Global transaction banking revenues are expected to decline in 2024 after reaching their highest level on record in the previous year amid high interest rates.

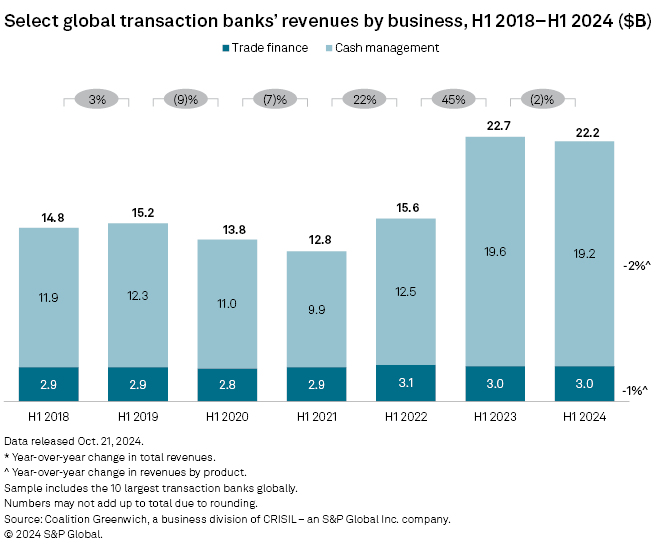

Combined revenues at the world's 10 largest transaction banks fell 2% year over year to $22.2 billion in the first half of 2024, the latest report by research company Coalition Greenwich shows.

The decline was driven by weaker cash management operations, where liquidity and balances revenues were hit by the slowdown in net interest income, according to the report. Trade finance revenues held up slightly better, declining only 1% on the prior-year period, thanks to trade volume growth which balanced out higher margin pressure.

Coalition Greenwich — a division of CRISIL, an S&P Global company — tracks transaction banking revenues at Bank of America Corp., Barclays PLC, BNP Paribas SA, Citigroup Inc., Deutsche Bank AG, HSBC Holdings PLC, JPMorgan Chase & Co., Société Générale SA, Standard Chartered PLC and Wells Fargo & Co.

Short-term outlook

Trade finance is poised to fare better in the second half of 2024 with revenues expected to increase slightly, while cash management should remain on a downward trend, said Eric Li, head of global banking research at Coalition Greenwich.

Overall transaction banking revenues in 2024 should be marginally lower compared to 2023 but the current outlook is much better than the originally anticipated drop for this year, Li said. This is due to the positive effect of structural hedges banks have put up to mitigate interest rate risks which have already started yielding benefits, according to Li.

"We think the benefit is going to last for a few quarters at least, which means it's going to significantly soften the blow coming from the rate cuts," Li said.

While the outlook for 2025 has brightened as well, the impact of rate cuts is still expected to weigh on cash management, with revenues likely to marginally decline again year over year, Li said. On the positive side, deposit balances are expected to increase next year, which would partly offset the negative impact of rate cuts, Li said.

"M2 money supply of major economies, [including] the US and the eurozone is actually going up, which does suggest that next year we will have more deposit balances in the market," Li said.

M2 is a measure of the money supply that includes cash, all money deposited in checking and savings accounts, and noncash assets which can easily be converted into cash.

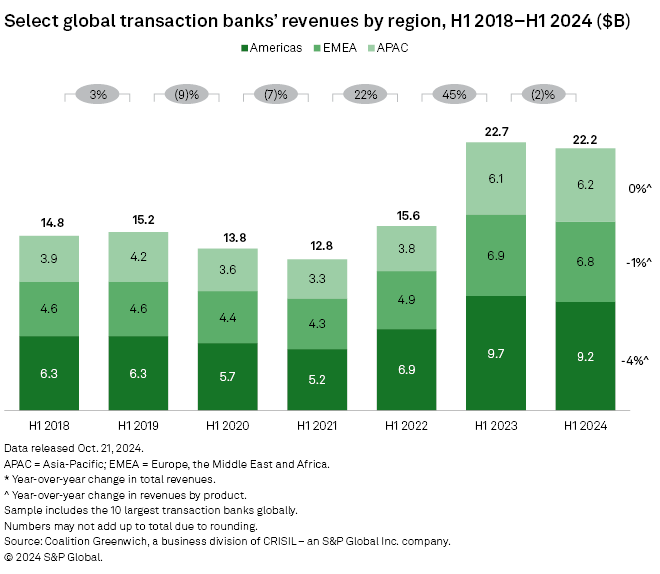

Regionally, the largest decline in transaction banking revenues, of 4% year over year, was in the Americas in the first half of 2024, with a smaller, 1% decline in Europe, while revenues in Asia-Pacific remained largely stable versus the prior-year period.

US tariffs

If the US import tariff hikes promised by Donald Trump during the US presidential campaign are implemented, this could trigger a trade war and lead to a slowdown in the global economy, affecting transaction banking revenues, Li said. "That is a big risk," he said.

After his election win, Trump vowed in a speech Nov. 6 to follow through with his campaign plans, noting he would govern by the motto "promises made, promises kept." Trump has proposed new tariffs of at least 10% on most imported goods and a new tariff of 60% on imports from China.

The London School of Economics has estimated the tariffs would result in GDP shrinking by 0.64% in the United States, by 0.68% in China and by 0.11% in the EU.

Retailers and manufacturing companies have started preparing for potential tariff changes and have been asking logistics partners to front-load shipments before any announcements by the new US administration, taking office Jan. 20, 2025, CNBC reported Nov. 6.