| The wildfires in California at the start of 2025 are a reminder that reinsurers continue to face high annual losses from natural catastrophes. |

The reinsurance industry will continue to be profitable even though prices fell at the Jan. 1 renewals, according to brokers.

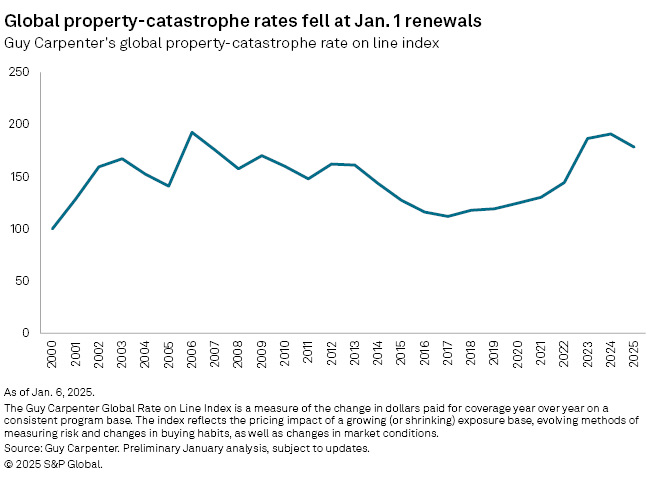

Global property-catastrophe rates on line, which are premiums as a percentage of cover, fell 8% on a risk-adjusted basis on Jan. 1, according to broker Howden Group Holdings Ltd.'s renewal report. Other brokers broadly agreed: Guy Carpenter & Co. LLC's global property-catastrophe rate on line index fell 6.6% at the renewals.

This is the first time property-catastrophe rates have fallen at Jan. 1 since 2017. Prices were expected to soften in the run-up to the renewals.

Lower prices typically mean lower profits, so the rate decreases could be seen as the end of the profitable period that reinsurers have enjoyed since making big changes to property-catastrophe reinsurance structures and prices at Jan. 1, 2023.

However, prices are still high compared to historical levels.

"This is still a very strong underwriting environment for insurers and reinsurers both in terms of terms and conditions and in terms of price," David Flandro, head of industry analytics and strategic advisory at reinsurance broker Howden Re, said in an interview.

Appetite to write

Prices fell because the industry had more capital to deploy on writing business. Since making changes to the structure of property-catastrophe reinsurance cover at the Jan. 1, 2023, renewals, the reinsurance industry's returns have exceeded their cost of capital. Although the industry was hit by a range of natural catastrophe losses in the fourth quarter, such as hurricanes Helene and Milton in the US, 2024 will likely prove to be another positive year for reinsurers.

Bigger profits mean more capital to play with. Although reinsurers have been returning some to shareholders through dividends and share buybacks, most of it will be used to write business, according to Mike Van Slooten, head of market analysis at Aon PLC's reinsurance solutions division.

"What that really means was that most, if not all, reinsurers were showing strong appetite for property business, where I think pricing and terms and conditions were viewed as attractive," Van Slooten said in an interview.

Global reinsurer capital increased to a new high of $715 billion as of September 2024, up from $670 billion at the end of 2023, according to Aon's report on the Jan. 1 renewals.

Crucially, however, attachment points, which determine the level of losses insurers must incur before their property-catastrophe reinsurance pays out, remained largely unchanged at Jan. 1. This means insurers will continue to bear more of the risk for smaller, more frequent natural catastrophe losses. The shift up of attachment points at Jan. 1, 2023, has played a big role in the profitability that reinsurers have enjoyed since, despite insured natural catastrophe losses topping $100 billion for the past five years.

"There's a view that the higher retentions that were imposed in 2023 have protected the reinsurers from a lot of the frequency losses that we've seen over the last two years, and investors are watching for any changes in that very closely," Van Slooten said. "Our analysis would be that really retentions didn't come under pressure at this renewal. The discussion really was all about pricing."

