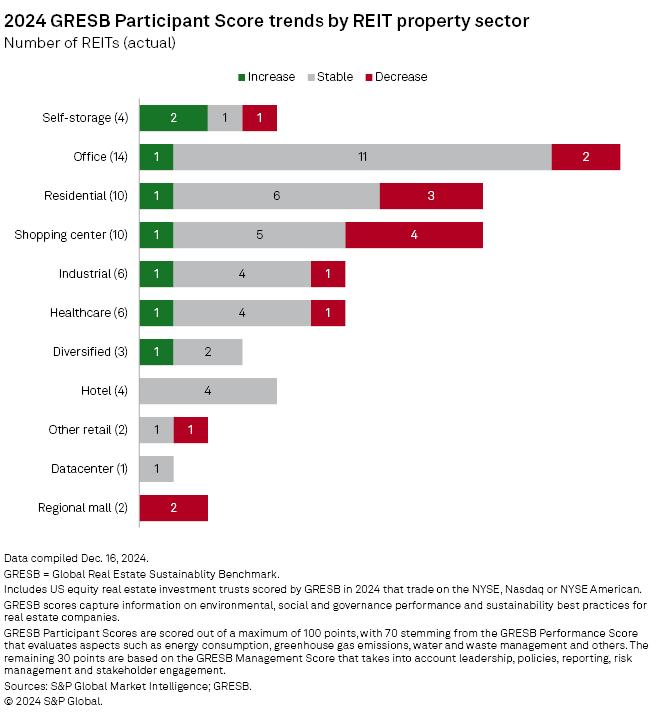

GRESB Participant Score changes by property sector

Of the 62 members that were also scored the year prior, 39 saw little change in their GRESB Participant Score this year and were labeled as stable. Meanwhile, 15 logged decreases compared with the previous year, while eight saw increases in their scores.

By property sector, four shopping center REITs saw decreases in their GRESB Participant Scores, the largest count of any property type. Alternatively, one shopping center REIT — Phillips Edison & Co. Inc. — posted an increase.

Of the four self-storage REITs that participated with GRESB in 2024, Public Storage and National Storage Affiliates Trust logged increases in their GRESB Participant Scores, while Extra Space Storage Inc. booked a decrease and CubeSmart's score was stable. Among the self-storage REITs, Public Storage was scored the highest at 79.83.

The two regional mall REITs scored by GRESB in 2024 — Simon Property Group Inc. and Macerich Co. — saw decreases in their scores.

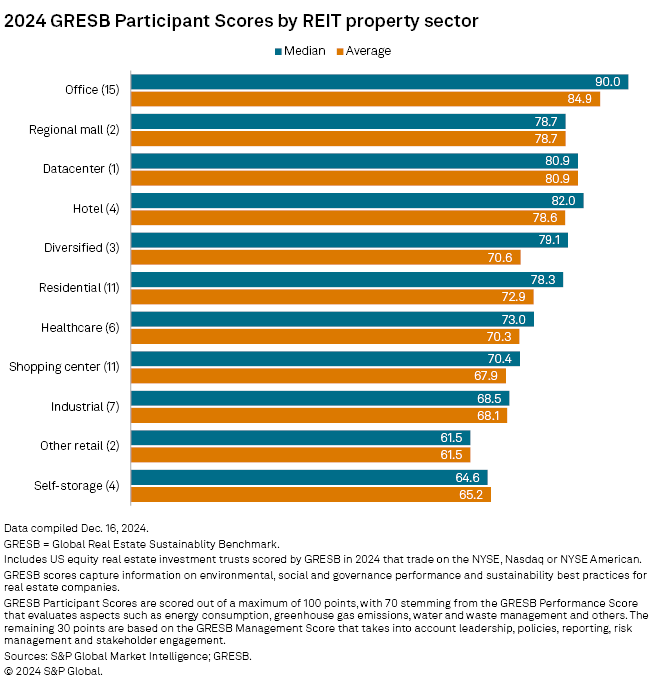

Office REITs continue to hold the highest scores

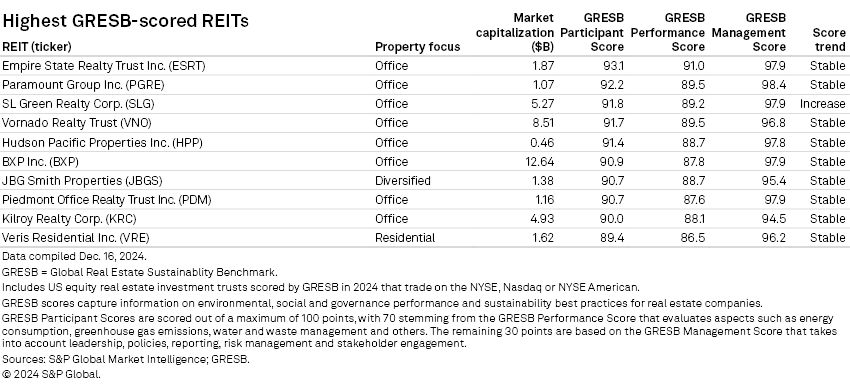

Office REITs were scored the highest overall, with a median GRESB Participant Score of 90. Eight of the 10 REITs with the highest GRESB Participant Scores came from the office sector.

Empire State Realty Trust Inc. was scored the highest at 93.1, followed by Paramount Group Inc. and SL Green Realty Corp. with GRESB Participant Scores of 92.2 and 91.8, respectively.

By contrast, manufactured home REIT UMH Properties Inc. had the lowest score among the US equity REITs that participated with GRESB in 2024, at 35.0. Diversified REIT Gladstone Commercial Corp. followed with a score of 41.8 and shopping center REIT Whitestone REIT with a score of 43.1.

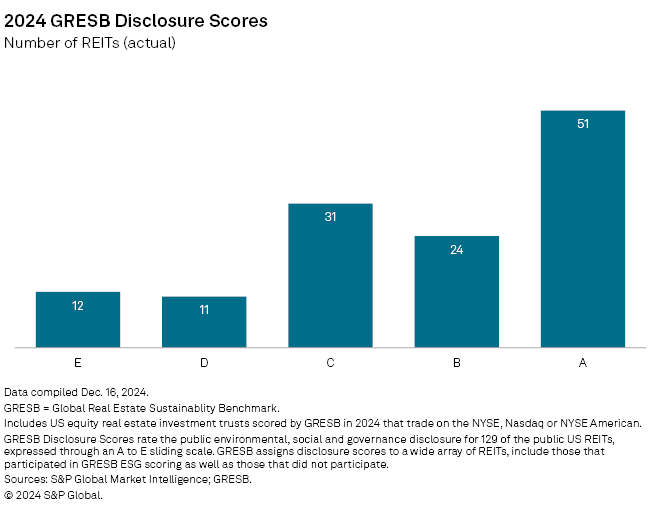

GRESB disclosure scores

In addition to the GRESB Participant Scores, GRESB rated the public ESG disclosure for 129 of the public US REITs, expressed through an A-to-E sliding scale.

Fifty-one REITs, or 39.5% of the scored universe, had their public ESG disclosure scored with an "A" by GRESB, the highest rating, while 24, or 18.6%, were scored with a "B."

A total of 12 REITs had their public ESG disclosure scored with an "E," the lowest rating.