Fracking drill rigs with oil gas flare petroleum pollution into the atmosphere in Texas.

Fracking drill rigs with oil gas flare petroleum pollution into the atmosphere in Texas.

Source: milehightraveler/Getty Images Plus via Getty Images

Companies within high-emitting sectors such as industrials and materials are lining up to enter the green bond market and will likely help to fuel supply in the year ahead.

Industrial players such as Ardagh Group SA, Novelis Inc. and Faurecia SE issued debut green bonds in 2021 and more will follow, according to experts.

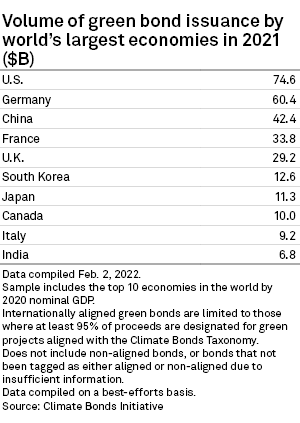

The need to finance climate change initiatives has become more "acute" amid a ramp-up in commitments by companies and governments to bring down greenhouse gas emissions, said Mitch Reznick, head of sustainable fixed income at Federated Hermes. "Brown" sectors such as industrials will increasingly tap into the green bond market to finance their green transition, Reznick said. Recent net-zero commitments by major polluters such as China and India may fuel sovereign green bond sales. India's government plans its debut green bond sale later this year, according to the nation's federal budget presented Feb. 1.

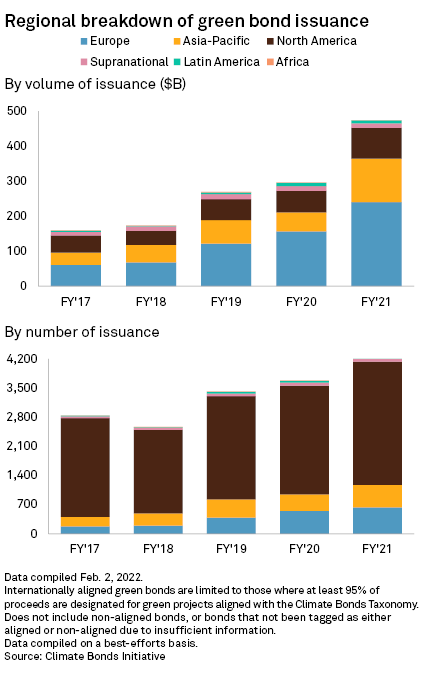

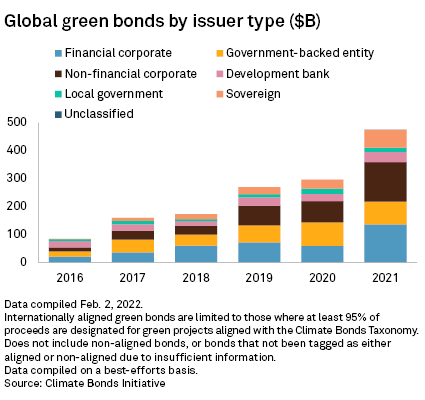

Green bond sales globally reached a record level of $473.88 billion in 2021, up from $296.00 billion in 2020, according to data by the Climate Bonds Initiative, or CBI.

The data covers bonds aligned with CBI definitions. Another $55.31 billion of green bonds issued globally in 2021 were reported by the CBI as non-aligned, while $95.39 billion have not yet been categorized.

Diverse issuers

"What marks 2021 as quite a significant milestone is that a variety of issuers strived to come up with green bond issuance wherever possible," said Love Sharma, head of India and Middle East credit at Lombard Odier Investment Managers.

Netherlands-based asset manager NN Investment Partners also anticipates "a strong acceleration" in supply by companies that have previously lagged in green bond issuance, including those operating in the metals and mining, oil and energy and chemicals sectors. This will help to drive an expected 35% growth in green bond issuance in 2022, according to the asset manager.

Utilities and financial institutions have traditionally been the most active issuers in the green bond market. In 2020, utilities made up 56% of nonfinancial corporate green bond issuers, while this number was just 12% for industrials and 4% for respectively energy and materials, according to S&P Global Ratings research published last year.

Global green bond issuance could "easily double" in 2022, according to Clifford Lee, global head of fixed income at DBS Bank. Some $900 billion of the bond market today is not labeled as green by the issuers even though the bonds finance activities that would be considered climate-aligned, according to a research by CBI last year that was commissioned by DBS. More than 40% of these bonds will mature by 2024.

"If a good proportion of these are refinanced as green bonds, the growth would be exponential," Lee said.

Regulatory boost

Regulatory initiatives are helping to encourage a more diverse set of sectors to raise green debt. In Europe, the largest market for green bonds, the release of the first technical screening criteria under the EU's taxonomy regulation has given more comfort to companies in sectors such as industrials to label certain projects green "without having to fear too much of a reputational risk," said Bram Bos, lead portfolio manager green bond at NN Investment Partners.

The EU's green taxonomy aims to help investors assess sustainable projects by defining clear criteria for economic activity to be considered green. So far the European Commission has released criteria covering sectors such as energy, forestry, manufacturing, transport and buildings.

Clarification of activities within aluminum, metals and cement manufacturing has particularly helped manufacturers define what is a "best-in-class" green bond within their industry, said Isobel Edwards, investment analyst for green bonds at NN Investment Partners. Greece-based industrial conglomerate Mytilineos SA, for one, heavily referenced the EU taxonomy criteria in a green bond issued in April 2021 that included manufacturing of recycled aluminum and primary aluminum production, Edwards said.

Bond issuers, even though it is not required of them, are increasingly looking for preliminary assessment on taxonomy alignment on their issuances, said Christa Clapp, partner at Cicero Shades of Green, a provider of second opinion on green bond frameworks.

The European Union is also expected to propel growth in the green bond market in the coming year, having recently kicked off plans to sell €250 billion worth of green bonds through 2026, while sovereign momentum will continue with more new issuers, said Bos.

Denmark, for one, issued its first green sovereign bond in January and declared it will raise regular funding through this instrument. The Philippines recently launched a sustainable finance framework that sets out its intention to sell green and social bonds.

Some $63.39 billion worth of sovereign green bonds were issued last year, up from $32.00 billion in 2020.