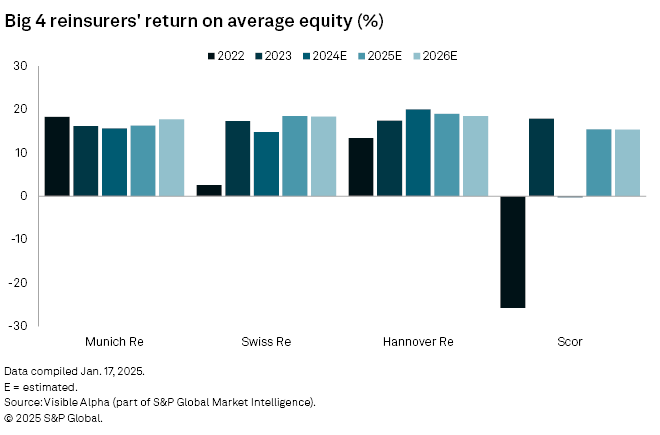

For three of the Big Four reinsurers, analysts are expecting lower returns on average equity in 2024 compared with 2023, according to consensus estimates from Visible Alpha, a part of S&P Global Market Intelligence. Some of this is likely down to company-specific challenges. Scor SE, for example, took reserving hits related to its life and health reinsurance business in 2024 and is projected to produce a negative return on equity in 2024. Swiss Re AG, meanwhile, bolstered US casualty reserves during 2024, which hit profits.

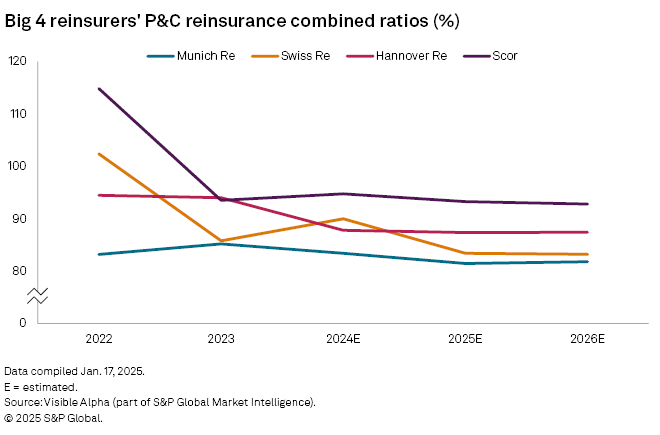

However, analysts expect all four to be producing returns on average equity of more than 15% in 2025 and 2026. They are also expecting all four of the reinsurers' property and casualty reinsurance combined ratios, which measure underwriting performance, to improve in 2025, according to Visible Alpha data.

Cloudy horizon

The question is how long conditions will remain positive.

"Limited changes in [terms and conditions] and attachment points imply still attractive near-term returns on capital; albeit the medium- to long-term outlook looks somewhat gloomy," KBW analysts wrote in a European reinsurance industry note covering the findings of the January renewals call hosted by KBW. "Although companies' balance sheet strength should support the earnings, we are cautious about the risk to the average reinsurance earnings multiple."

However, they added that "higher interest rates due to return of inflation could limit the rate reductions."

Although global property-catastrophe rates on line rates decreased at Jan. 1, this will not necessarily result in persistent declines going forward. Geopolitical tensions, wars, and the threat of strikes, riots and civil commotions, among other challenges, persist. The wildfires in California at the start of the year, which could cost the industry up to $30 billion, according to estimates from Moody's RMS Event Response, are a reminder that insurers and reinsurers continue to face a heightened level of natural catastrophe claims, even though the wildfire loss itself is manageable from an industry perspective.

Higher interest rates mean better investment returns, but they also mean that reinsurers need to continue to produce returns far higher than their weighted average cost of capital to keep investors interested.

Howden Re's Flandro recalled that while there was a decline in prices after some market-changing natural catastrophes, there was a plateau after Hurricane Katrina in 2005 because of the series of challenges that followed, including the global financial crisis of 2007–2009. Flandro believes a post-Katrina-like pattern is more likely now than gradual softening.

"We just have a heightened level of risk premium. Interest rates are not going down. Inflation is not going down as quickly as people thought. We just have more volatility. So there's scope for rates to stay higher," Flandro said.

An attractive market

For now, however, market conditions are conducive to investors.

"I don't think it should discourage anyone from coming into the market that pricing is moving around a little bit from a very high ceiling," Flandro said. "From that perspective, it's still a very strong profit market for insurers and reinsurers."

The formation of two new reinsurers in time for Jan. 1 — Oak Re at Lloyd's and Mereo Insurance in Bermuda — is a sign that "investors acknowledge that there has been a change or a shift … in the earnings of the reinsurers over the last two years," Aon's Van Slooten said, "and potentially, they're going to look to become a bit more involved going forward, we hope."

However, this investor interest will not necessarily result in the formation of more new reinsurers. Investors now have a range of options to participate in the industry, Van Slooten noted, including catastrophe bonds and special-purpose reinsurers, known as sidecars, that back existing companies. In addition, barriers to entry into reinsurance are higher, and the market remains volatile and competitive.

"I'm not expecting to see a class of 2025 being formed," Van Slooten said.